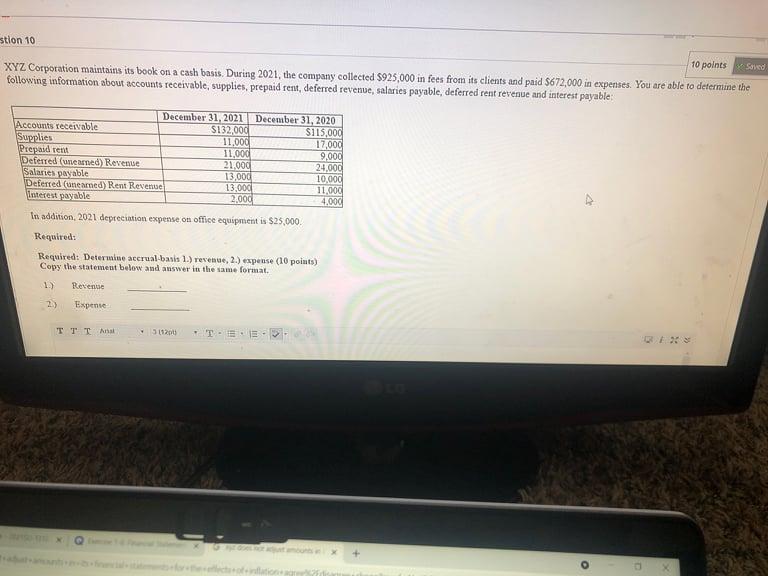

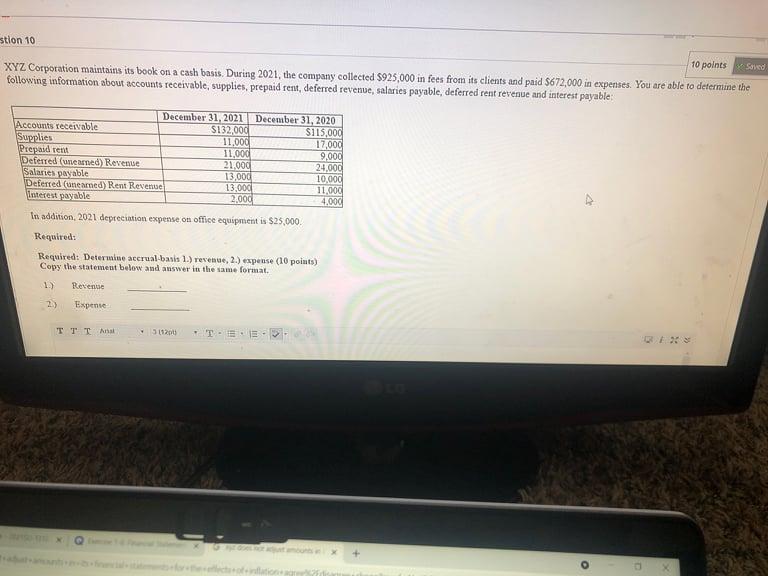

ired: Determine accrual-basis 1.) revenue, 2.) expense (10 points) the statement below and answer in the same format. Revenue Expense For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TTT Arial 3(12pt) TE M pix Y I Pathop A Moving to another question will save this response O + D Q Acounting Unit 1 hours 3ta determine accrual band cashbatis revenues expenses 03-13-2-required transa 93076505 thoito Intermediat intermediat. Intermediat O Edition mation Expert Q&A Study Pack Practice View all solutions stion 10 10 points Saved XYZ Corporation maintains its book on a cash basis. During 2021, the company collected $925,000 in fees from its clients and paid $672,000 in expenses. You are able to determine the following information about accounts receivable, supplies, prepaid rent, deferred revenue, salaries payable, deferred rent revenue and interest payable: December 31, 2021 December 31, 2020 Accounts receivable S132,000 $115,000 Supplies 11,000 17.000 Prepaid rent 11,000 9,000 Deferred (unearned) Revenue 21,000 24,000 Salaries payable 13,000 10.000 Deferred (uneared) Rent Revenue 13,000 11.000 Interest payable 2,000 4.000 In addition, 2021 depreciation expense on office equipment is $25,000 Required: Required: Determine accrual basis 1.) revenge, 2.) expense (10 points) Copy the statement below and answer in the same format. 1.) Revenge 2) Expense TTTA 5112pts ired: Determine accrual-basis 1.) revenue, 2.) expense (10 points) the statement below and answer in the same format. Revenue Expense For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TTT Arial 3(12pt) TE M pix Y I Pathop A Moving to another question will save this response O + D Q Acounting Unit 1 hours 3ta determine accrual band cashbatis revenues expenses 03-13-2-required transa 93076505 thoito Intermediat intermediat. Intermediat O Edition mation Expert Q&A Study Pack Practice View all solutions stion 10 10 points Saved XYZ Corporation maintains its book on a cash basis. During 2021, the company collected $925,000 in fees from its clients and paid $672,000 in expenses. You are able to determine the following information about accounts receivable, supplies, prepaid rent, deferred revenue, salaries payable, deferred rent revenue and interest payable: December 31, 2021 December 31, 2020 Accounts receivable S132,000 $115,000 Supplies 11,000 17.000 Prepaid rent 11,000 9,000 Deferred (unearned) Revenue 21,000 24,000 Salaries payable 13,000 10.000 Deferred (uneared) Rent Revenue 13,000 11.000 Interest payable 2,000 4.000 In addition, 2021 depreciation expense on office equipment is $25,000 Required: Required: Determine accrual basis 1.) revenge, 2.) expense (10 points) Copy the statement below and answer in the same format. 1.) Revenge 2) Expense TTTA 5112pts