Answered step by step

Verified Expert Solution

Question

1 Approved Answer

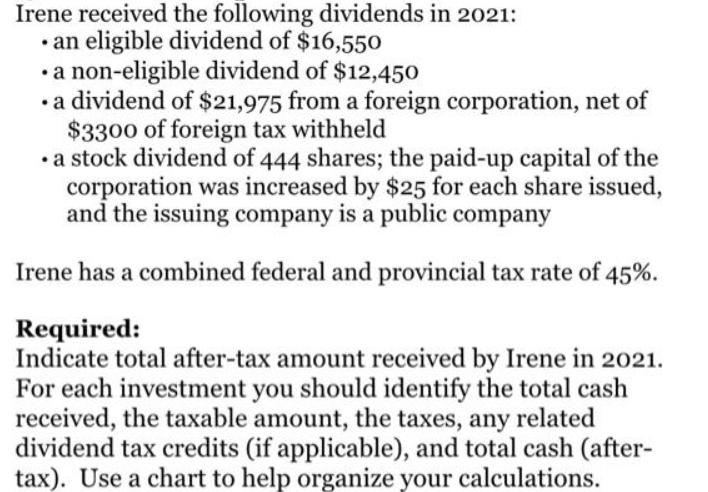

Irene received the following dividends in 2021: an eligible dividend of $16,550 a non-eligible dividend of $12,450 a dividend of $21,975 from a foreign

Irene received the following dividends in 2021: an eligible dividend of $16,550 a non-eligible dividend of $12,450 a dividend of $21,975 from a foreign corporation, net of $3300 of foreign tax withheld a stock dividend of 444 shares; the paid-up capital of the corporation was increased by $25 for each share issued, and the issuing company is a public company Irene has a combined federal and provincial tax rate of 45%. Required: Indicate total after-tax amount received by Irene in 2021. For each investment you should identify the total cash received, the taxable amount, the taxes, any related dividend tax credits (if applicable), and total cash (after- tax). Use a chart to help organize your calculations.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question The taxability of the dividend usually depends on the type of dividend 1 Eligible dividend ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started