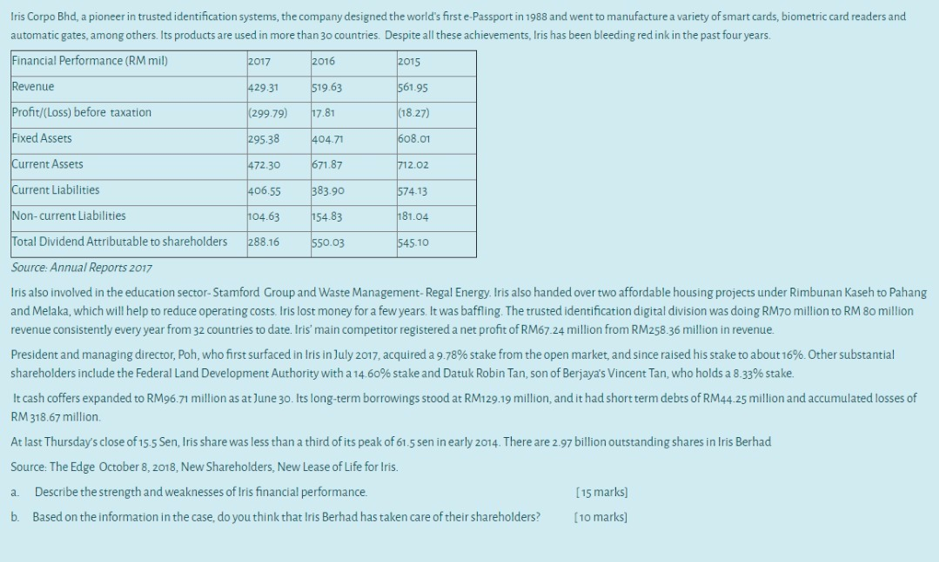

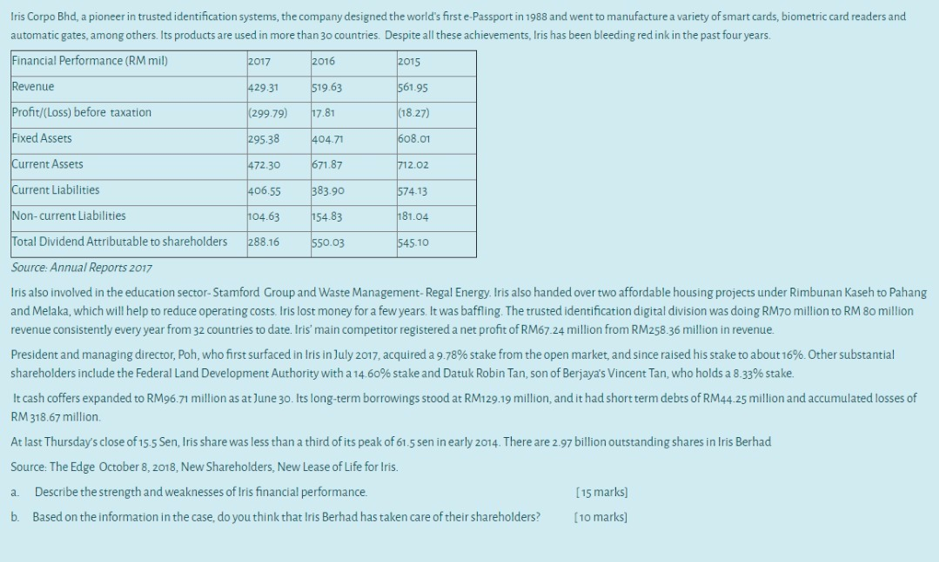

Iris Corpo Bhd, a pioneer in trusted identification systems, the company designed the world's first e-Passport in 1988 and went to manufacture a variety of smart cards, biometric card readers and automatic gates, among others. Its products are used in more than 30 countries. Despite all these achievements, Iris has been bleeding red ink in the past four years inancial Performance (RM mil) Revenue rofit/(Loss) before taxation 015 429.31 299.79) 17.81 295.38 404.71 519.63 1.95 18.27) 01 2.02 4.13 81.04 xed Assets Current Assets Current Liabilities 671.87 72.30 06.55 38390 04.63 54.83 on-current Liabilities Total Diidend Attributable to shareholders 288:16 550 0345 10 Source: Annual Reports 2017 Iris also involved in the education sector-Stamford Group and Waste Management-Regal Energy, Iris also handed over two affordable housing projects under Rimbunan Kaseh to Pahang and Melaka, which will help to reduce operating costs, Iris lost money for a few years. It was baffling. The trusted identification digital division was doing RM70 million to RM 80 million revenue consistently every year from 32 countries to date. Iris main competitor registered a net profit of RM67.24 million from RM258.36 million in revenue President and managing director, Po , who first surfaced in ris in uly 201 7, acquired a 9.78% stake rom the open market, and since raised his stake to about 16%. Other substantial shareholders include the Federal Land Development Authority with a 14 60% stake and Datuk Robin Tan, son of Berjaya's Vincent Tan, who holds a 8 3% stake It cash coffers expanded to RM96.71 million as at June 30. Its long-term borrowings stood at RM129.19 million, and it had short term debts of RM44.25 million and accumulated losses of RM 318.67 million. At last Thursday's close of 155 Sen, Iris share was less than a third of its peak of 61.5 sen in early 2014. There are 2.97 billion outstanding shares in Iris Berhad Source. The Edge October 8, 2018, New Shareholders, New Lease of Life for lris. a. Describe the strength and weaknesses of Iris financial performance b. Based on the information in the case, do you think that Iris Berhad has taken care of their shareholders? marks] 15 marks] Iris Corpo Bhd, a pioneer in trusted identification systems, the company designed the world's first e-Passport in 1988 and went to manufacture a variety of smart cards, biometric card readers and automatic gates, among others. Its products are used in more than 30 countries. Despite all these achievements, Iris has been bleeding red ink in the past four years inancial Performance (RM mil) Revenue rofit/(Loss) before taxation 015 429.31 299.79) 17.81 295.38 404.71 519.63 1.95 18.27) 01 2.02 4.13 81.04 xed Assets Current Assets Current Liabilities 671.87 72.30 06.55 38390 04.63 54.83 on-current Liabilities Total Diidend Attributable to shareholders 288:16 550 0345 10 Source: Annual Reports 2017 Iris also involved in the education sector-Stamford Group and Waste Management-Regal Energy, Iris also handed over two affordable housing projects under Rimbunan Kaseh to Pahang and Melaka, which will help to reduce operating costs, Iris lost money for a few years. It was baffling. The trusted identification digital division was doing RM70 million to RM 80 million revenue consistently every year from 32 countries to date. Iris main competitor registered a net profit of RM67.24 million from RM258.36 million in revenue President and managing director, Po , who first surfaced in ris in uly 201 7, acquired a 9.78% stake rom the open market, and since raised his stake to about 16%. Other substantial shareholders include the Federal Land Development Authority with a 14 60% stake and Datuk Robin Tan, son of Berjaya's Vincent Tan, who holds a 8 3% stake It cash coffers expanded to RM96.71 million as at June 30. Its long-term borrowings stood at RM129.19 million, and it had short term debts of RM44.25 million and accumulated losses of RM 318.67 million. At last Thursday's close of 155 Sen, Iris share was less than a third of its peak of 61.5 sen in early 2014. There are 2.97 billion outstanding shares in Iris Berhad Source. The Edge October 8, 2018, New Shareholders, New Lease of Life for lris. a. Describe the strength and weaknesses of Iris financial performance b. Based on the information in the case, do you think that Iris Berhad has taken care of their shareholders? marks] 15 marks]