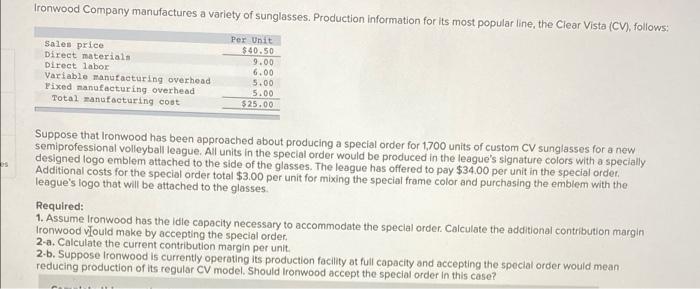

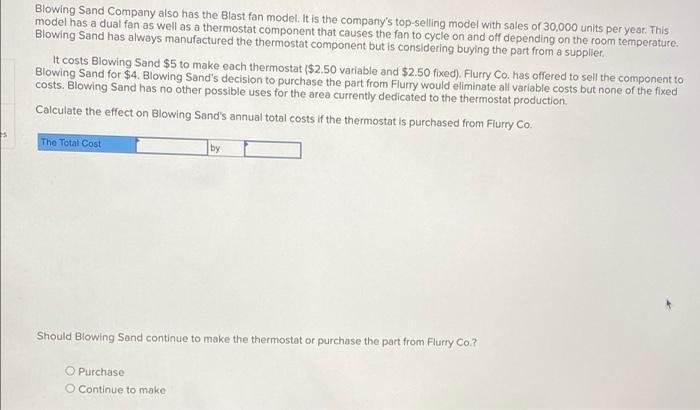

Ironwood Company manufactures a variety of sunglasses. Production information for its most popular line, the Clear Vista (CV), follows: Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing cost Per Unit $40.50 9.00 6.00 5.00 5.00 $25.00 Suppose that Ironwood has been approached about producing a special order for 1700 units of custom CV sunglasses for a new semiprofessional volleyball league. All units in the special order would be produced in the league's signature colors with a specially designed logo emblem attached to the side of the glasses. The league has offered to pay $34.00 per unit in the special order. Additional costs for the special order total $3.00 per unit for mixing the special frame color and purchasing the emblem with the league's logo that will be attached to the glasses Required: 1. Assume Ironwood has the Idle capacity necessary to accommodate the special order. Calculate the additional contribution margin Ironwood vould make by accepting the special order. 2-a. Calculate the current contribution margin per unit 2.b. Suppose Ironwood is currently operating its production facility at full capacity and accepting the special order would mean reducing production of its regular CV model. Should Ironwood accept the special order in this case? Blowing Sand Company also has the Blast fan model. It is the company's top-selling model with sales of 30,000 units per year. This model has a dual fan as well as a thermostat component that causes the fan to cycle on and off depending on the room temperature. Blowing Sand has always manufactured the thermostat component but is considering buying the part from a supplier It costs Blowing Sand $5 to make each thermostat ($2.50 variable and $2.50 fixed). Flurry Co. has offered to sell the component to Blowing Sand for $4. Blowing Sand's decision to purchase the part from Flurry would eliminate all variable costs but none of the fixed costs. Blowing Sand has no other possible uses for the area currently dedicated to the thermostat production Calculate the effect on Blowing Sand's annual total costs if the thermostat is purchased from Flurry Co. The Total Cost by Should Blowing Sand continue to make the thermostat or purchase the part from Flurry Co.? Purchase Continue to make