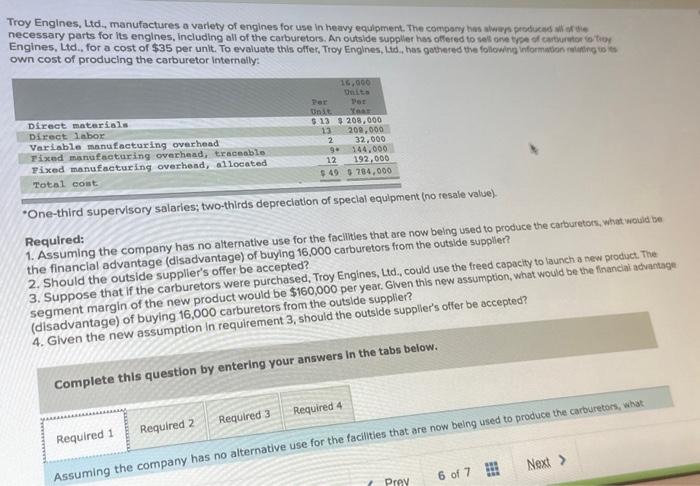

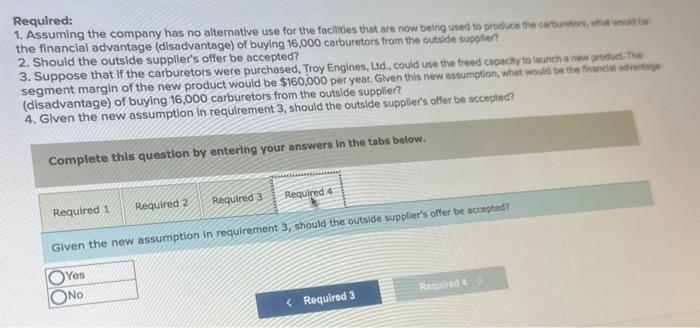

Iroy Engines, Ltd, manufactures a varlety of engines for use in heavy equipment. The compsny thas alwars prodicad wi ir tie vecessary parts for its englnes, Including all of the carburetors. An outside supplier has oflered to selt one type of carthurition io thoy Engines, Lid., for a cost of $35 per unit. To evaluate this offer, Troy Englnes, lid, has pothered the following intormmition ratuting to own cost of producing the carburetor internally: nent (no resale value) Required: 1. Assuming the company has no alternative use for the faclittes that are now belng used to produce the carburetors, what would be the financlal advantage (disadvantage) of buylng 16,000 carburetors from the outside suppiler? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Ltd., could use the freed capacity to launch a new prodict The segment margin of the new product would be $160,000 per year. Given this new assumpton, what would be the financiai advantage (disadvantage) of buying 16,000 carburetors from the outside suppher? 4. Given the new assumption in requirement 3, should the outside suppler's offer be accepted? Complete this question by entering your answers in the tabs below. Assuming the company has no alternative use for the facilties that are now belng used to produce the carburetors. what Requlred: 1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburmtors, whik weble ve the financlal advantage (disadvantage) of buying 16,000 corburetors from the outside supplien? 2. Should the outside suppller's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Ltd, couid use the freed capacity to launch a new produst, Thin segment margin of the new product would be $160,000 per year. Glven this new assumption, what would be the flandid aduartagy (disadvantage) of buying 16,000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3 , should the outside supplier's offer be accepted? Complete this question by entering your answers in the tabs below. Assuming the company has no alternative use for the facilities that are naw being used to produce the carturetars, what Complete this question by entering your answers in the tabs belew. Should the outside supplier's offer be accepted? Requlred: 1. Assuming the company has no alternative use for the facilies that are now being used to produch the saburetark, uhat wenis be the financlal advantage (disadvantage) of buying 16,000 carburetors from the outside supplier? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Hd, could use the freed capacty to inunch a new giodict, Ihie segment margin of the new product would be $160,000 per year. Given this new assumption, what would se the fhanciat antirlaph (disadvantage) of buying 16,000 carburetors from the outside supplie? 4. Given the new assumption in requirement 3 , should the outside supplier's offer be accepted? Complete this question by entering your answers in the tabs below. Suppose that if the carburetors were purchased, Troy Engines, Ltd, could use the freed capacty to launch a neu proovat the suppose that if the carburetors were purchased, Troy Engines, Gd, could use the freed capact what would be the naundal Required: 1. Assuming the company has no alternative use for the focilites that are now being used to produca the carthation, rhat weiss be the financial advantage (disadvantage) of buying 16,000 carburetors from the outside supplen 2. Should the outside supplier's offer be accepted? 3. Suppose that If the carburetors were purchased. Troy Engines, Lid, could use the freed capactly to launch a rew choduct The segment margin of the new product would be $160,000 per year, Given this new astumption, what wald be the finmeial mfrethe? (disadvantage) of buying 16,000 carburetors from the outside supplie? 4. Given the new assumption in requirement 3 , should the outside supplier's offer be accepted? Complete this question by entering your answers in the tabs below. Given the new assumption in requirement 3 , should the outside suppler's offer be accepted