Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IRR Done Manually 4. (25 points) EECS Inc. must decide which of the following two machines they should acquire to use in a production to

IRR Done Manually

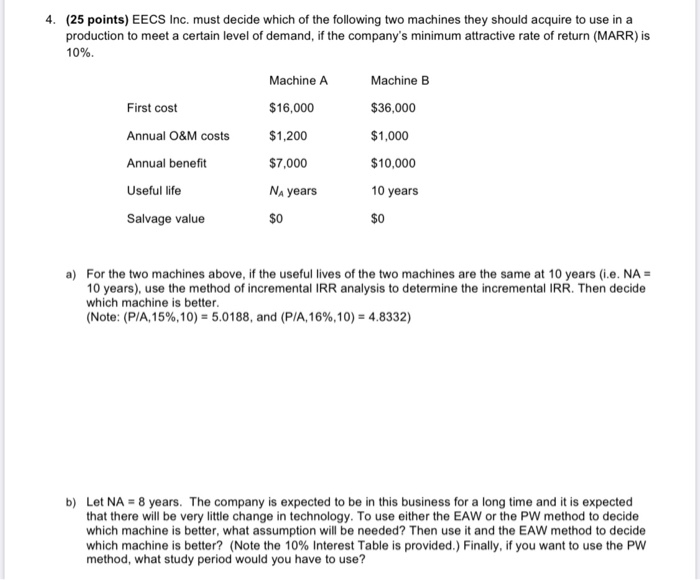

4. (25 points) EECS Inc. must decide which of the following two machines they should acquire to use in a production to meet a certain level of demand, if the company's minimum attractive rate of return (MARR) is 10%. Machine B Machine A $16,000 First cost $36,000 Annual O&M costs $1,200 $1,000 Annual benefit $7,000 $10,000 10 years Useful life NA years Salvage value $0 a) For the two machines above, if the useful lives of the two machines are the same at 10 years (i.e. NA = 10 years), use the method of incremental IRR analysis to determine the incremental IRR. Then decide which machine is better. (Note: (P/A, 15%, 10) = 5.0188, and (P/A, 16%, 10) = 4.8332) b) Let NA = 8 years. The company is expected to be in this business for a long time and it is expected that there will be very little change in technology. To use either the EAW or the PW method to decide which machine is better, what assumption will be needed? Then use it and the EAW method to decide which machine is better? (Note the 10% Interest Table is provided.) Finally, if you want to use the PW method, what study period would you have to use? 4. (25 points) EECS Inc. must decide which of the following two machines they should acquire to use in a production to meet a certain level of demand, if the company's minimum attractive rate of return (MARR) is 10%. Machine B Machine A $16,000 First cost $36,000 Annual O&M costs $1,200 $1,000 Annual benefit $7,000 $10,000 10 years Useful life NA years Salvage value $0 a) For the two machines above, if the useful lives of the two machines are the same at 10 years (i.e. NA = 10 years), use the method of incremental IRR analysis to determine the incremental IRR. Then decide which machine is better. (Note: (P/A, 15%, 10) = 5.0188, and (P/A, 16%, 10) = 4.8332) b) Let NA = 8 years. The company is expected to be in this business for a long time and it is expected that there will be very little change in technology. To use either the EAW or the PW method to decide which machine is better, what assumption will be needed? Then use it and the EAW method to decide which machine is better? (Note the 10% Interest Table is provided.) Finally, if you want to use the PW method, what study period would you have to useStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started