Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Irving Corp. is currently all equity is considering a $555000 debt issue maintain a debt equity ratio of 0.40 in the capital structure following M&M

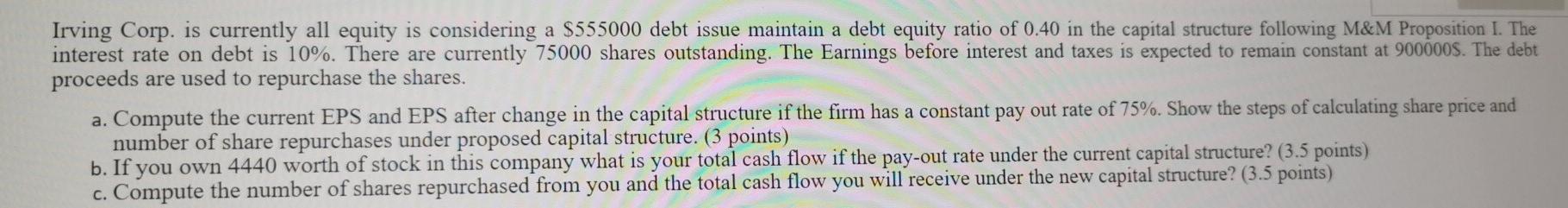

Irving Corp. is currently all equity is considering a $555000 debt issue maintain a debt equity ratio of 0.40 in the capital structure following M&M Proposition I. The interest rate on debt is 10%. There are currently 75000 shares outstanding. The Earnings before interest and taxes is expected to remain constant at 900000$. The debt proceeds are used to repurchase the shares. a. Compute the current EPS and EPS after change in the capital structure if the firm has a constant pay out rate of 75%. Show the steps of calculating share price and number of share repurchases under proposed capital structure. (3 points) b. If you own 4440 worth of stock in this company what is your total cash flow if the pay-out rate under the current capital structure? (3.5 points) c. Compute the number of shares repurchased from you and the total cash flow you will receive under the new capital structure? (3.5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started