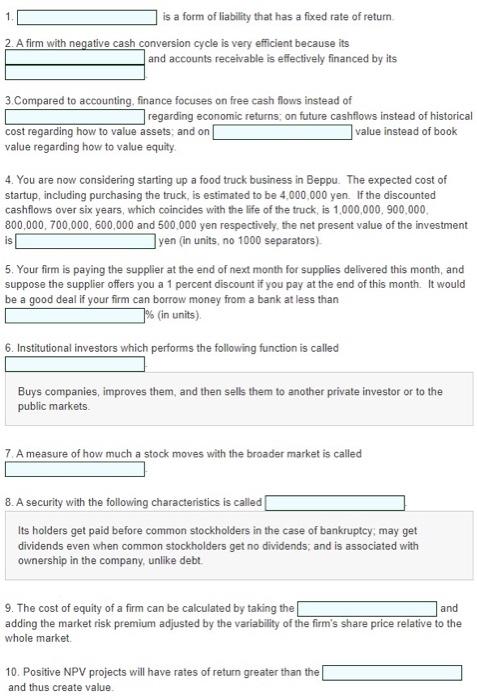

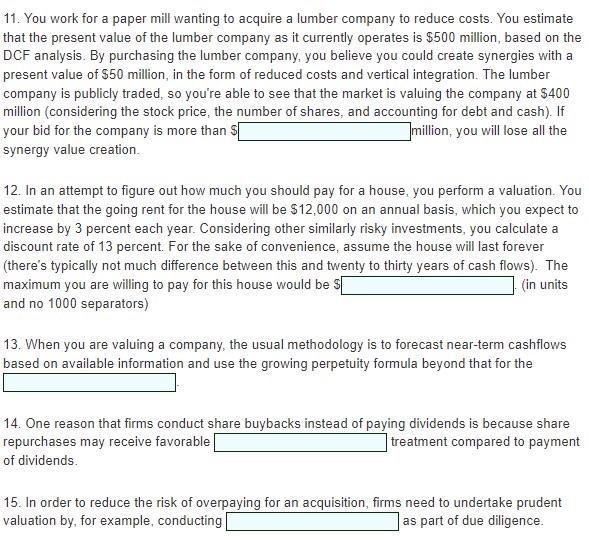

is a form of liability that has a fixed rate of return 2. A firm with negative cash conversion cycle is very efficient because its and accounts receivable is effectively financed by its 3.Compared to accounting, finance focuses on free cash flows instead of regarding economic returns: on future cashflows instead of historical cost regarding how to value assets and on value instead of book value regarding how to value equity 4. You are now considering starting up a food truck business in Beppu. The expected cost of startup, including purchasing the truck, is estimated to be 4,000,000 yen If the discounted cashflows over six years, which coincides with the life of the truck, is 1,000,000,900,000 800,000, 700,000,600,000 and 500,000 yen respectively, the net present value of the investment yen (in units, no 1000 separators) 5. Your firm is paying the supplier at the end of next month for supplies delivered this month, and suppose the supplier offers you a 1 percent discount if you pay at the end of this month. It would be a good deal if your firm can borrow money from a bank at less than 1% (in units) is 6. Institutional investors which performs the following function is called Buys companies, improves them, and then sells them to another private investor or to the public markets 7. A measure of how much a stock moves with the broader market is called 8. A security with the following characteristics is called Its holders get paid before common stockholders in the case of bankruptcy, may get dividends even when common stockholders get no dividends, and is associated with ownership in the company, unlike debt 9. The cost of equity of a firm can be calculated by taking the and adding the market risk premium adjusted by the variability of the firm's share price relative to the whole market 10. Positive NPV projects will have rates of return greater than the and thus create value 11. You work for a paper mill wanting to acquire a lumber company to reduce costs. You estimate that the present value of the lumber company as it currently operates is $500 million, based on the DCF analysis. By purchasing the lumber company, you believe you could create synergies with a present value of $50 million, in the form of reduced costs and vertical integration. The lumber company is publicly traded, so you're able to see that the market is valuing the company at $400 million (considering the stock price, the number of shares, and accounting for debt and cash). If your bid for the company is more than million, you will lose all the synergy value creation. 12. In an attempt to figure out how much you should pay for a house, you perform a valuation. You estimate that the going rent for the house will be $12,000 on an annual basis, which you expect to increase by 3 percent each year. Considering other similarly risky investments, you calculate a discount rate of 13 percent. For the sake of convenience, assume the house will last forever (there's typically not much difference between this and twenty to thirty years of cash flows). The maximum you are willing to pay for this house would be s (in units and no 1000 separators) 13. When you are valuing a company, the usual methodology is to forecast near-term cashflows based on available information and use the growing perpetuity formula beyond that for the 14. One reason that firms conduct share buybacks instead of paying dividends is because share repurchases may receive favorable treatment compared to payment of dividends. 15. In order to reduce the risk of overpaying for an acquisition, firms need to undertake prudent valuation by, for example, conducting as part of due diligence