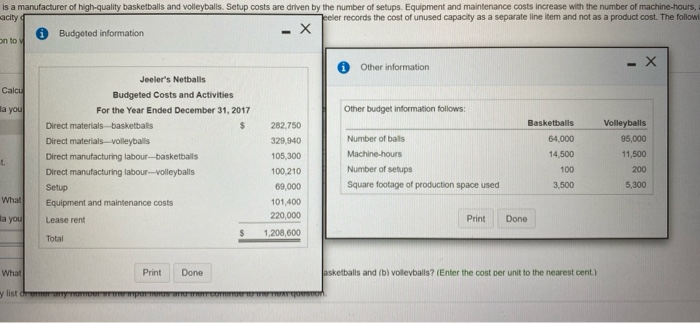

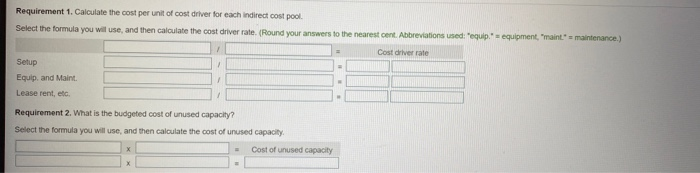

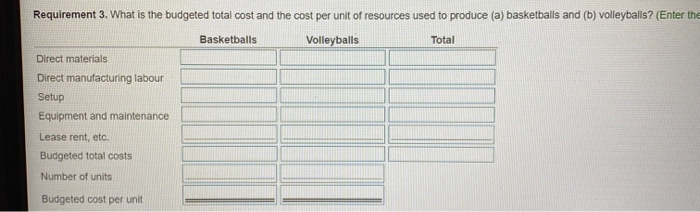

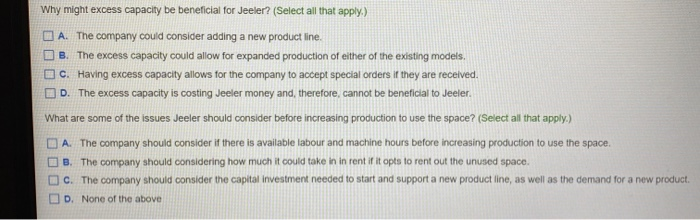

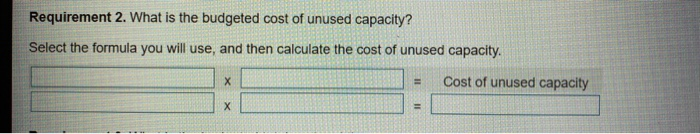

is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setups. Equipment and maintenance costs increase with the number of machine-hours, acity eeler records the cost of unused capacity as a separate line item and not as a product cost. The follow Budgeted information -X on to v Other information - Calcu a you Other budget information follows: Basketballs Jeeler's Netballs Budgeted Costs and Activities For the Year Ended December 31, 2017 Direct materials basketballs $ Direct materials volleyballs Direct manufacturing labour-basketballs Direct manufacturing labour-volleyballs Setup Equipment and maintenance costs Lease rent 282,750 329,940 105,300 100,210 69,000 101,400 220,000 1,208,600 t Number of bals Machine-hours Number of setups Square footage of production space used Volleyballs 95,000 11,500 200 5,300 64,000 14,500 100 3,500 What a you Print Done Total What Print Done asketballs and (b) volleyballs? (Enter the cost per unit to the nearest cent) Requirement 1. Calculate the cost per unit of cost driver for each indirect cost pool. Select the formula you will use, and then calculate the cost driver rate. (Round your answers to the nearest cent. Abbreviations usedequip." equipment, "maint* = maintenance.) Cost driver rate Setup Equip. and Maint Lease rent, etc Requirement 2. What is the budgeted cost of unused capacity? Select the formula you will use, and then calculate the cost of unused capacity Cost of unused capacity Requirement 3. What is the budgeted total cost and the cost per unit of resources used to produce (a) basketballs and (b) volleyballs? (Enter the Basketballs Volleyballs Total Direct materials Direct manufacturing labour Setup Equipment and maintenance Lease rent, etc. Budgeted total costs Number of units Budgeted cost per unit Why might excess capacity be beneficial for Jeeler? (Select all that apply.) A. The company could consider adding a new product line. B. The excess capacity could allow for expanded production of either of the existing models. OC. Having excess capacity allows for the company to accept special orders if they are received. D. The excess capacity is costing Jeeler money and therefore, cannot be beneficial to Jeeler. What are some of the issues Jeeler should consider before increasing production to use the space? (Select all that apply.) A. The company should consider if there is available labour and machine hours before increasing production to use the space. B. The company should considering how much it could take in in rent if it opts to rent out the unused space. C. The company should consider the capital investment needed to start and support a new product line, as well as the demand for a new product. D. None of the above Requirement 2. What is the budgeted cost of unused capacity? Select the formula you will use, and then calculate the cost of unused capacity. Cost of unused capacity Jeeler's Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the number of setup square foot. Capacity of the facility is 11,000 square feet, and Jeeler is using only 80% of this capacity. Jeeler records the co for Jeeler. Click the icon to view the budgeted information.) (Click the icon to view other information.)