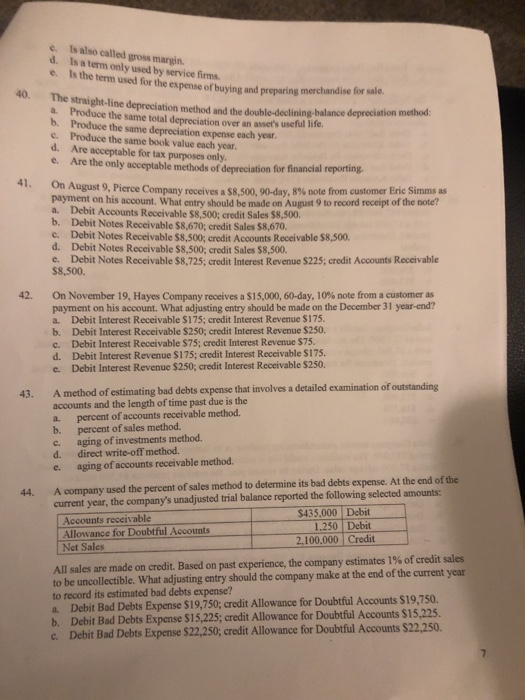

Is also called gross margin. d. c. Is a term only used by service firms e. Is the term used for the expense of buying and preparing merchandise for sale. 40. The straight-line depreciation method and the double-declining-balance depreciation method: Produce the same total depreciation over an asset's useful life. b. Produce the same depreciation expense each year. c. Produce the same book value each year d. Are acceptable for tax purposes only. e. Are the only acceptable methods of depreciation for financial reporting a 41. On August 9, Pierce Company receives a S8.500, 90-day, 8 % note from customer Eric Simms as payment on his account. What entry should be made on August 9 to record receipt of the note? Debit Accounts Receivable $8.500; credit Sales $8,500. b. a. Debit Notes Receivable $8,670; credit Sales $8,670. Debit Notes Receivable $8,500; credit Accounts Receivable $8,500. d. c. Debit Notes Receivable $8,500; credit Sales $8,500. e. Debit Notes Receivable $8,725; credit Interest Revenue $225; credit Accounts Receivable $8,500. On November 19, Hayes Company receives a $15,000, 60-day, 10 % note from a customer as payment on his account. What adjusting entry should be made on the December 31 year-end? Debit Interest Receivable $175; credit Interest Revenue $175. b. 42. a. Debit Interest Receivable $250; credit Interest Revenue $250. Debit Interest Receivable $75; credit Interest Revenue $75. c. Debit Interest Revenue $175; credit Interest Receivable $175. d. Debit Interest Revenue $250; credit Interest Receivable $250. e. A method of estimating bad debts expense that involves a detailed examination of outstanding accounts and the length of time past due is the percent of accounts receivable method. 43. a. percent of sales method, b. aging of investments method. c. direct write-off method. d. aging of accounts receivable method. e. A company used the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts 44. $435,000 Dcbit 1.250 Debit Accounts receivable Allowance for Doubtful Accounts 2,100.000 Credit Net Sales All sales are made on credit. Based on past experience, the company estimates 1% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? a. Debit Bad Debts Expense $19,750; credit Allowance for Doubtful Accounts $19,750. b. Debit Bad Debts Expense $15,225; credit Allowance for Doubtful Accounts $15,225. Debit Bad Debts Expense $22,250; credit Allowance for Doubtful Accounts $22,250. c. 7