Answered step by step

Verified Expert Solution

Question

1 Approved Answer

is April 2, 2018, and you are considering purchasing an investment-grade corporate bond that has a $1,000 face value and matures on June 4,2022 .

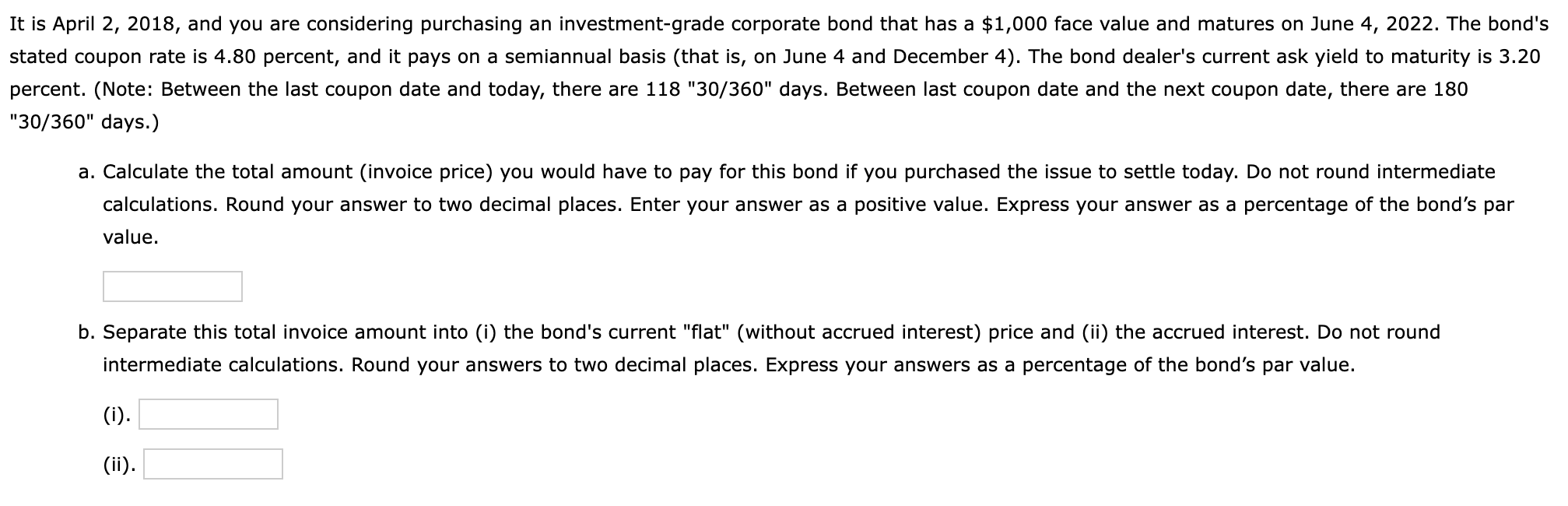

is April 2, 2018, and you are considering purchasing an investment-grade corporate bond that has a $1,000 face value and matures on June 4,2022 . The bond's ated coupon rate is 4.80 percent, and it pays on a semiannual basis (that is, on June 4 and December 4 ). The bond dealer's current ask yield to maturity is 3.20 rcent. (Note: Between the last coupon date and today, there are 118 "30/360" days. Between last coupon date and the next coupon date, there are 180 0/360 " days.) a. Calculate the total amount (invoice price) you would have to pay for this bond if you purchased the issue to settle today. Do not round intermediate calculations. Round your answer to two decimal places. Enter your answer as a positive value. Express your answer as a percentage of the bond's par value. b. Separate this total invoice amount into (i) the bond's current "flat" (without accrued interest) price and (ii) the accrued interest. Do not round intermediate calculations. Round your answers to two decimal places. Express your answers as a percentage of the bond's par value. (i). (ii)

is April 2, 2018, and you are considering purchasing an investment-grade corporate bond that has a $1,000 face value and matures on June 4,2022 . The bond's ated coupon rate is 4.80 percent, and it pays on a semiannual basis (that is, on June 4 and December 4 ). The bond dealer's current ask yield to maturity is 3.20 rcent. (Note: Between the last coupon date and today, there are 118 "30/360" days. Between last coupon date and the next coupon date, there are 180 0/360 " days.) a. Calculate the total amount (invoice price) you would have to pay for this bond if you purchased the issue to settle today. Do not round intermediate calculations. Round your answer to two decimal places. Enter your answer as a positive value. Express your answer as a percentage of the bond's par value. b. Separate this total invoice amount into (i) the bond's current "flat" (without accrued interest) price and (ii) the accrued interest. Do not round intermediate calculations. Round your answers to two decimal places. Express your answers as a percentage of the bond's par value. (i). (ii) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started