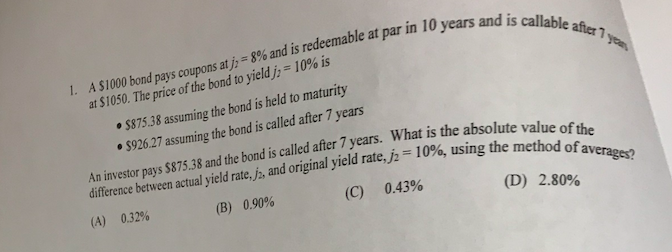

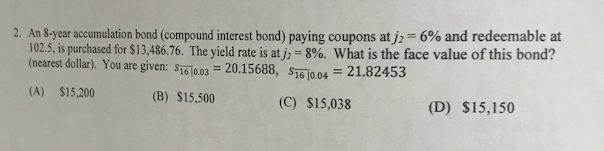

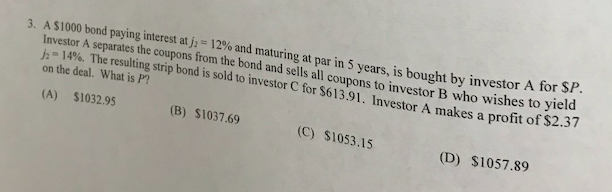

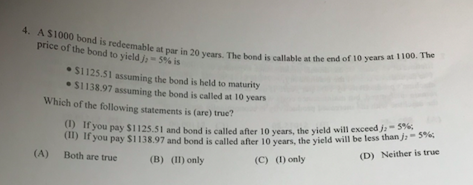

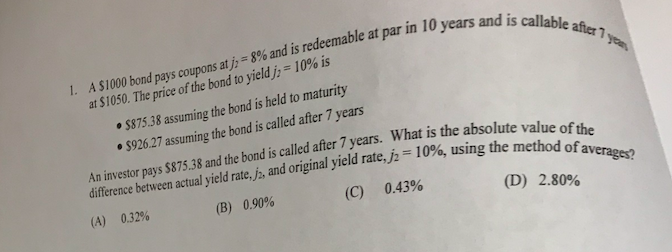

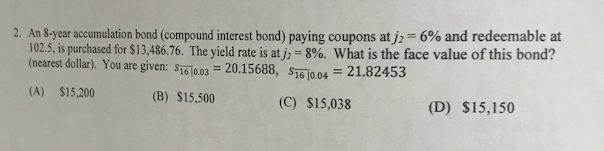

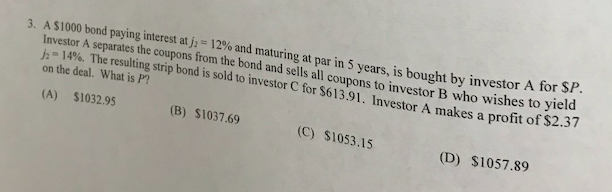

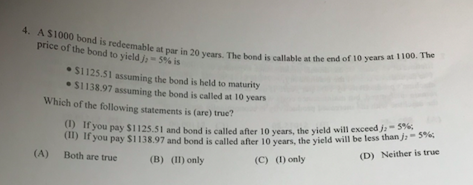

is callable after 7 1. A$1000 bond pays coupons atJ2 8% and is redeemable at par in 10 years and at $1050. The price of the bond to yieldj,-10% is #587538 assuming the bond is held to maturity $92627 asuming the bond is called after 7 years An investor pays $875.38 and the bond is called after 7 years.w What is the absolute value of the between actual yield rate,Ja and original yield rate,J,-10%, using the method of (C) of averages? (A) 0.32% (B) 0.90% 0.43% (D) 2.80% 6% and redeemable at An 8-year accumulation bond (compound interest bond) paying coupons atJ2 102.5, is purchased for $13,486.76. The yield rate is at j2 8%. What is the face value of this bond? (nearest dollar). You are given:S16003 20.15688, 1600421.82453 (A) $15,200 2 (B) $15,500 (C) $15,038 (D) $15,150 3. A $1000 bond payi ng interest atfz 12% and maturingat par in 5 years, is bought by investor A for SP. r A separates the coupons from the bond Investo i:" 14%. The resulting strip bond is sold to on the deal. What is P? and sells all coupons to investor B who wi vestor C for $613.91. Investor A makes a profit of $ in (A) $1032.95 (B) $1037.69 (C) $1053.15 (D) $1057.89 4. A $1000 bond price of the bond to yield),-5% is s redeemable at par in 20 years. The bond is callable at the end of 10 years ast I1 #51 125.51 assuming the bond is held to maturity #51 138.97 assuming the bond is called at 10 years Which of the following statements is (are) true? (1) If you pay $1125.51 un) If you pay $1138.97 and bond is called after 10 years, the yield will be less than)s5 Both are true and bond is called after 10 years, the yield will exceed j,-5%; (D) Neither is true (A) (B) (II) only (C) (1) only is callable after 7 1. A$1000 bond pays coupons atJ2 8% and is redeemable at par in 10 years and at $1050. The price of the bond to yieldj,-10% is #587538 assuming the bond is held to maturity $92627 asuming the bond is called after 7 years An investor pays $875.38 and the bond is called after 7 years.w What is the absolute value of the between actual yield rate,Ja and original yield rate,J,-10%, using the method of (C) of averages? (A) 0.32% (B) 0.90% 0.43% (D) 2.80% 6% and redeemable at An 8-year accumulation bond (compound interest bond) paying coupons atJ2 102.5, is purchased for $13,486.76. The yield rate is at j2 8%. What is the face value of this bond? (nearest dollar). You are given:S16003 20.15688, 1600421.82453 (A) $15,200 2 (B) $15,500 (C) $15,038 (D) $15,150 3. A $1000 bond payi ng interest atfz 12% and maturingat par in 5 years, is bought by investor A for SP. r A separates the coupons from the bond Investo i:" 14%. The resulting strip bond is sold to on the deal. What is P? and sells all coupons to investor B who wi vestor C for $613.91. Investor A makes a profit of $ in (A) $1032.95 (B) $1037.69 (C) $1053.15 (D) $1057.89 4. A $1000 bond price of the bond to yield),-5% is s redeemable at par in 20 years. The bond is callable at the end of 10 years ast I1 #51 125.51 assuming the bond is held to maturity #51 138.97 assuming the bond is called at 10 years Which of the following statements is (are) true? (1) If you pay $1125.51 un) If you pay $1138.97 and bond is called after 10 years, the yield will be less than)s5 Both are true and bond is called after 10 years, the yield will exceed j,-5%; (D) Neither is true (A) (B) (II) only (C) (1) only