Answered step by step

Verified Expert Solution

Question

1 Approved Answer

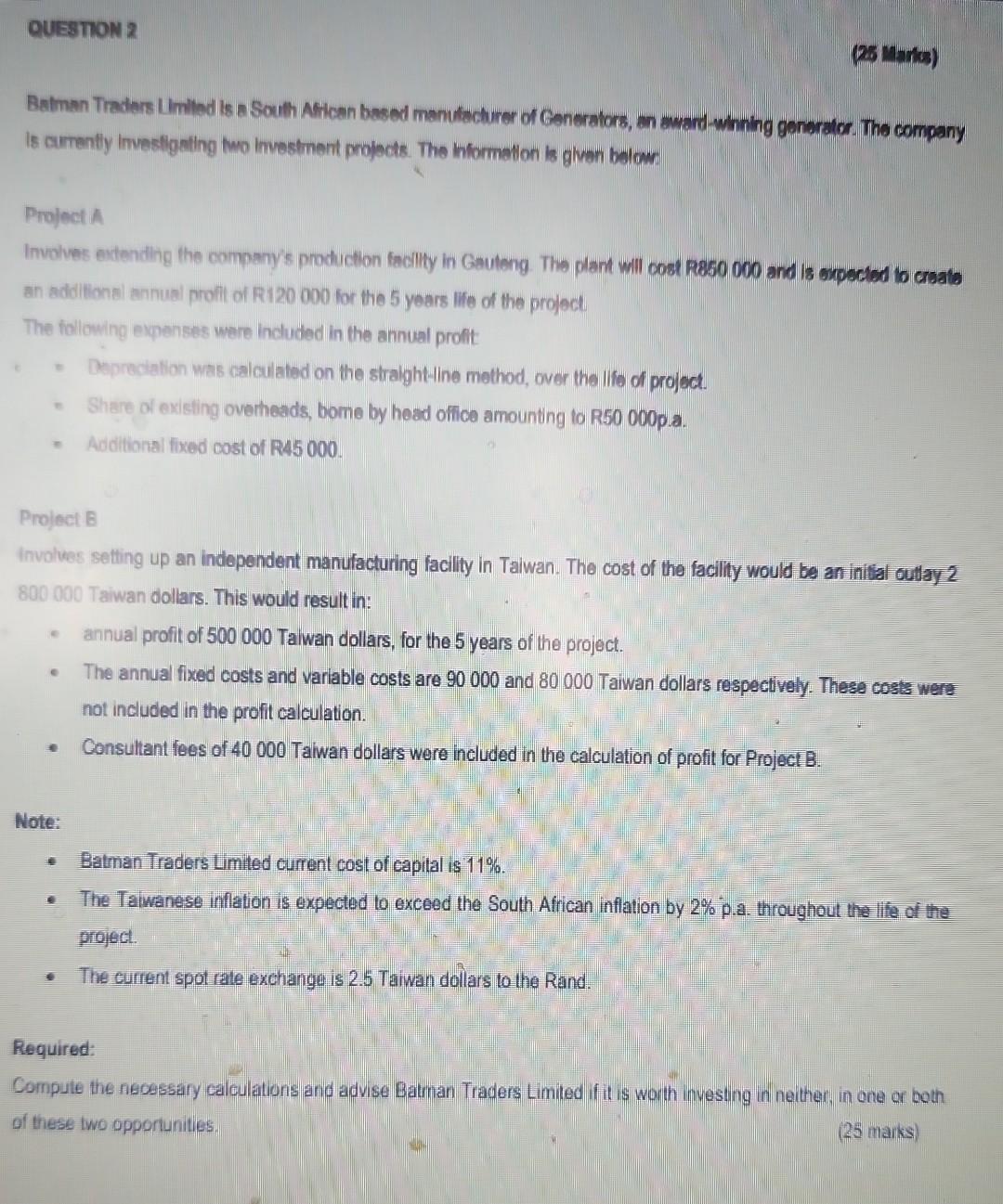

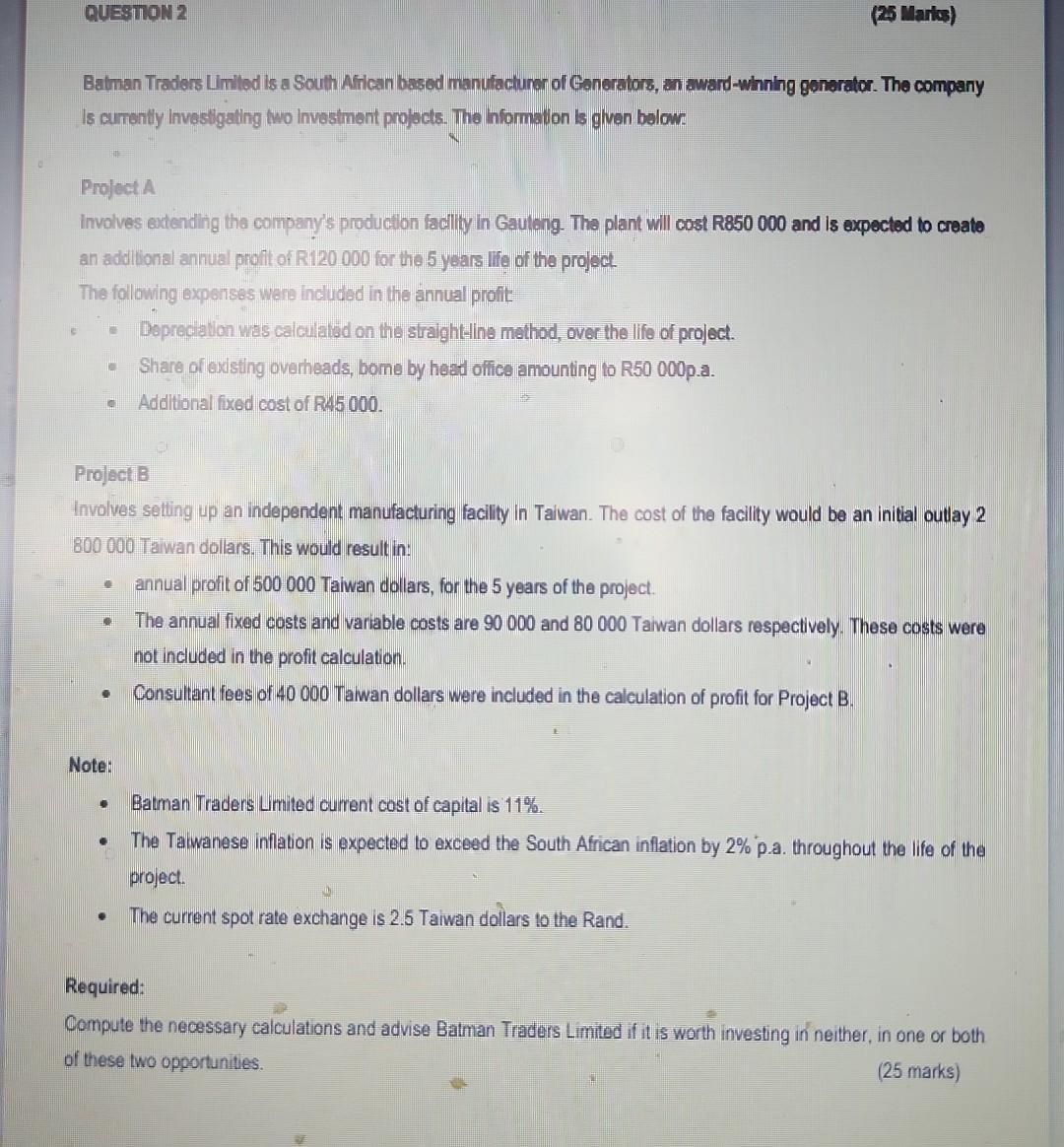

is currently invesligaling two livvestinent projeds. The informallon is glvan below Project A an addilional annual proili of R120 000 for the 5 years life

is currently invesligaling two livvestinent projeds. The informallon is glvan below Project A an addilional annual proili of R120 000 for the 5 years life of the project. The following expenses ware induded in the annual profit " Dverrecialion was calculated on the siralght-iline mothod, over the life of project. - Share of existing overheads, bome by hoad ofilice amounting to R50 000p.a. - Additional fixed cost of R45 000 . Project B invotues setting up an independent manufacturing facility in Taiwan. The cost of the facility would be an initial oullay 2 800000 Taiwan dollars. This would result in: - annual profit of 500000 Taiwan dollars, for the 5 years of the project. - The annual fixed costs and variable costs are 90000 and 80000 Taiwan dollars respectively. These costs were not included in the profit calculation. - Consultant fees of 40000 Taiwan dollars were included in the calculation of profit for Project B. Note: - Batman Traders Limited current cost of capital is 11%. - The Taiwanese inflation is expected to exceed the South African inflation by 2% p.a. throughout the life of the project. - The current spot rate exchange is 2.5 Taiwan dollars to the Rand. Required: Compute the necessary calculations and advise Batman Traders Limited if it is worth investing in neither, in one or both of these two opportunities. (25 marks) Batman Tradors Umilod is a South Afilcan basod manufacturor of Gonorators, an award-whning generator. The company is curronily investigating two investment projocts. The information is given bolow: Project A Involves extending tha company's production facility in Gautang. The plant will cost R850 000 and is expected to create an addlitional annual profit of R120 000 for the 5 years life of the project. The following exponses wero Included in the annual profit: - Depreciation was calculatid on the straighteline method, over the life of project. - Share of exising overheads, bome by head olice emounting to R50 000p.a. - Additional fixed cost of R45 000 . Projact B Involves selting up an independent manufacturing facility in Taiwan. The cost of the facility would be an initial outlay 2 800000 Taiwan dollars. This would result in: - annual profit of 500000 Taiwan dollars, for the 5 years of the project. - The annual fixed costs and variable costs are 90000 and 80000 Taiwan dollars respectively. These costs were not included in the profit calculation. - Consultant fees of 40000 Taiwan dollars were included in the calculation of profit for Project B. Note: - Batman Traders Limited current cost of capital is 11%. - The Tawanese inflation is expected to exceed the South African inflation by 2% p.a. throughout the life of the project. - The current spot rate exchange is 2.5 Taiwan dollars to the Rand. Required: Compute the necessary calculations and advise Balman Traders Limited if it is worth investing in neither, in one or both of these two opportunities. ( 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started