Answered step by step

Verified Expert Solution

Question

1 Approved Answer

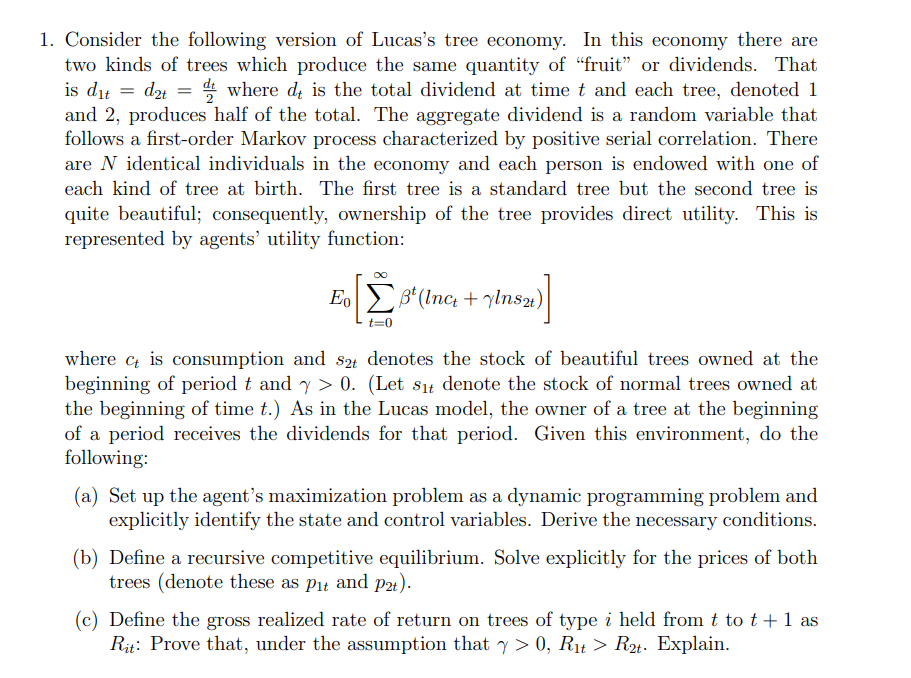

is dit 1. Consider the following version of Lucas's tree economy. In this economy there are two kinds of trees which produce the same

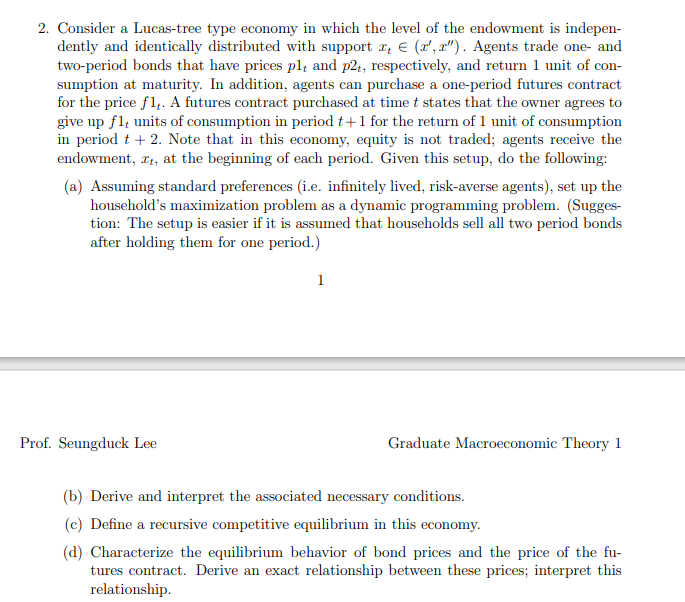

is dit 1. Consider the following version of Lucas's tree economy. In this economy there are two kinds of trees which produce the same quantity of "fruit" or dividends. That d2+ = where d is the total dividend at time t and each tree, denoted 1 and 2, produces half of the total. The aggregate dividend is a random variable that follows a first-order Markov process characterized by positive serial correlation. There are N identical individuals in the economy and each person is endowed with one of each kind of tree at birth. The first tree is a standard tree but the second tree is quite beautiful; consequently, ownership of the tree provides direct utility. This is represented by agents' utility function: = Eo Bt (Inc + ylns2t) where ct is consumption and s2t denotes the stock of beautiful trees owned at the beginning of period t and y> 0. (Let sit denote the stock of normal trees owned at the beginning of time t.) As in the Lucas model, the owner of a tree at the beginning of a period receives the dividends for that period. Given this environment, do the following: (a) Set up the agent's maximization problem as a dynamic programming problem and explicitly identify the state and control variables. Derive the necessary conditions. (b) Define a recursive competitive equilibrium. Solve explicitly for the prices of both trees (denote these as pit and p2t). (c) Define the gross realized rate of return on trees of type i held from t to t+1 as Rit: Prove that, under the assumption that y > 0, Rt > R2t. Explain. 2. Consider a Lucas-tree type economy in which the level of the endowment is indepen- dently and identically distributed with support x (z', x"). Agents trade one- and two-period bonds that have prices plt and p2t, respectively, and return 1 unit of con- sumption at maturity. In addition, agents can purchase a one-period futures contract for the price fl,. A futures contract purchased at time t states that the owner agrees to give up f1 units of consumption in period t+1 for the return of 1 unit of consumption in period t + 2. Note that in this economy, equity is not traded; agents receive the endowment, It, at the beginning of each period. Given this setup, do the following: (a) Assuming standard preferences (i.e. infinitely lived, risk-averse agents), set up the household's maximization problem as a dynamic programming problem. (Sugges- tion: The setup is easier if it is assumed that households sell all two period bonds after holding them for one period.) Prof. Seungduck Lee 1 Graduate Macroeconomic Theory 1 (b) Derive and interpret the associated necessary conditions. (c) Define a recursive competitive equilibrium in this economy. (d) Characterize the equilibrium behavior of bond prices and the price of the fu- tures contract. Derive an exact relationship between these prices; interpret this relationship.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Agents Maximization Problem The agents maximization problem can be set up as a dynamic programming problem with the following state and control vari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started