Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is it really new? or should i add the whole part of the article Tiffany heads to India in tie-up with Mukesh Ambani's Reliance Upmarket

Is it really new? or should i add the whole part of the article

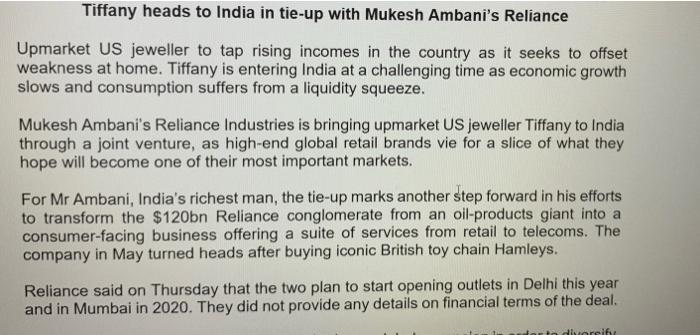

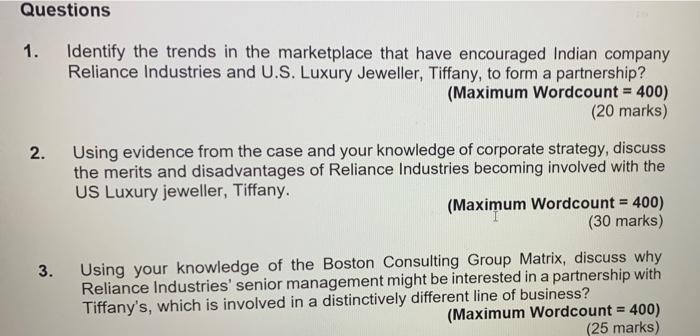

Tiffany heads to India in tie-up with Mukesh Ambani's Reliance Upmarket US jeweller to tap rising incomes in the country as it seeks to offset weakness at home. Tiffany is entering India at a challenging time as economic growth slows and consumption suffers from a liquidity squeeze. Mukesh Ambani's Reliance Industries is bringing upmarket US jeweller Tiffany to India through a joint venture, as high-end global retail brands vie for a slice of what they hope will become one of their most important markets, For Mr Ambani, India's richest man, the tie-up marks another step forward in his efforts to transform the $120bn Reliance conglomerate from an oil-products giant into a consumer-facing business offering a suite of services from retail to telecoms. The company in May turned heads after buying iconic British toy chain Hamleys. Reliance said on Thursday that the two plan to start opening outlets in Delhi this year and in Mumbai in 2020. They did not provide any details on financial terms of the deal. to divorci Questions 1. Identify the trends in the marketplace that have encouraged Indian company Reliance Industries and U.S. Luxury Jeweller, Tiffany, to form a partnership? (Maximum Wordcount = 400) (20 marks) 2. Using evidence from the case and your knowledge of corporate strategy, discuss the merits and disadvantages of Reliance Industries becoming involved with the US Luxury jeweller, Tiffany. (Maximum Wordcount = 400) (30 marks) 3. Using your knowledge of the Boston Consulting Group Matrix, discuss why Reliance Industries' senior management might be interested in a partnership with Tiffany's, which is involved in a distinctively different line of business? (Maximum Wordcount = 400) (25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started