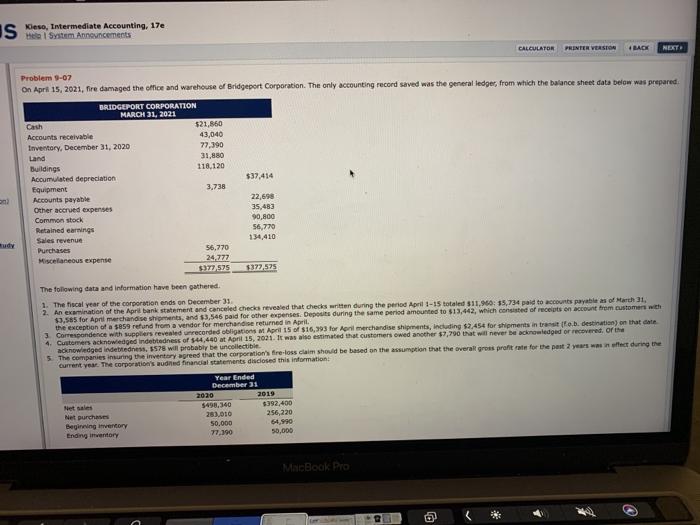

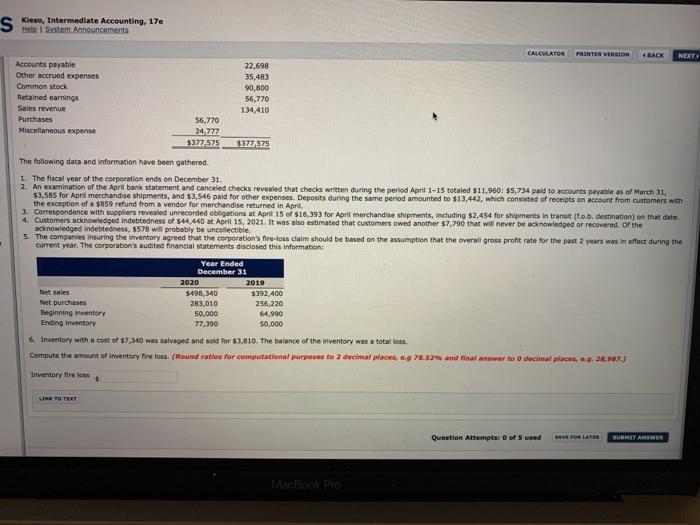

IS Mesa, Intermediate Accounting, 17e CALCULATOR PRINTER VERSION BACK NEXT Problem 9-07 On April 15, 2021, fire damaged the office and warehouse of Bridgeport Corporation. The only accounting record saved was the general ledger, from which the balance sheet data below was prepared BRIDGEPORT CORPORATION MARCH 31, 2021 Cash $21,860 Accounts receivable 43,040 Inventory, December 31, 2020 77,390 Land 31,880 Buildings 110,120 Accumulated depreciation $37,414 Equipment 3,738 Accounts payable 22,698 Other accrued expenses 35,483 Common stock 90,800 Retained earnings 56,770 Sales revenue 134,410 Purchases 56,770 Miscellaneous experte 24,777 $377 575 1372575 The following data and Information have been gathered 1. The tiscal year of the corporation ends on December 31 2. An examination of the Apri bank statement and canceled check revealed that checks written during the period April 1-15 totaled $11.960: 15,734 paid to accounts payable as of March 31. $3,585 for Apni merchandise shipments, and $3,546 paid for other expenses. Deposits during the same period amounted to $13,442, which consisted of receipts on account from customers with 3 Correspondence with suppliers revealed unrecorded obligation April 15 of $16,393 for April merchandise shipments, including $2,454 for shipments in transfo.b. destination on that date 4. Customers acknowledged indebtedness of $44,440 at April 15, 2001. It was al estimated that customers owed another $7,790 that will never be acknowledged or recovered, or the anowiedged indettedness, 1578 will probably be uncollectible 5. The companies inuring the inventory agreed that the corporation's fre-loss claim should be based on the assumption that the overall grous profit rate for the past 2 years antece during the Current year. The corporation's wudhe financial statements disclosed this information: Year Ended December 31 2020 2019 Net sales 5498,340 $392,400 Net purchases 283,010 256,220 Beginning inventory 50,000 64.990 Ending inventory 77.390 50,000 MNCBook Pro S Kleso, Intermediate Accounting, 17e Help System Announcements CALCULATOR PRINTER VERSION 4 RACK NET: Accounts payable Other accrued expenses Common stock Retained earnings Sales revenue Purchases Miscellaneous expense 22,698 35,483 90,800 56,770 134,410 56.770 24,277 $377 575 $377575 The following data and information have been gathered 1. The fiscal year of the corporation ends on December 31. 2. An examination of the Apeil bank statement and canceled checks revealed that checks written during the period April 1-15 totaled $11,960: 55,734 paid to accounts payable as of March 31, $3.585 for April merchandise shipments, and $3,546 paid for other expenses. Deposits during the same period amounted to $13,442, which consisted of receipts on account from customers with the exception of a $859 refund from a vender for merchandise returned in April. 3. Correspondence with suppliers revealed unrecorded obligations at April 15 of $16,393 for April merchandise shipments, including $2,454 for shipments in transito.b. destination) on that date. 4. Customers acknowledged indebtedness of $14.440 at April 15, 2021. It was also estimated that customers owed another $7,790 that will never be acknowledged or recovered of the 5. The companies induring the inventory agreed that the corporation's pre-loss claim should be based on the assumption that the overall gross profit rate for the past 2 years was in effect during the current year. The corporation's audited financial statements disclosed this information Year Ended December 31 2020 2019 Net sales 3498,340 $392,400 Net purchases 283,010 256,220 Beginning inventory 50,000 64,990 Ending inventory 77,390 50,000 5. Inventory with a cost of $7,340 was salvaged and sold for $3.810. The balance of the inventory was a total loss. Compute the amount of inventory Preloss. (Round ration for computational purpose to 2 decimal places, eg 78.529 and final answer to decinal pow. 26.07.) Inventory fire los $ LINE TO TERT Question Attempts of sused LAVE FOR LATER SUBMIT ANSWER MacBook Pro