Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is my answer correct? thanks A CPA firm performs the annual audit of The Leahy Group, a private company. The client has asked the firm

Is my answer correct? thanks

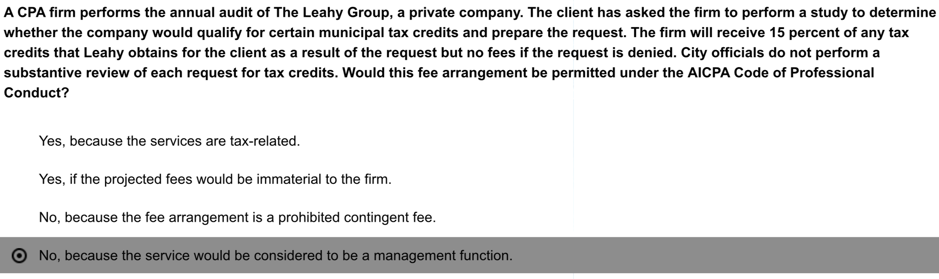

A CPA firm performs the annual audit of The Leahy Group, a private company. The client has asked the firm to perform a study to determine whether the company would qualify for certain municipal tax credits and prepare the request. The firm will receive 15 percent of any tax credits that Leahy obtains for the client as a result of the request but no fees if the request is denied. City officials do not perform a substantive review of each request for tax credits. Would this fee arrangement be permitted under the AICPA Code of Professional Conduct? Yes, because the services are tax-related Yes, if the projected fees would be immaterial to the firm No, because the fee arrangement is a prohibited contingent fee. No, because the service would be considered to be a management functionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started