Answered step by step

Verified Expert Solution

Question

1 Approved Answer

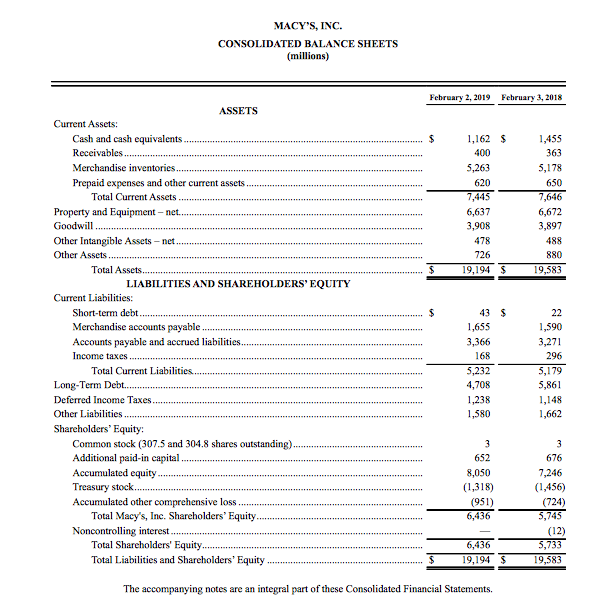

Is my answers for Question 2 correct? Does the total really match the balance sheet cash? MACY'S, INC. CONSOLIDATED BALANCE SHEETS (millions) February 2, 2019

Is my answers for Question 2 correct? Does the total really match the balance sheet cash?

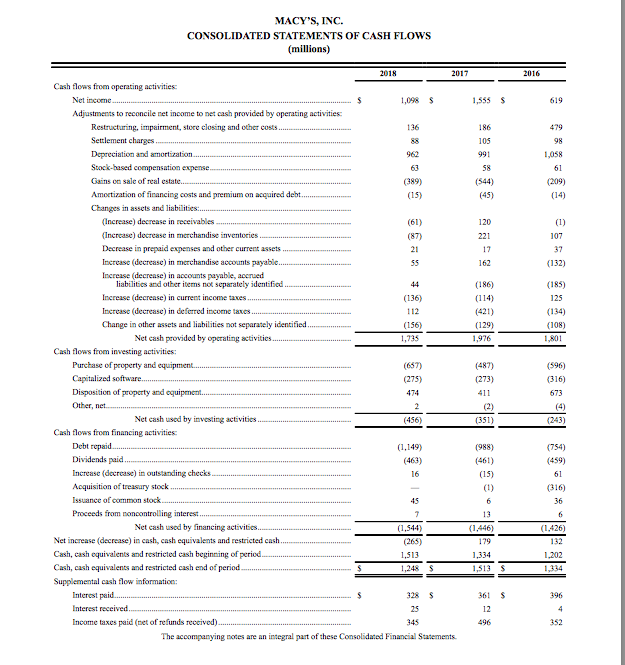

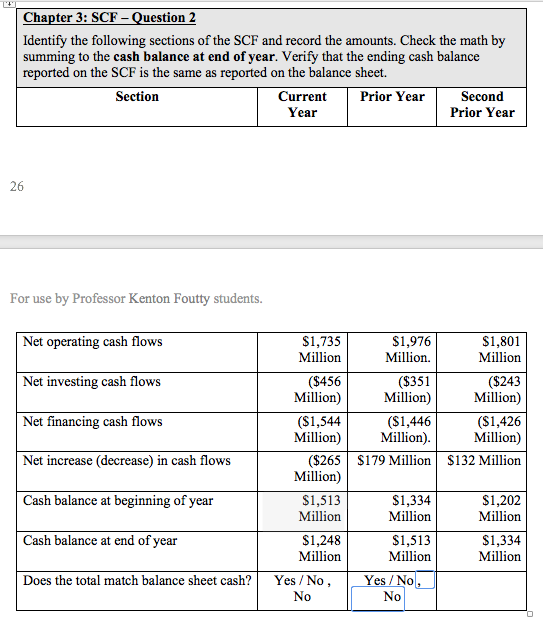

MACY'S, INC. CONSOLIDATED BALANCE SHEETS (millions) February 2, 2019 February 3, 2018 1,455 363 5,178 650 7,646 1,162 $ 400 5,263 620 7,445 6,637 3,908 478 726 19,1945 6,672 3,897 488 880 19,583 ....$ 22 ASSETS Current Assets: Cash and cash equivalents........ Receivables. . ....... Merchandise inventories Prepaid expenses and other current assets Total Current Assets Property and Equipment - net......... Goodwill..... Other Intangible Assets - net................ Other Assets Total Assets......................... **** LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Short-term debt....... Merchandise accounts payable Accounts payable and accrued liabilities........ Income taxes........ Total Current Liabilities... Long-Term Debt....................... Deferred Income Taxes......... Other Liabilities Shareholders' Equity: Common stock (307.5 and 304.8 shares outstanding). Additional paid-in capital... Accumulated equity........ Treasury stock... Accumulated other comprehensive loss............ Total Macy's, Inc. Shareholders' Equity.......... Noncontrolling interest Total Shareholders' Equity......................... Total Liabilities and Shareholders' Equity 1,655 3,366 1,590 3,271 296 168 5,232 5.179 4,708 1,238 1,580 5,861 1,148 1,662 652 8,050 (1,318) (951) 6,436 676 7,246 (1,456) (724) 5,745 6,4365 19,194 $ (12) ,733 19,583 The accompanying notes are an integral part of these Consolidated Financial Statements. MACY'S, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (millions) 2016 $ 619 479 1,058 61 (209) (185) 125 (134) (108) 1.801 2018 2017 Cash flows from operating activities Net income 1,098 $ 1,555 Adjastments to reconcile net income to the cash provided by operating activities Restructuring, impairment, store closing and other costs. 186 Settlement charges 105 Depreciation and amortization..... 991 Stock-based compensation expense. Gains on sale of real estate... Amortization of financing costs and premium on acquired debt. Changes in assets and liabilities.... Increase) decrease in receivables Increase) decrease in merchandise inventories Decrease in prepaid expenses and other current assets... Increase (decrease) in merchandise accounts payable Increase (decrease) in accounts payable, accrued liabilities and other items not separately identified.... (186) Increase (decrease) in current income taxes (136) (114) Increase (decrease) in deferred income taxes... 112 (421) Change in other assets and liabilities not separately identified......... (156) (129) Net cash provided by operating activities 1,735 1.976 Cash flows from investing activities: Purchase of property and equipment........ (657) Capitalized software... (275) (273) Disposition of property and equipment.......... Othernet Net cash used by investing activities.... (456) (351) Cash flows from financing activities Debt repaid. (1.149) 1988) Dividends paid... (463) (461) Increase (decrease) in outstanding checks... (15) Acquisition of treasury stock Issuance of common stock... Proceeds from noncontrolling interest... Net cash used by financing activities... (1,544) (1.446) Net increase (decrease) in cash, cash equivalents and restricted cash..... (265) Cash, cash equivalents and restricted cash beginning of period 1,513 1.334 Cash, cash equivalents and restricted cash end of period.... 1,248 S 1,513 Supplemental cash flow information: Interest paid... 361 Interest received... Income taxes paid (net of refunds received).. 496 The accompanying notes are an integral part of these Consolidated Financial Statements (487) (596) (316) 673 (754) 16 61 (316) (1.426) 132 1,202 $ $ 396 352 Chapter 3: SCF - Question 2 Identify the following sections of the SCF and record the amounts. Check the math by summing to the cash balance at end of year. Verify that the ending cash balance reported on the SCF is the same as reported on the balance sheet. Section Current Prior Year Second Year Prior Year 26 For use by Professor Kenton Foutty students. Net operating cash flows Net investing cash flows $1,801 Million ($243 Million) ($1,426 Million) $132 Million Net financing cash flows Net increase (decrease) in cash flows $1,735 $1,976 Million Million. ($456 ($351 Million) Million) ($1,544 ($1,446 Million) Million). ($265 $179 Million Million) $1,513 $1,334 Million Million $1,248 $1,513 Million Million Yes/No, |_Yes/No, No No Cash balance at beginning of year $1,202 Million Cash balance at end of year $1,334 Million Does the total match balance sheet cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started