Answered step by step

Verified Expert Solution

Question

1 Approved Answer

is my work correct? the professor responded on the bottom with extra notes The Forecast and Budget Department of XYZ Corporation (involved in the retail

is my work correct? the professor responded on the bottom with extra notes

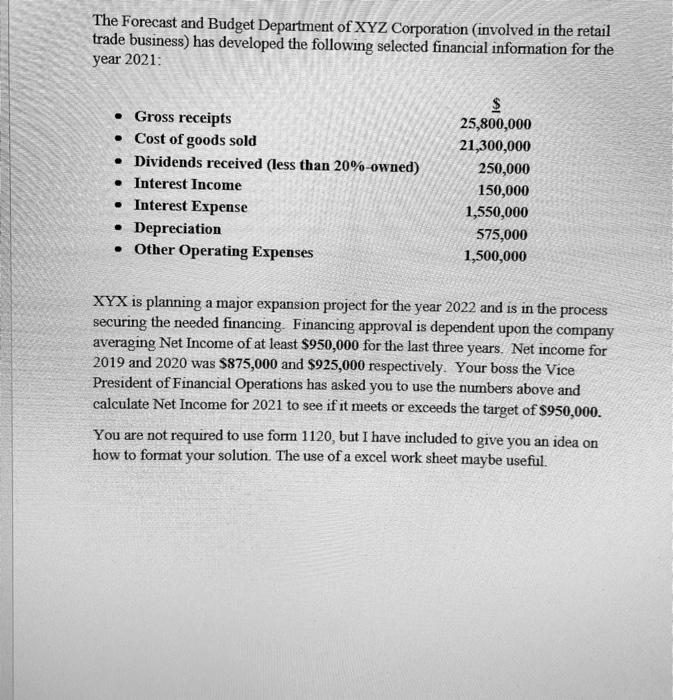

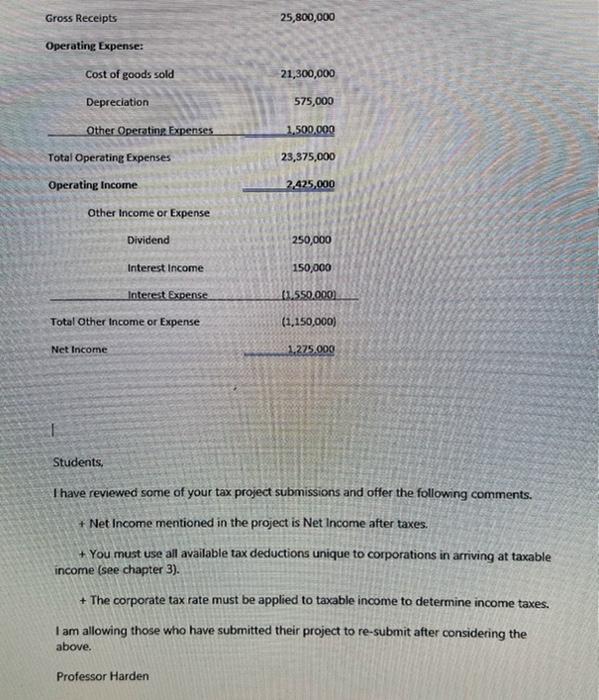

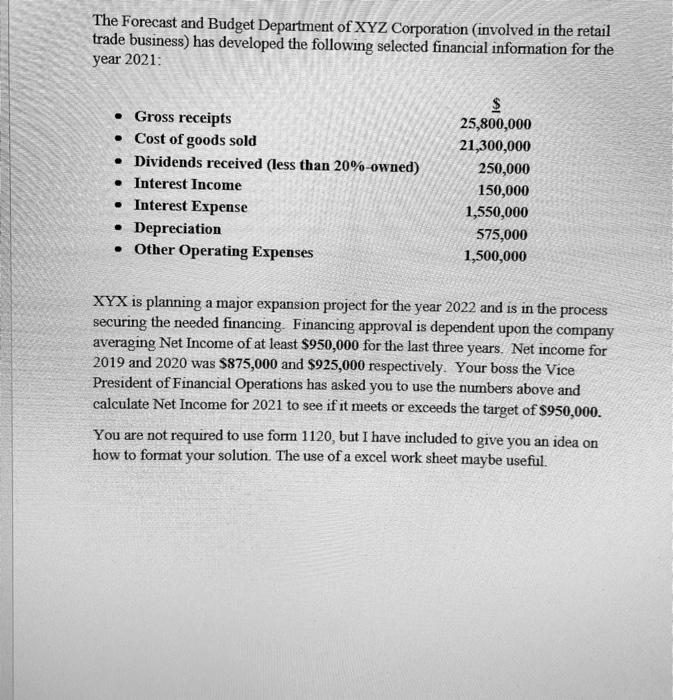

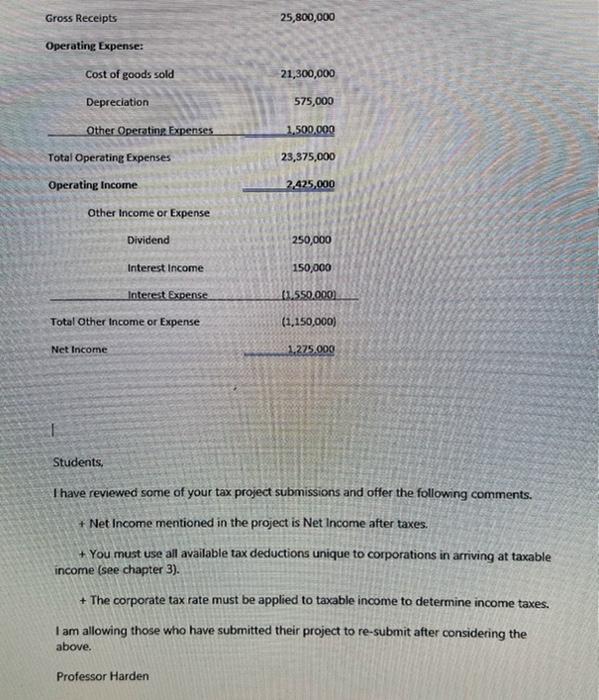

The Forecast and Budget Department of XYZ Corporation (involved in the retail trade business) has developed the following selected financial information for the year 2021: Gross receipts Cost of goods sold Dividends received (less than 20%-owned) Interest Income Interest Expense Depreciation Other Operating Expenses 25,800,000 21,300,000 250,000 150,000 1,550,000 575,000 1,500,000 XYX is planning a major expansion project for the year 2022 and is in the process securing the needed financing. Financing approval is dependent upon the company averaging Net Income of at least $950,000 for the last three years. Net income for 2019 and 2020 was $875,000 and $925,000 respectively. Your boss the Vice President of Financial Operations has asked you to use the numbers above and calculate Net Income for 2021 to see if it meets or exceeds the target of $950,000. You are not required to use form 1120, but I have included to give you an idea on how to format your solution. The use of a excel work sheet maybe useful. Gross Receipts 25,800,000 Operating Expense: Cost of goods sold 21,300,000 Depreciation 575,000 Other Operating Expenses 1.500.000 Total Operating Expenses 23,375,000 Operating Income 2,425,000 Other Income or Expense Dividend 250,000 Interest Income 150,000 Interest Expense 01.550.000 Total Other Income or Expense (1,150,000) Net Income 1.275.000 Students, I have reviewed some of your tax project submissions and offer the following comments. + Net Income mentioned in the project is Net Income after taxes. + You must use all available tax deductions unique to corporations in arriving at taxable income (see chapter 3). + The corporate tax rate must be applied to taxable income to determine income taxes. I am allowing those who have submitted their project to re-submit after considering the above. Professor Harden

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started