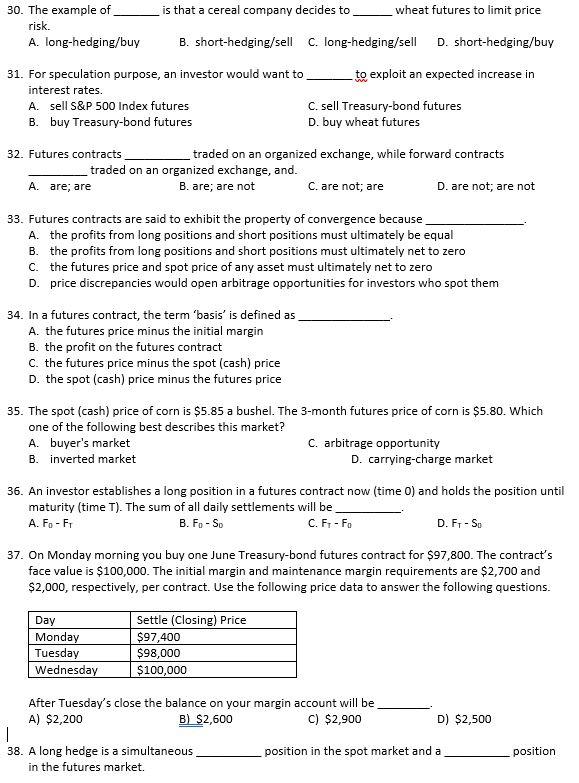

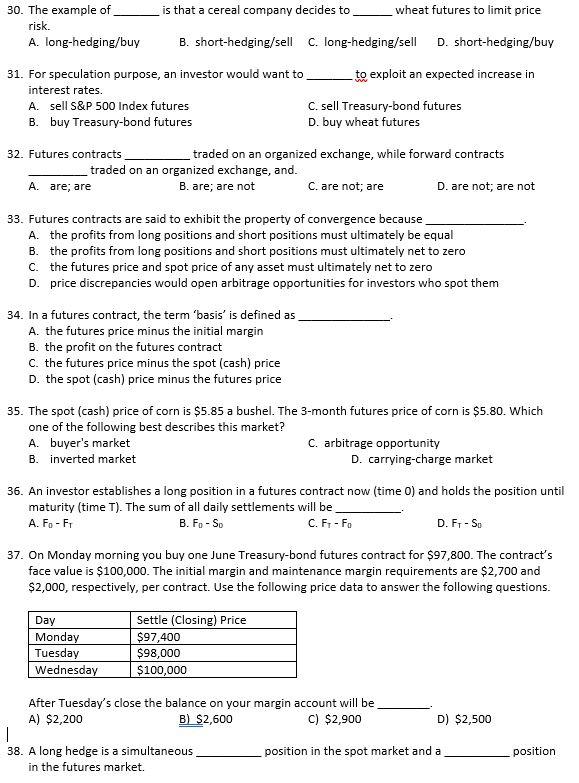

is that a cereal company decides to wheat futures to limit price 30. The example of risk. A. long-hedging/buy B. short-hedging/sell C. long-hedging/sell D. short-hedging/buy 31. For speculation purpose, an investor would want to to exploit an expected increase in interest rates. A. sell S&P 500 Index futures C. sell Treasury-bond futures B. buy Treasury-bond futures D. buy wheat futures 32. Futures contracts traded on an organized exchange, while forward contracts traded on an organized exchange, and. A are, are B. are; are not C. are not; are D. are not; are not 33. Futures contracts are said to exhibit the property of convergence because A. the profits from long positions and short positions must ultimately be equal B. the profits from long positions and short positions must ultimately net to zero C. the futures price and spot price of any asset must ultimately net to zero D. price discrepancies would open arbitrage opportunities for investors who spot them 34. In a futures contract, the term 'basis' is defined as A. the futures price minus the initial margin B. the profit on the futures contract C. the futures price minus the spot (cash) price D. the spot (cash) price minus the futures price 35. The spot (cash) price of corn is $5.85 a bushel. The 3-month futures price of corn is $5.80. Which one of the following best describes this market? A. buyer's market C. arbitrage opportunity B. inverted market D. carrying-charge market 36. An investor establishes a long position in a futures contract now (time 0) and holds the position until maturity (time T). The sum of all daily settlements will be A. Fo - F1 B. Fo-So C. F- Fo D. F1 - Sb 37. On Monday morning you buy one June Treasury-bond futures contract for $97,800. The contract's face value is $100,000. The initial margin and maintenance margin requirements are $2,700 and $2,000, respectively, per contract. Use the following price data to answer the following questions. Day Monday Tuesday Wednesday Settle (Closing) Price $97,400 $98,000 $100,000 After Tuesday's close the balance on your margin account will be A) $2,200 B) $2,600 C) $2,900 D) $2,500 | 38. A long hedge is a simultaneous position in the spot market and a in the futures market. position