Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the bottom Additional Information, the adjusting entries? Which are the adjusting entries, transaction entries, and closing entries? Transactions for the month of December, 2019

Is the bottom Additional Information, the adjusting entries? Which are the adjusting entries, transaction entries, and closing entries?

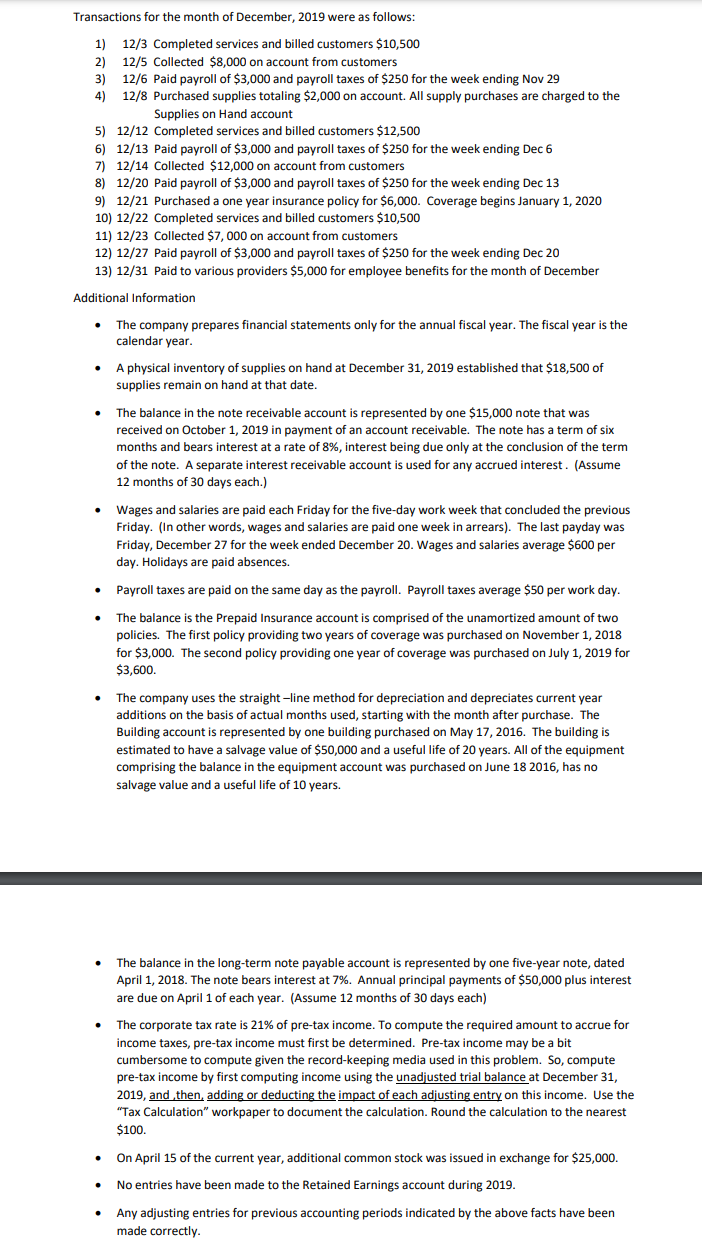

Transactions for the month of December, 2019 were as follows: 1) 12/3 Completed services and billed customers $10,500 2) 12/5 Collected $8,000 on account from customers 3) 12/6 Paid payroll of $3,000 and payroll taxes of $250 for the week ending Nov 29 4) 12/8 Purchased supplies totaling $2,000 on account. All supply purchases are charged to the Supplies on Hand account 5) 12/12 Completed services and billed customers $12,500 6) 12/13 Paid payroll of $3,000 and payroll taxes of $250 for the week ending Dec 6 7) 12/14 Collected $12,000 on account from customers 8) 12/20 Paid payroll of $3,000 and payroll taxes of $250 for the week ending Dec 13 9) 12/21 Purchased a one year insurance policy for $6,000. Coverage begins January 1, 2020 10) 12/22 Completed services and billed customers $10,500 11) 12/23 Collected $7,000 on account from customers 12) 12/27 Paid payroll of $3,000 and payroll taxes of $250 for the week ending Dec 20 13) 12/31 Paid to various providers $5,000 for employee benefits for the month of December Additional Information The company prepares financial statements only for the annual fiscal year. The fiscal year is the calendar year. A physical inventory of supplies on hand at December 31, 2019 established that $18,500 of supplies remain on hand at that date. The balance in the note receivable account is represented by one $15,000 note that was received on October 1, 2019 in payment of an account receivable. The note has a term of six months and bears interest at a rate of 8%, interest being due only at the conclusion of the term of the note. A separate interest receivable account is used for any accrued interest. (Assume 12 months of 30 days each.) Wages and salaries are paid each Friday for the five-day work week that concluded the previous Friday. (In other words, wages and salaries are paid one week in arrears). The last payday was Friday, December 27 for the week ended December 20. Wages and salaries average $600 per day. Holidays are paid absences. Payroll taxes are paid on the same day as the payroll. Payroll taxes average $50 per work day. . The balance is the Prepaid Insurance account is comprised of the unamortized amount of two policies. The first policy providing two years of coverage was purchased on November 1, 2018 for $3,000. The second policy providing one year of coverage was purchased on July 1, 2019 for $3,600. The company uses the straight-line method for depreciation and depreciates current year additions on the basis of actual months used, starting with the month after purchase. The Building account is represented by one building purchased on May 17, 2016. The building is estimated to have a salvage value of $50,000 and a useful life of 20 years. All of the equipment comprising the balance in the equipment account was purchased on June 18 2016, has no salvage value and a useful life of 10 years. The balance in the long-term note payable account is represented by one five-year note, dated April 1, 2018. The note bears interest at 7%. Annual principal payments of $50,000 plus interest are due on April 1 of each year. (Assume 12 months of 30 days each) The corporate tax rate is 21% of pre-tax income. To compute the required amount to accrue for income taxes, pre-tax income must first be determined. Pre-tax income may be a bit cumbersome to compute given the record-keeping media used in this problem. So, compute pre-tax income by first computing income using the unadjusted trial balance at December 31, 2019, and then, adding or deducting the impact of each adjusting entry on this income. Use the "Tax Calculation" workpaper to document the calculation. Round the calculation to the nearest $100. . On April 15 of the current year, additional common stock was issued in exchange for $25,000. No entries have been made to the Retained Earnings account during 2019. . Any adjusting entries for previous accounting periods indicated by the above facts have been made correctlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started