Answered step by step

Verified Expert Solution

Question

1 Approved Answer

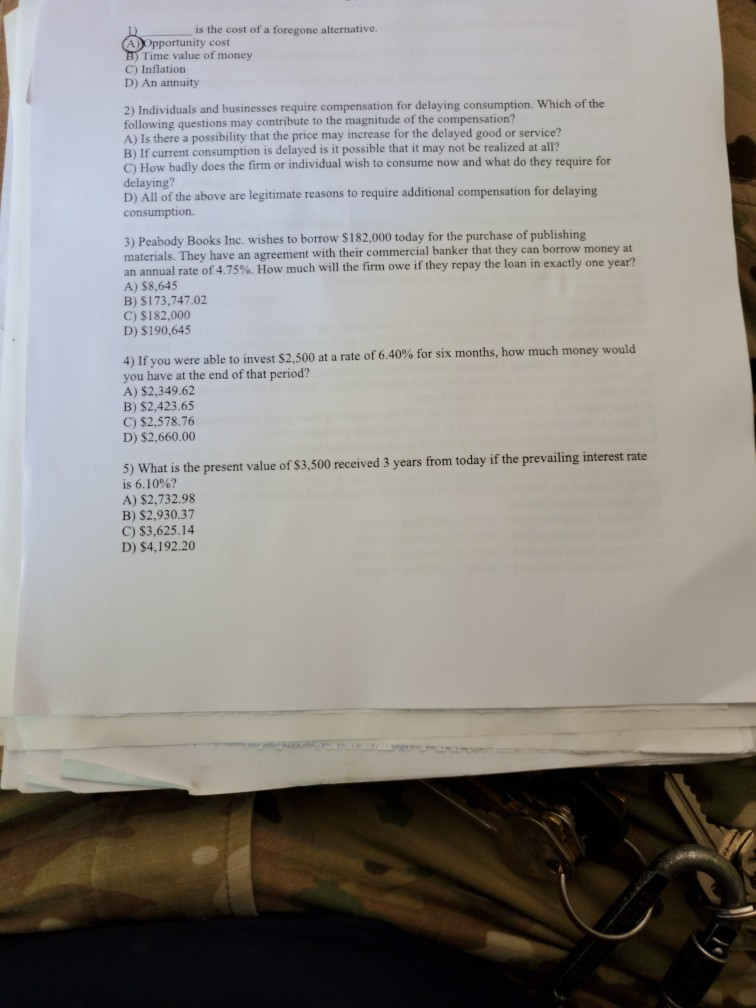

is the cost of a foregone alternative. (A) Opportunity cost B) Time value of money C) Inflation D) An annuity 2) Individuals and businesses require

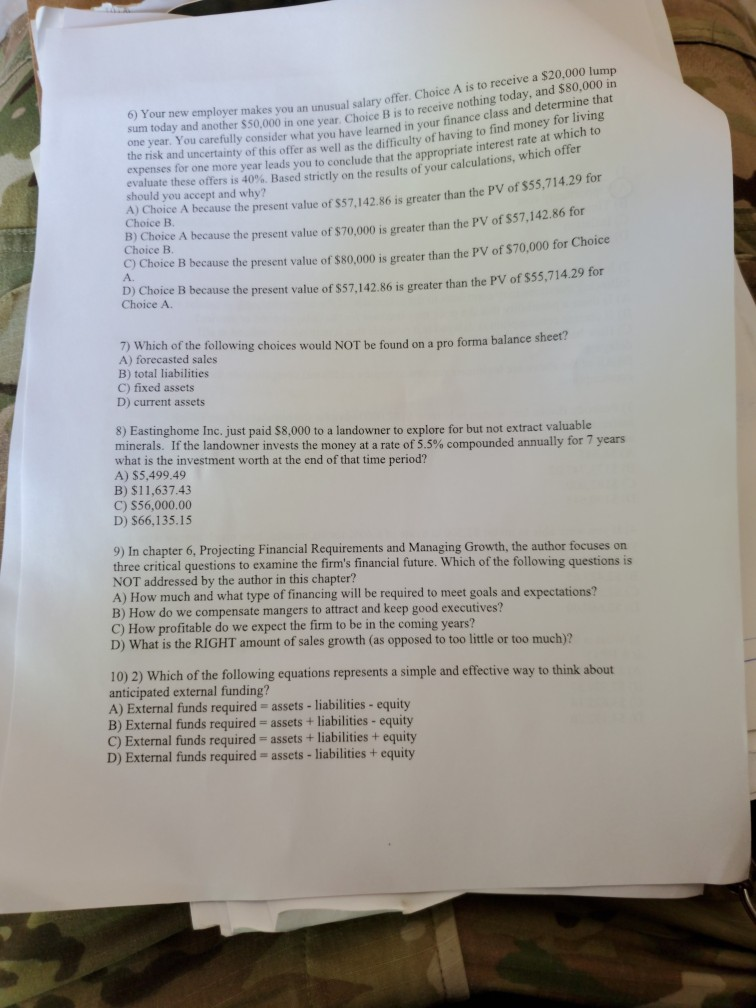

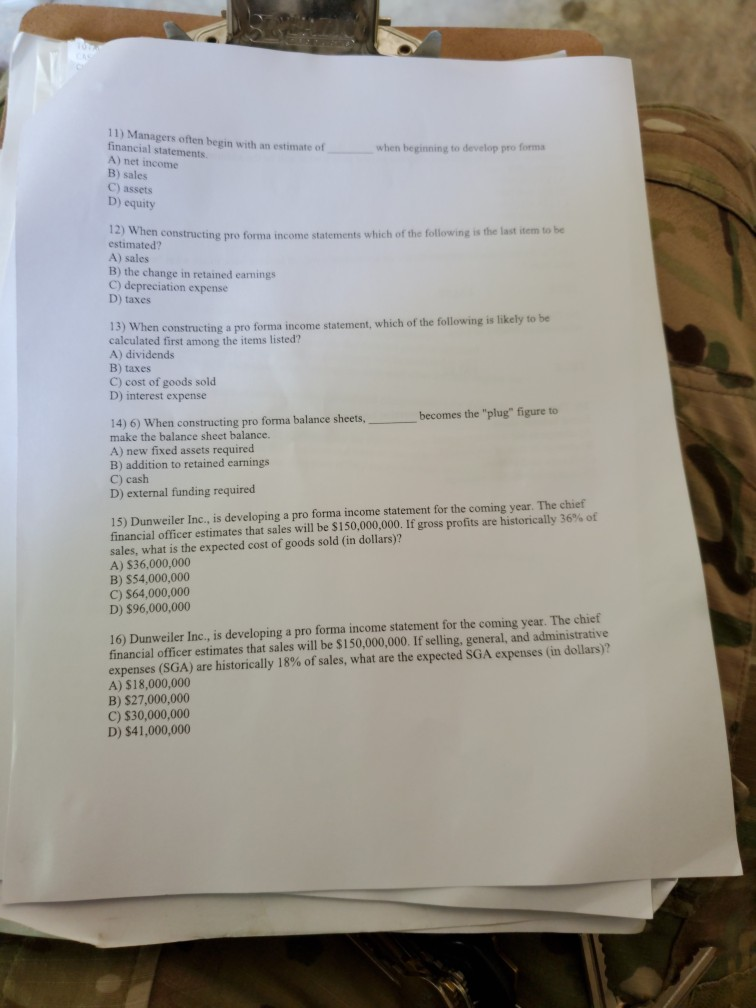

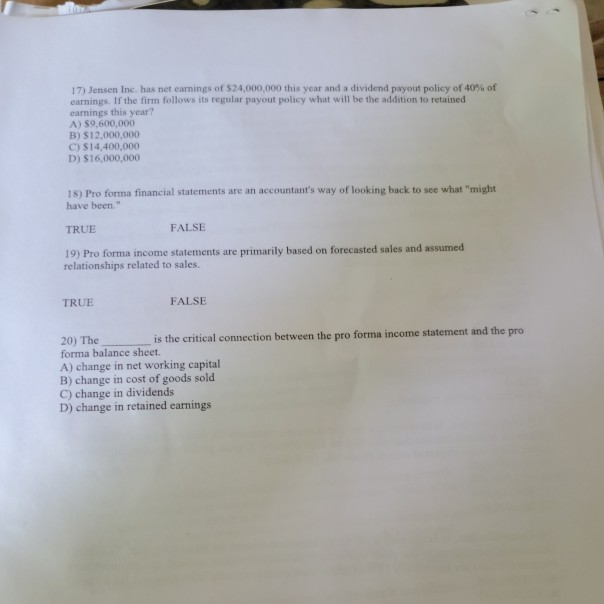

is the cost of a foregone alternative. (A) Opportunity cost B) Time value of money C) Inflation D) An annuity 2) Individuals and businesses require compensation for delaying consumption. Which of the following questions may contribute to the magnitude of the compensation? A) Is there a possibility that the price may increase for the delayed good or service? B) If current consumption is delayed is it possible that it may not be realized at all? How badly does the firm or individual wish to consume now and what do they require for delaying? D) All of the above are legitimate reasons to require additional compensation for delaying! consumption 3) Peabody Books Inc. wishes to borrow $182,000 today for the purchase of publishing materials. They have an agreement with their commercial banker that they can borrow money at an annual rate of 4.75%. How much will the firm owe if they repay the loan in exactly one year? A) $8,645 B) $173,747.02 C) $182,000 D) $190,645 4) If you were able to invest $2,500 at a rate of 6.40% for six months, how much money would you have at the end of that period? A) $2,349.62 B) $2,423.65 C) $2.578.76 D) $2,660.00 5) What is the present value of $3,500 received 3 years from today if the prevailing interest rate is 6.10%? A) $2,732.98 B) $2,930.37 C) $3,625.14 D) $4,192.20 6) Your new employer makes you an unusual sum today and another S50,000 in one year Choice B is to one year. You carefully consider what you have learned in your the risk and uncertainty of this offer as well as the difficulty of having to expenses for one more year leads you to conclude that the appropria evaluate these offers is 40%. Based strictly on the results of your calcul should you accept and why? reater than the PV of $55,714.29 for , Choice A because the present value of $57.142.86 is greater than the PV of nakes you an unusual salary offer. Choice A is to receive a $20,000 lump one year Choice B is to receive nothing today, and $80,000 in hat you have learned in your finance class and determine that ell as the difficulty of having to find money for living ide that the appropriate interest rate at which to Hly on the results of your calculations, which offer Choice B. B Choice A because the present value of $70.000 is greater than the PV of $57,142.60 TO Choice B C) Choice B because the present value of $80,000 is greater than the Prof value of $80,000 is greater than the PV of $70,000 for Choice D) Choice B because the present value of $57.142.86 is greater than the Pro Choice A. lue of $57,142.86 is greater than the PV of $55,714.29 for 7) Which of the following choices would NOT be found on a pro forma balance sheet A) forecasted sales B) total liabilities C) fixed assets D) current assets 8) Eastinghome Inc. just paid $8,000 to a landowner to explore for but not extract valuable minerals. If the landowner invests the money at a rate of 5.5% compounded annually for 7 years what is the investment worth at the end of that time period? A) $5,499.49 B) $11,637.43 C) $56,000.00 D) $66,135.15 9) In chapter 6, Projecting Financial Requirements and Managing Growth, the author focuses on three critical questions to examine the firm's financial future. Which of the following questions is NOT addressed by the author in this chapter? A) How much and what type of financing will be required to meet goals and expectations? B) How do we compensate mangers to attract and keep good executives? C) How profitable do we expect the firm to be in the coming years? D) What is the RIGHT amount of sales growth (as opposed to too little or too much)? 10) 2) Which of the following equations represents a simple and effective way to think about anticipated external funding? A) External funds required assets - liabilities - equity B) External funds required = assets + liabilities - equity C) External funds required assets + liabilities + equity D) External funds required - assets - liabilities + equity when beginning to develop pro forma 11) Managers often begin with an estimate of financial statements. A) net income B) sales C) assets D) equity when constructing pro forma income statements which of the following is the last item to be estimated? A) sales B) the change in retained earnings C) depreciation expense D) taxes 13) When constructing a pro forma income statement, which of the following is likely to be calculated first among the items listed? A) dividends B) taxes C) cost of goods sold D) interest expense 14) 6) When constructing pro forma balance sheets, _ becomes the "plug" figure to make the balance sheet balance. A) new fixed assets required B) addition to retained earnings C) cash D) external funding required 15) Dunweiler Inc., is developing a pro forma income statement for the coming year. The chief financial officer estimates that sales will be $150,000,000. If gross profits are historically 36% of sales, what is the expected cost of goods sold in dollars)? A) $36,000,000 B) S54,000,000 C) $64,000,000 D) $96,000,000 16) Dunweiler Inc., is developing a pro forma income statement for the coming year. The chief financial officer estimates that sales will be $150,000,000. If selling, general, and administrative expenses (SGA) are historically 18% of sales, what are the expected SGA expenses (in dollars)? A) $18,000,000 B) $27,000,000 C) $30,000,000 D) $41,000,000 17) Jensen Inc. has net earnings of $24,000,000 this year and a dividend payout policy of 40% of earnings. If the firm follows its regular payout policy what will be the addition to retained carines this year A) 59,600,000 B) $12,000,000 C) $14.400,000 D) $16,000,000 18) Pro forma financial statements are an accountant's way of looking back to see what might have been TRUE FALSE 19) Pro forma income statements are primarily based on forecasted sales and assumed relationships related to sales TRUE FALSE 20) The is the critical connection between the pro forma income statement and the pro forma balance sheet. A) change in net working capital B) change in cost of goods sold C) change in dividends D) change in retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started