Question

Is the following statement correct if the bank decides to accept the loan account of Mr. Roth in TTM Projects Pty Ltd as collateral? Statement:

Is the following statement correct if the bank decides to accept the loan account of Mr. Roth in TTM Projects Pty Ltd as collateral?

Statement:

When the loan account is accepted as collateral it will allow the bank to claim the amount of the loan account in addition to other outstanding amounts in case of the insolvency of TTM Projects Pty Ltd. It is not an easy realizable form of collateral, but it will improve the claims of the bank.

a. Correct

b. Incorrect

READ THE CASE STUDY BELOW AND PLEASE ANSWER THE ABOVE QUESTION.

CASE STUDY:

Mr. Roth applies for a medium-term loan (5 years) of $4 000 000 to purchase specialized machinery which would expand the production capacity of his business substantially and $3 000 000 additional overdraft facilities to augment the working capital requirements as a result of the expansion.

The business TTM Projects Pty Ltd specializes in the manufacturing of electrical and electronic components for the automotive industry.

Mr. Roth (the only shareholder of the company) offers the following collateral to the bank for the requested facilities:

- Unlimited guarantee/suretyship by himself;

- A second mortgage bond over his residential property for $2 000 000. (The realistic market value of the property is $3 250 000 according to a valuation recently done by the bank. The first bond to the value of $2,500,000 in favor of your bank secures the existing debt pertaining to the residential property.);

- A cession of debtors;

- A cession of his loan accounts in TTM Projects Pty Ltd;

- A mortgage over the machinery to be purchased; and

- A mortgage over inventory.

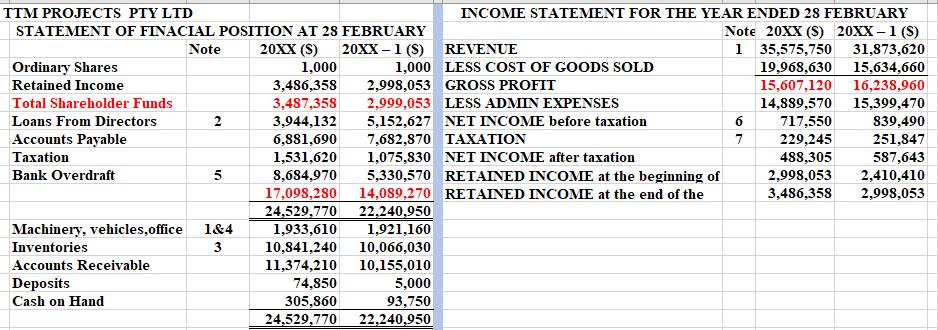

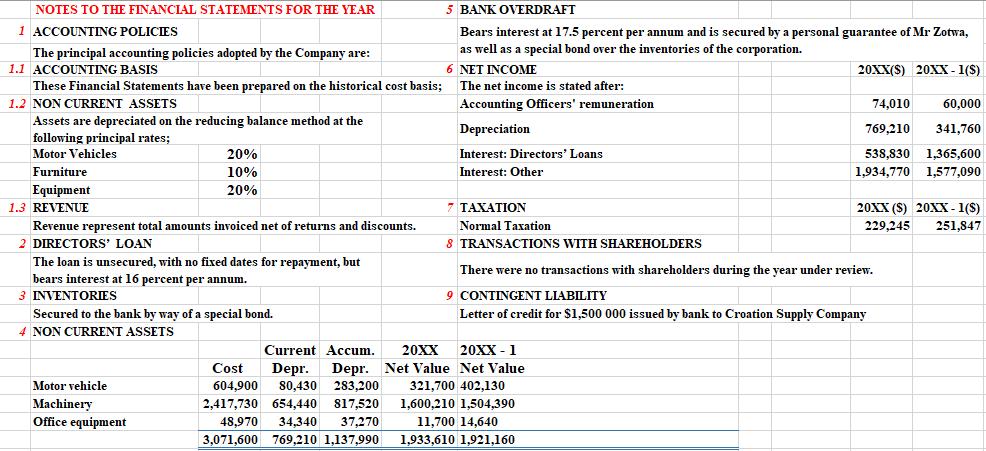

TTM PROJECTS PTY LTD INCOME STATEMENT FOR THE YEAR ENDED 28 FEBRUARY Note 20XX (S) 20XX 1 (S) 1 35,575,750 31,873,620 15,634,660 16,238,960 15,399,470 839,490 251,847 587,643 2,410,410 STATEMENT OF FINACIAL POSITION AT 28 FEBRUARY 20XX (S) 1,000 Note 20XX 1 (S) REVENUE Ordinary Shares 1,000 LESS COST OF GOODS SOLD 19,968,630 15,607,120 Retained Income 2,998,053 GROSS PROFIT 3,486,358 3,487,358 3,944,132 6,881,690 1,531,620 Total Shareholder Funds 2,999,053 LESS ADMIN EXPENSES 5,152,627 NET INCOME before taxation 7,682,870 TAXATION 14,889,570 717,550 229,245 Loans From Directors 2 6 Accounts Payable 7 1,075,830 NET INCOME after taxation 5,330,570 RETAINED INCOMIE at the beginning of 14,089,270 RETAINED INCOME at the end of the 22,240,950 1,921,160 10,066,030 10,155,010 Taxation 488,305 2,998,053 3,486,358 Bank Overdraft 5 8,684,970 17,098,280 24,529,770 1,933,610 10,841,240 11,374,210 74,850 2,998,053 Machinery, vehicles,office 1&4 Inventories 3 Accounts Receivable Deposits 5,000 Cash on Hand 305,860 24,529,770 93,750 22,240,950 in

Step by Step Solution

3.54 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

b Incorrect The loan account can be accepted as collatera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started