Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The budget director says, In the worst case, we cannot do anything about the cost of living adjustment, the stock market tanks, and we earn

The budget director says, “In the worst case, we cannot do anything about the cost of living adjustment, the stock market tanks, and we earn very little—say 3 percent. Productivity goes to zero and other factors remain the same. That is the ‘worst case.’ How bad would that be?” Explain the logical reason.

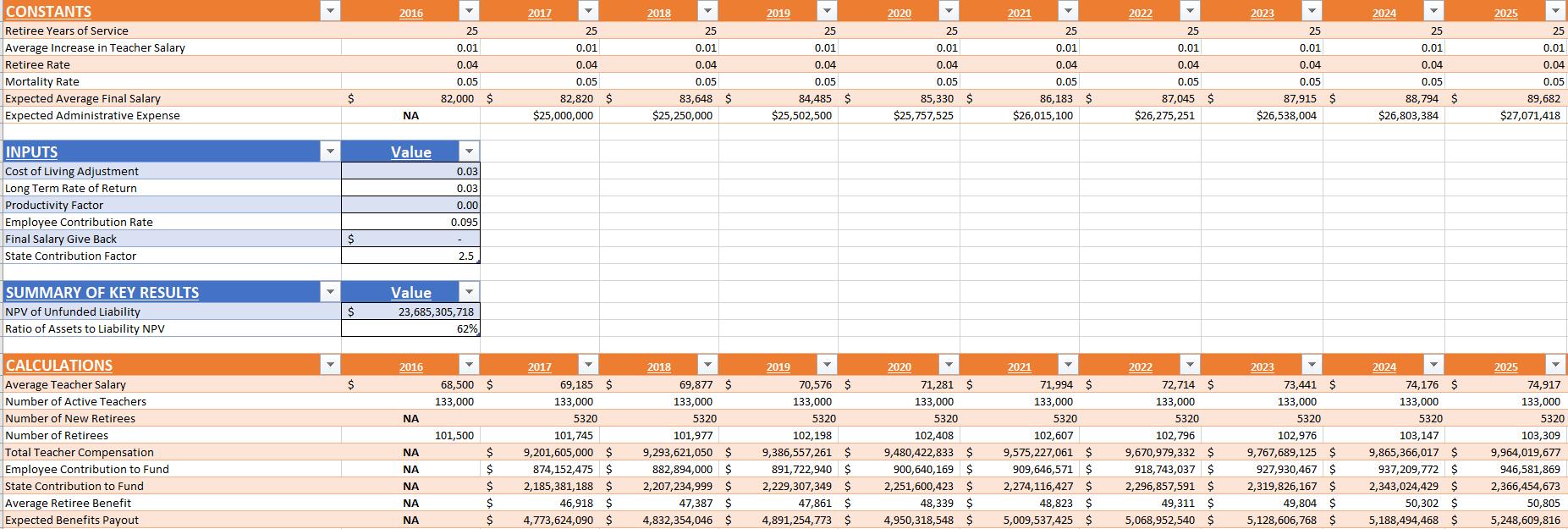

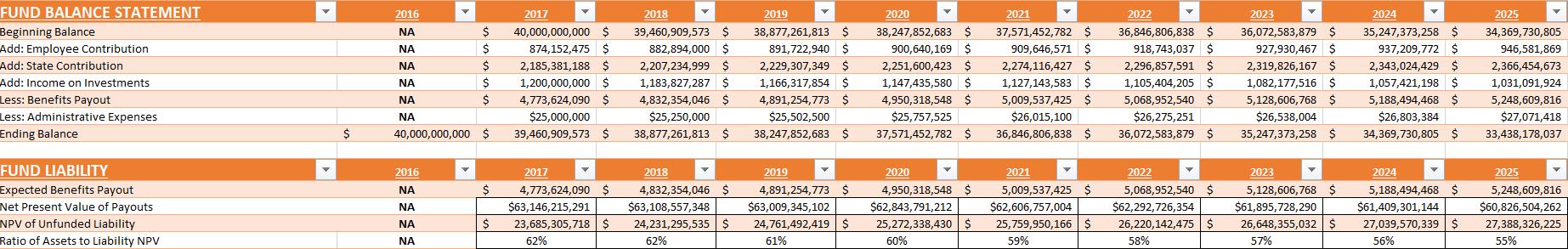

CONSTANTS 2018 2020 2021 2022 2016 2017 2019 2023 2024 2025 Retiree Years of Service 25 25 25 25 25 25 25 25 25 25 Average Increase in Teacher Salary 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 Retiree Rate 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 Mortality Rate Expected Average Final Salary Expected Administrative Expense 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.05 0.05 $ 83,648 $ 85.330 $ 86,183 $ $26,015,100 82,000 $ 82,820 $ 84,485 $ 87,045 $ 87,915 $ 88,794 $ 89,682 NA $25,000,000 $25,250,000 $25,502,500 $25,757,525 $26,275,251 $26,538,004 $26,803,384 $27,071,418 INPUTS Value Cost of Living Adjustment Long Term Rate of Return Productivity Factor Employee Contribution Rate 0.03 0.03 0.00 0.095 Final Salary Give Back State Contribution Factor 2.5 SUMMARY OF KEY RESULTS NPV of Unfunded Liability Value 23,685,305,718 Ratio of Assets to Liability NPV 62% CALCULATIONS Average Teacher Salary 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2$ 68,500 $ 69,185 $ 69,877 $ 70,576 $ 71,281 $ 71,994 $ 72,714 $ 73,441 $ 74,176 $ 74,917 Number of Active Teachers 133,000 133,000 133,000 133,000 133,000 133,000 133,000 133,000 133,000 133,000 Number of New Retirees Number of Retirees NA 5320 5320 5320 5320 5320 5320 5320 5320 5320 101,500 2$ 101,745 101,977 102,198 102,408 102,607 102,796 102,976 103,147 103,309 Total Teacher Compensation Employee Contribution to Fund State Contribution to Fund 9,293,621,050 $ 9,575,227,061 $ 909,646,571 $ 9,767,689,125$ 927,930,467 $ NA 9,201,605,000 $ 9,386,557,261 $ 9,480,422,833 $ 9,670,979,332 $ 9,865,366,017 $ 9,964,019,677 NA 2$ 874,152,475 $ 882,894,000 $ 891,722,940$ 900,640,169$ 918,743,037 $ 937,209,772 $ 946,581,869 NA 2,185,381,188 $ 2,207,234,999 $ 2,229,307,349 $ 2,251,600,423 $ 2,274,116,427 $ 2,296,857,591 $ 2,319,826,167 $ 2,343,024,429 $ 2,366,454,673 Average Retiree Benefit Expected Benefits Payout $ 49,311 $ 49,804 $ 5,128,606,768 $ NA 46,918 $ 47,387 $ 47,861 $ 48,339 $ 48,823 $ 50,302 $ 50,805 NA $ 4,773,624,090 $ 4,832,354,046 $ 4,891,254,773 $ 4,950,318,548 $ 5,009,537,425 $ 5,068,952,540 $ 5,188,494,468 $ 5,248,609,816

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

When we want to apply risk management effectively the concept of worstcase scenario is a concept where planner cosider for potential disasters losses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started