Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the initial investment 1,800,000 or 1,980,000? Company A is seeking to purchase a major piece of equipment for $1.5 million. It will cost an

Is the initial investment 1,800,000 or 1,980,000?

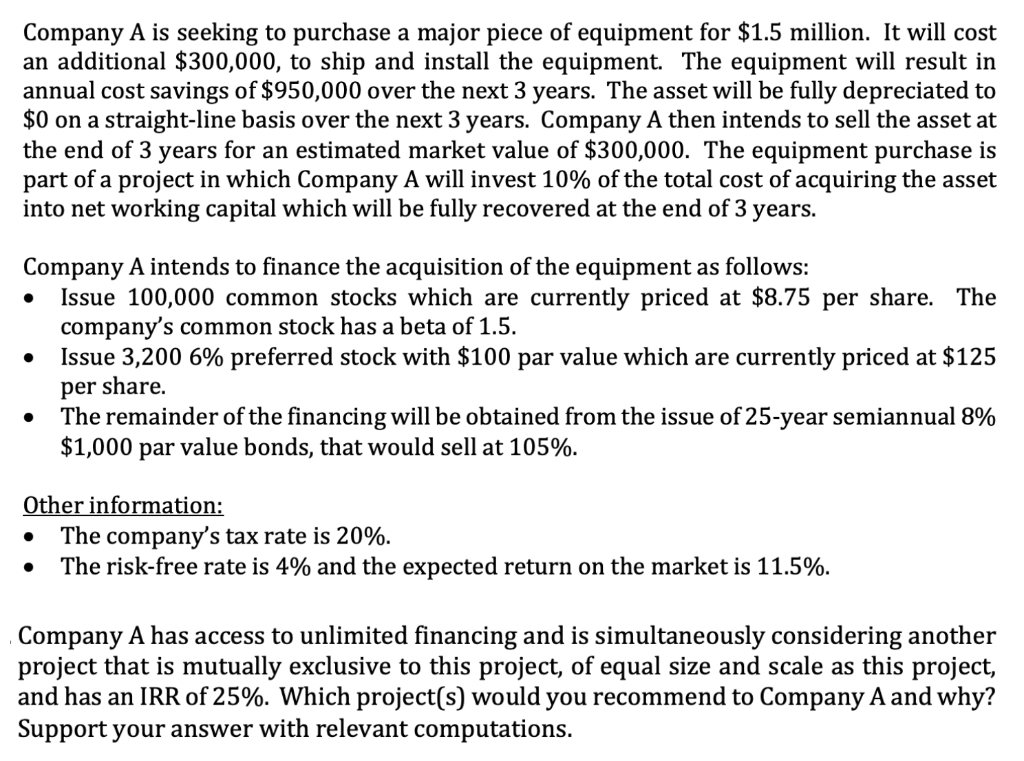

Company A is seeking to purchase a major piece of equipment for $1.5 million. It will cost an additional $300,000, to ship and install the equipment. The equipment will result in annual cost savings of $950,000 over the next 3 years. The asset will be fully depreciated to $0 on a straight-line basis over the next 3 years. Company A then intends to sell the asset at the end of 3 years for an estimated market value of $300,000. The equipment purchase is part of a project in which Company A will invest 10% of the total cost of acquiring the asset into net working capital which will be fully recovered at the end of 3 years. Company A intends to finance the acquisition of the equipment as follows: - Issue 100,000 common stocks which are currently priced at $8.75 per share. The company's common stock has a beta of 1.5. - Issue 3,200 6\% preferred stock with $100 par value which are currently priced at $125 per share. - The remainder of the financing will be obtained from the issue of 25 -year semiannual 8\% $1,000 par value bonds, that would sell at 105%. Other information: - The company's tax rate is 20%. - The risk-free rate is 4% and the expected return on the market is 11.5%. Company A has access to unlimited financing and is simultaneously considering another project that is mutually exclusive to this project, of equal size and scale as this project, and has an IRR of 25%. Which project(s) would you recommend to Company A and why? Support your answer with relevant computationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started