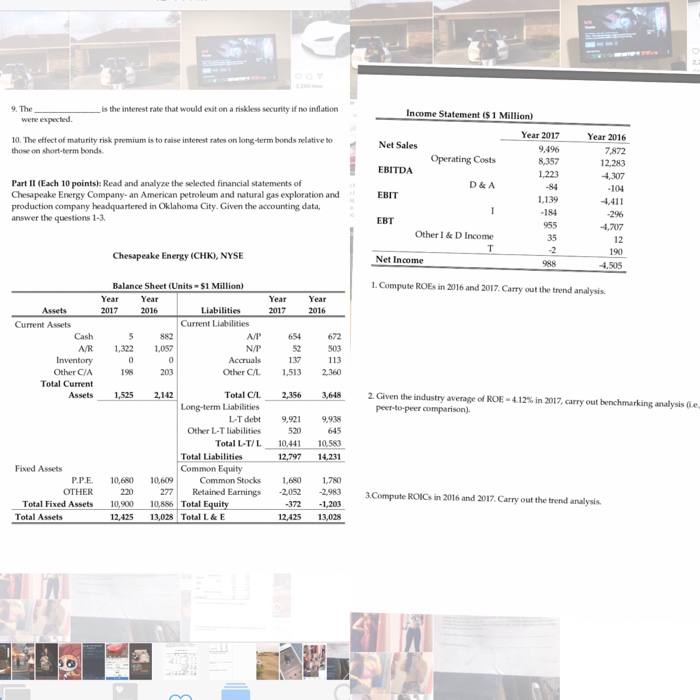

is the interest rate that would exit on a riskless security if no inflation Income Statement ($ 1 Million) 9. The were expected 10. The effect of maturity risk premium is to raise interest rates on long-term bonds relative to those on short-term bonds Year 2017 9,496 Year 2016 7,872 12,283 Net Sales Operating Costs EBITDA 1,223 D & A 104 4,411 Part II (Each 10 points): Read and analyze the selected financial statements of Chesapeake Energy Company- an American petroleum and natural gas exploration and production company headquartered in Oklahoma City. Given the accounting data answer the questions 1-3. EBIT 1,139 184 EBT Other I & D Income 35 .2 12 Chesapeake Energy (CHK), NYSE Net Income 4,505 1. Compute ROEs in 2016 and 2017. Carry out the trend analysis Balance Sheet (Units $1 Million) Year 2017 Year Year 2016 Year 2017 Liabilities 2016 Current Liabilities Current Assets A/P N/P 503 113 Other C/L 1513 2,360 A/R 1,322 1,057 Other C/A Total Current 198 Total C/L Given the industry average of ROE-412% in 2017, carry out benchmarking analysis 142 L-T debt Other L-T liabilities 9,921 9,938 Total L-T/L 10,441 10.583 Total Liabilities 12,797 14,231 Common Stocks 1680 1780 OTHER 220277Retained Earnings 2052 2,983 Total Fixed Assets 10,900 10,886 Total Equity 372 1,203 Fixed Assets Common Equity .PE 10,680 10,609 - 3ompute ROICs in 2016 and 2017. Carry out the trend analysis Total Assets 12,425 13,028 Total L&E 12,425 13,028 is the interest rate that would exit on a riskless security if no inflation Income Statement ($ 1 Million) 9. The were expected 10. The effect of maturity risk premium is to raise interest rates on long-term bonds relative to those on short-term bonds Year 2017 9,496 Year 2016 7,872 12,283 Net Sales Operating Costs EBITDA 1,223 D & A 104 4,411 Part II (Each 10 points): Read and analyze the selected financial statements of Chesapeake Energy Company- an American petroleum and natural gas exploration and production company headquartered in Oklahoma City. Given the accounting data answer the questions 1-3. EBIT 1,139 184 EBT Other I & D Income 35 .2 12 Chesapeake Energy (CHK), NYSE Net Income 4,505 1. Compute ROEs in 2016 and 2017. Carry out the trend analysis Balance Sheet (Units $1 Million) Year 2017 Year Year 2016 Year 2017 Liabilities 2016 Current Liabilities Current Assets A/P N/P 503 113 Other C/L 1513 2,360 A/R 1,322 1,057 Other C/A Total Current 198 Total C/L Given the industry average of ROE-412% in 2017, carry out benchmarking analysis 142 L-T debt Other L-T liabilities 9,921 9,938 Total L-T/L 10,441 10.583 Total Liabilities 12,797 14,231 Common Stocks 1680 1780 OTHER 220277Retained Earnings 2052 2,983 Total Fixed Assets 10,900 10,886 Total Equity 372 1,203 Fixed Assets Common Equity .PE 10,680 10,609 - 3ompute ROICs in 2016 and 2017. Carry out the trend analysis Total Assets 12,425 13,028 Total L&E 12,425 13,028