Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the Investment in Held-to-Maturity Debt Securities a long-term asset account or a current asset account? 8. Pr.13-04 Bond Investment Premium Amortization Schedule 1 Instructions

Is the "Investment in Held-to-Maturity Debt Securities" a long-term asset account or a current asset account?

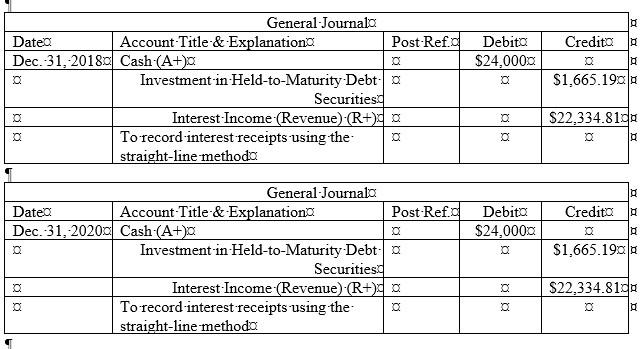

8. Pr.13-04 Bond Investment Premium Amortization Schedule 1 Instructions Mercer Corporation acquired S400,000 of Park Company's bonds on June 30, 2018, for $409,991.12. The bonds carry a 12% stated interest rate and pay interest semiannually on June 30 and December 31. The appropriate market interest rate is 11%, and the bonds are due June 30, 2021. 1 Required: 1. Prepare an investment interest income and premium amortization schedule, using the a straight-line method b. effective interest method 2. Prepare journal entries to record the December 31, 2018, and December 31, 2020 interest receipts using both methods. Credito Debito $24,0000 $1,665.1900 General Journalo Dated Account Title & Explanation Post-Ref. Dec 31, 20180 Cash (A+) Investment-in-Held-to-Maturity Debt Securities Interest Income (Revenue) (R+do To record interest receipts using the straight-line methodo $22,334.810 Credito Debito $24,000 mmm $1,665.190 General Journala Date Account-Title-& Explanation Post-Ref. Dec 31, 20200 Cash (A+) Investment-in-Held-to-Maturity Debt: 0 Securities Interest Income (Revenue) (R+do To record interest receipts using the straight-line methodo $22,334.810 a oStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started