Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the kinked red line correct? and is the new CML better? So far, we have been silent about the lending and borrowing in portfolio

Is the kinked red line correct? and is the new CML better?

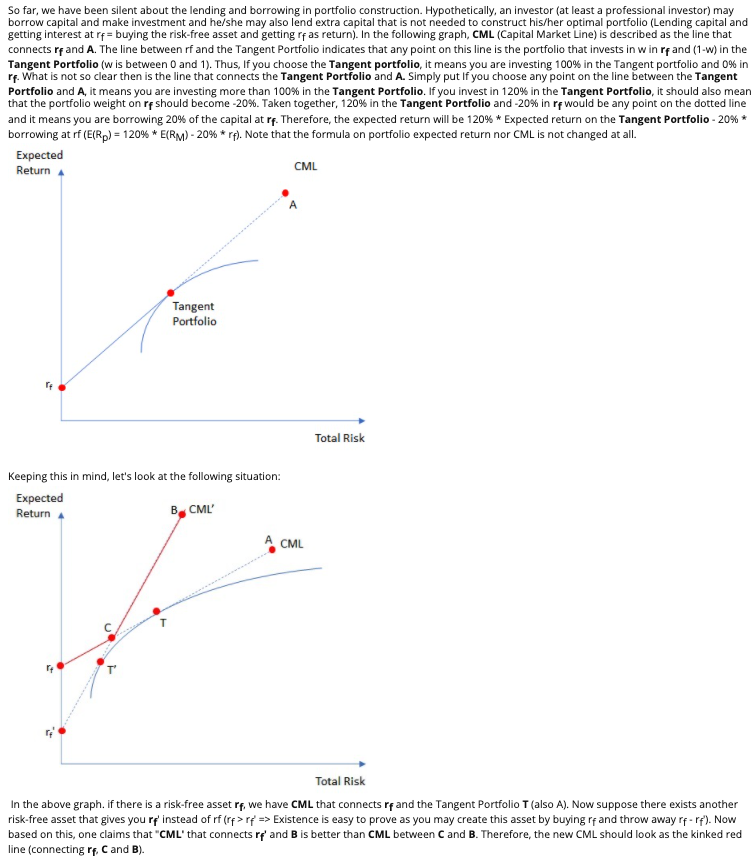

So far, we have been silent about the lending and borrowing in portfolio construction. Hypothetically, an investor (at least a professional investor) may borrow capital and make investment and he/she may also lend extra capital that is not needed to construct his/her optimal portfolio (Lending capital and getting interest at rf=buying the risk-free asset and getting rf as return). In the following graph, CML (Capital Market Line) is described as the line that connects rp and A. The line between rf and the Tangent Portfolio indicates that any point on this line is the portfolio that invests in win rand (1-w) in the Tangent Portfolio (w is between 0 and 1). Thus, If you choose the Tangent portfolio, it means you are investing 100% in the Tangent portfolio and 0% in rf. What is not so clear then is the line that connects the Tangent Portfolio and A. Simply put if you choose any point on the line between the Tangent Portfolio and A, it means you are investing more than 100% in the Tangent Portfolio. If you invest in 120% in the Tangent Portfolio, it should also mean that the portfolio weight on rp should become -20%. Taken together, 120% in the Tangent Portfolio and -20% in rf would be any point on the dotted line and it means you are borrowing 20% of the capital at rf. Therefore, the expected return will be 120% * Expected return on the Tangent Portfolio -20% * borrowing at rf (E(Rp) = 120% * E(RM) -20% * rf). Note that the formula on portfolio expected return nor CML is not changed at all. Expected Return CML Tangent Portfolio Total Risk Keeping this in mind, let's look at the following situation: Expected Return B, CML CML Total Risk In the above graph. if there is a risk-free asset rf, we have CML that connects rp and the Tangent Portfolio T (also A). Now suppose there exists another risk-free asset that gives you rf' instead of rf (rf>rf => Existence is easy to prove as you may create this asset by buying rf and throw away rf - rf'). Now based on this one claims that "CML' that connects rp' and B is better than CML between C and B. Therefore, the new CML should look as the kinked red line (connecting rf, C and B)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started