Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the owner level tax the exact same for both scenarios??? Or is the C corp taxed at dividend rate?? Your client, Kerri, is considering

Is the owner level tax the exact same for both scenarios??? Or is the C corp taxed at dividend rate??

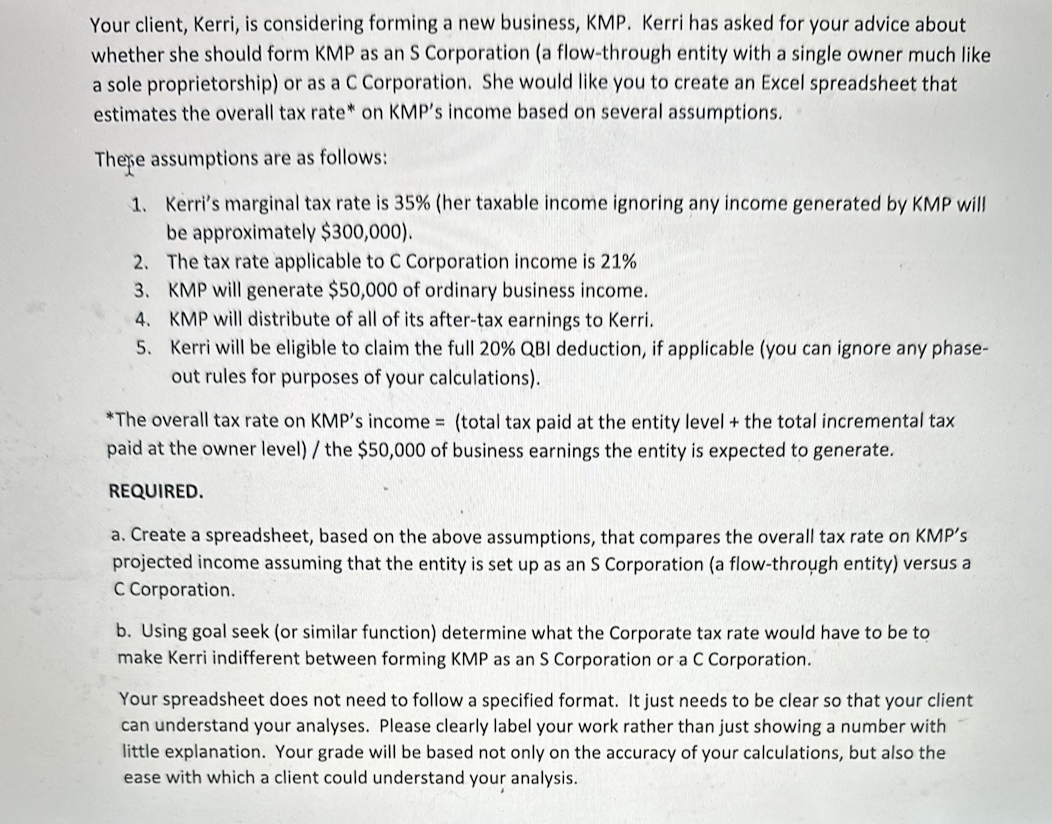

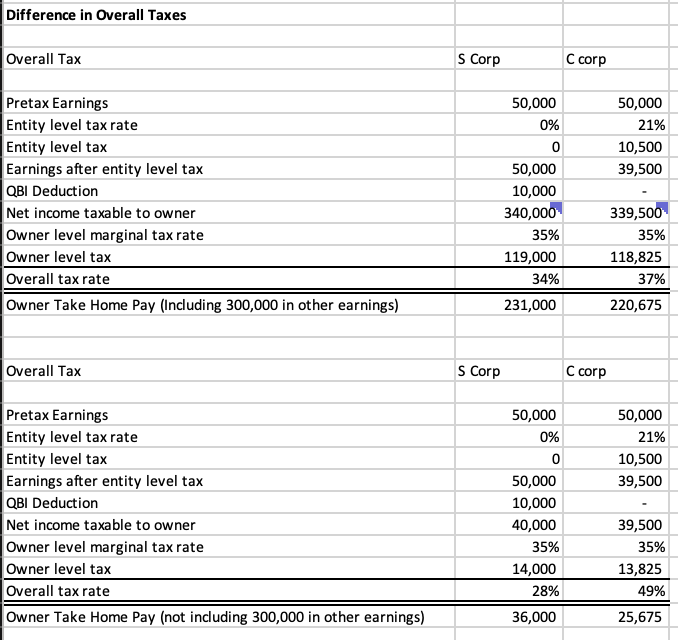

Your client, Kerri, is considering forming a new business, KMP. Kerri has asked for your advice about whether she should form KMP as an S Corporation (a flow-through entity with a single owner much like a sole proprietorship) or as a C Corporation. She would like you to create an Excel spreadsheet that estimates the overall tax rate* on KMP's income based on several assumptions. There assumptions are as follows: 1. Kerri's marginal tax rate is 35% (her taxable income ignoring any income generated by KMP will be approximately $300,000). 2. The tax rate applicable to C Corporation income is 21% 3. KMP will generate $50,000 of ordinary business income. 4. KMP will distribute of all of its after-tax earnings to Kerri. 5. Kerri will be eligible to claim the full 20% QBI deduction, if applicable (you can ignore any phaseout rules for purposes of your calculations). *The overall tax rate on KMP's income = (total tax paid at the entity level + the total incremental tax paid at the owner level) / the $50,000 of business earnings the entity is expected to generate. REQUIRED. a. Create a spreadsheet, based on the above assumptions, that compares the overall tax rate on KMP's projected income assuming that the entity is set up as an S Corporation (a flow-through entity) versus a c Corporation. b. Using goal seek (or similar function) determine what the Corporate tax rate would have to be to make Kerri indifferent between forming KMP as an S Corporation or a C Corporation. Your spreadsheet does not need to follow a specified format. It just needs to be clear so that your client can understand your analyses. Please clearly label your work rather than just showing a number with little explanation. Your grade will be based not only on the accuracy of your calculations, but also the ease with which a client could understand your analysis. Difference in Overall Taxes Overall Tax S Corp C corp Pretax Earnings Entity level tax rate Entity level tax Earnings after entity level tax QBI Deduction Net income taxable to owner Owner level marginal tax rate Owner level tax \begin{tabular}{|r|r|} \hline 50,000 & 50,000 \\ \hline 0% & 21% \\ \hline 0 & 10,500 \\ \hline 50,000 & 39,500 \\ \hline 10,000 & \\ \hline 340,000 & 339,500 \\ \hline 35% & 35% \\ \hline 119,000 & 118,825 \\ \hline 34% & 37% \\ \hline \hline 231,000 & 220,675 \\ \hline \end{tabular} Overall Tax S Corp C corp Pretax Earnings Entity level tax rate Entity level tax Earnings after entity level tax QBI Deduction Net income taxable to owner Owner level marginal tax rate Owner level tax Overall tax rate Owner Take Home Pay (not including 300,000 in other earnings) \begin{tabular}{|r|r|} \hline 50,000 & 50,000 \\ \hline 0% & 21% \\ \hline 0 & 10,500 \\ \hline 50,000 & 39,500 \\ \hline 10,000 & \\ \hline 40,000 & 39,500 \\ \hline 35% & 35% \\ \hline 14,000 & 13,825 \\ \hline 28% & 49% \\ \hline \hline 36,000 & 25,675 \\ \hline \end{tabular} Your client, Kerri, is considering forming a new business, KMP. Kerri has asked for your advice about whether she should form KMP as an S Corporation (a flow-through entity with a single owner much like a sole proprietorship) or as a C Corporation. She would like you to create an Excel spreadsheet that estimates the overall tax rate* on KMP's income based on several assumptions. There assumptions are as follows: 1. Kerri's marginal tax rate is 35% (her taxable income ignoring any income generated by KMP will be approximately $300,000). 2. The tax rate applicable to C Corporation income is 21% 3. KMP will generate $50,000 of ordinary business income. 4. KMP will distribute of all of its after-tax earnings to Kerri. 5. Kerri will be eligible to claim the full 20% QBI deduction, if applicable (you can ignore any phaseout rules for purposes of your calculations). *The overall tax rate on KMP's income = (total tax paid at the entity level + the total incremental tax paid at the owner level) / the $50,000 of business earnings the entity is expected to generate. REQUIRED. a. Create a spreadsheet, based on the above assumptions, that compares the overall tax rate on KMP's projected income assuming that the entity is set up as an S Corporation (a flow-through entity) versus a c Corporation. b. Using goal seek (or similar function) determine what the Corporate tax rate would have to be to make Kerri indifferent between forming KMP as an S Corporation or a C Corporation. Your spreadsheet does not need to follow a specified format. It just needs to be clear so that your client can understand your analyses. Please clearly label your work rather than just showing a number with little explanation. Your grade will be based not only on the accuracy of your calculations, but also the ease with which a client could understand your analysis. Difference in Overall Taxes Overall Tax S Corp C corp Pretax Earnings Entity level tax rate Entity level tax Earnings after entity level tax QBI Deduction Net income taxable to owner Owner level marginal tax rate Owner level tax \begin{tabular}{|r|r|} \hline 50,000 & 50,000 \\ \hline 0% & 21% \\ \hline 0 & 10,500 \\ \hline 50,000 & 39,500 \\ \hline 10,000 & \\ \hline 340,000 & 339,500 \\ \hline 35% & 35% \\ \hline 119,000 & 118,825 \\ \hline 34% & 37% \\ \hline \hline 231,000 & 220,675 \\ \hline \end{tabular} Overall Tax S Corp C corp Pretax Earnings Entity level tax rate Entity level tax Earnings after entity level tax QBI Deduction Net income taxable to owner Owner level marginal tax rate Owner level tax Overall tax rate Owner Take Home Pay (not including 300,000 in other earnings) \begin{tabular}{|r|r|} \hline 50,000 & 50,000 \\ \hline 0% & 21% \\ \hline 0 & 10,500 \\ \hline 50,000 & 39,500 \\ \hline 10,000 & \\ \hline 40,000 & 39,500 \\ \hline 35% & 35% \\ \hline 14,000 & 13,825 \\ \hline 28% & 49% \\ \hline \hline 36,000 & 25,675 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started