Question

Is the Restaurant Group Plc parent company a viable option to invest in? Introduction: Provide background information on the parent company and the current situation.

Is the Restaurant Group Plc parent company a viable option to invest in?

Introduction:

Provide background information on the parent company and the current situation. Include the aims and hypothesis of the report.

Method:

How will this report be carried out?

Findings:

Create pie charts and graphs to show the main trends for potential investors.

Discussion:

What are the main trends that you have found out about the company’s finances?

Conclusion:

What can you conclude about this company? Is it a viable option for investors? Provide reasons for your answers and relate this to the wider context.

Recommendations:

Do you have any recommendations for the parent company to attract potential investors?

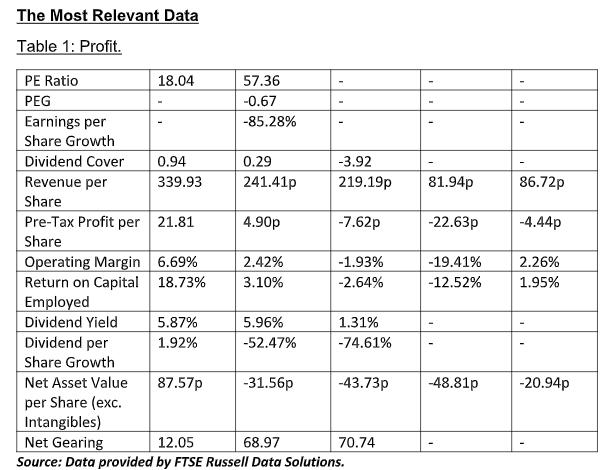

The Most Relevant Data Table 1: Profit. PE Ratio PEG Earnings per Share Growth Dividend Cover Revenue per Share 18.04 Pre-Tax Profit per 21.81 Share Employed Dividend Yield Dividend per Share Growth 0.94 339.93 Operating Margin 6.69% Return on Capital 18.73% Net Asset Value per Share (exc. Intangibles) 5.87% 1.92% 87.57p 57.36 -0.67 -85.28% 0.29 241.41p 4.90p 2.42% 3.10% 5.96% -52.47% -31.56p -3.92 219.19p -7.62p -1.93% -2.64% 1.31% -74.61% Net Gearing 12.05 68.97 Source: Data provided by FTSE Russell Data Solutions. 81.94p 70.74 -22.63p -19.41% -12.52% -43.73p -48.81p - 86.72p -4.44p 2.26% 1.95% -20.94p

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The Restaurant Group Plc A Viable Investment Introduction The Restaurant Group Plc is a company operating in the UK restaurant industry This report ai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started