Answered step by step

Verified Expert Solution

Question

1 Approved Answer

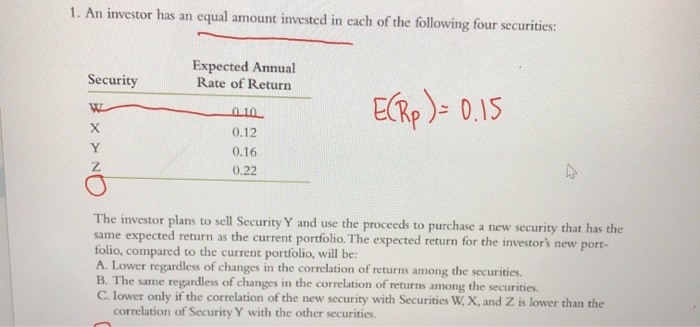

Is the world in the liquidity trap? FINC4360-Sumn X Prime Video Watch Pokemon De N Netflix + =93C40AFOD80C159B%2121397&authkey=%21AHGTC142nfifaZw&page=View&wd=target%28Classes.one * Go premium FINC4360 Summer 2020 Open

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started