is their any way you could show work too? im so lost.

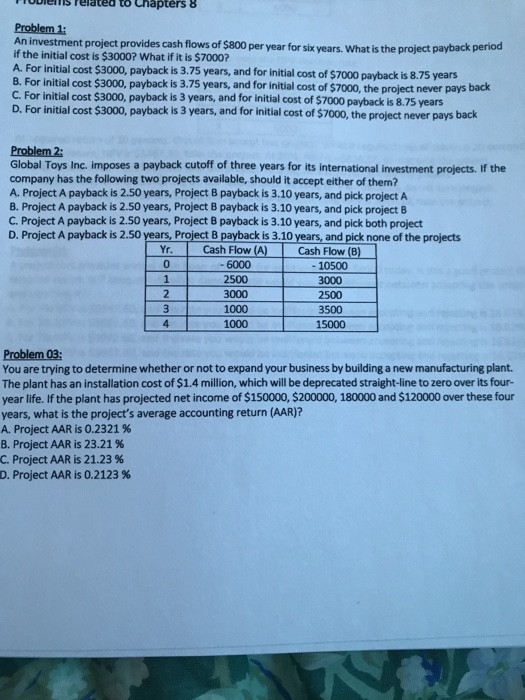

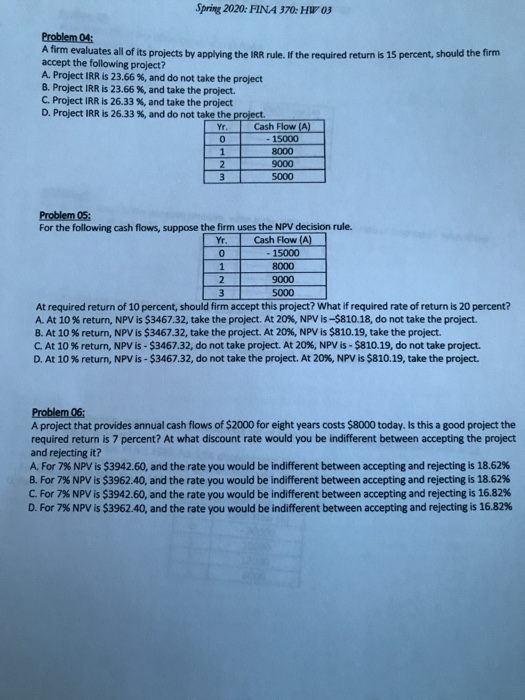

Povlems related to Lhapters 8 Problem 1: An investment project provides cash flows of $800 per year for six years. What is the project payback period if the initial cost is $3000? What if it is $7000? A. For initial cost $3000, payback is 3.75 years, and for initial cost of $7000 payback is 8.75 years B. For initial cost $3000, payback is 3.75 years, and for initial cost of $7000, the proiect never pays back C. For initial cost $3000, payback is 3 years, and for initial cost of $7000 payback is 8.75 years D. For initial cost $3000, payback is 3 years, and for initial cost of $7000, the project never pays back Problem 2: Global Toys Inc. imposes a payback cutoff of three years for its international investment projects. If the company has the following two projects available, should it accept either of them? A. Project A payback is 2.50 years, Project B payback is 3.10 years, and pick project A B. Project A payback is 2.50 years, Project B payback is 3.10 years, and pick project B C. Project A payback is 2.50 years, Project B payback is 3.10 years, and pick both project D. Project A payback is 2.50 years, Project B payback is 3.10 years, and pick none of the projects Yr. Cash Flow (A) Cash Flow (B) 0 -6000 - 10500 1 2500 3000 12 3000 2500 3 1000 3500 4 1000 15000 Problem 03: You are trying to determine whether or not to expand your business by building a new manufacturing plant. The plant has an installation cost of $1.4 million, which will be deprecated straight-line to zero over its four- year life. If the plant has projected net income of $150000, $200000, 180000 and $120000 over these four years, what is the project's average accounting return (AAR)? A. Project AAR is 0.2321 % B. Project AAR is 23.21% C. Project AAR is 21.23% D. Project AAR is 0.2123% Spring 2020: FINA 370: HW 03 Problem 04: A firm evaluates all of its projects by applying the IRR rule. If the required return is 15 percent, should the firm accept the following project? A. Project IRR is 23.66 %, and do not take the project B. Project IRR is 23.66 %, and take the project. C. Project IRR is 26.33 X, and take the project D. Project IRR is 26.33 , and do not take the project. Yr. Cash Flow (A) - 15000 8000 9000 3 5000 Problem 05: For the following cash flows, suppose the firm uses the NPV decision rule. Yr. Cash Flow (A) 0 - 15000 8000 90.00 5000 At required return of 10 percent, should firm accept this project? What if required rate of return is 20 percent? A. At 10% return, NPV is $3467.32, take the project. At 20%, NPV is -$810.18, do not take the project. B. At 10% return, NPV is $3467.32, take the project. At 20%, NPV is $810.19, take the project. C. At 10% return, NPV is - $3467.32, do not take project. At 20%, NPV is - $810.19, do not take project. D. At 10 % return, NPV is - $3467.32, do not take the project. At 20%, NPV is $810.19, take the project. Problem 06: A project that provides annual cash flows of $2000 for eight years costs $8000 today. Is this a good project the required return is 7 percent? At what discount rate would you be indifferent between accepting the project and rejecting it? A. For 7% NPV is $3942.60, and the rate you would be indifferent between accepting and rejecting is 18.62% B. For 7% NPV is $3962.40, and the rate you would be indifferent between accepting and rejecting is 18.62% C. For 7% NPV is $3942.60, and the rate you would be indifferent between accepting and rejecting is 16.82% D. For 7% NPV is $3962.40. and the rate you would be indifferent between accepting and rejecting is 16.82%