Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is there a certain cell that I have to hold and drag all the way down to the lowest column? Thank you! MORTGAGE LOAN DEMO

Is there a certain cell that I have to hold and drag all the way down to the lowest column? Thank you!

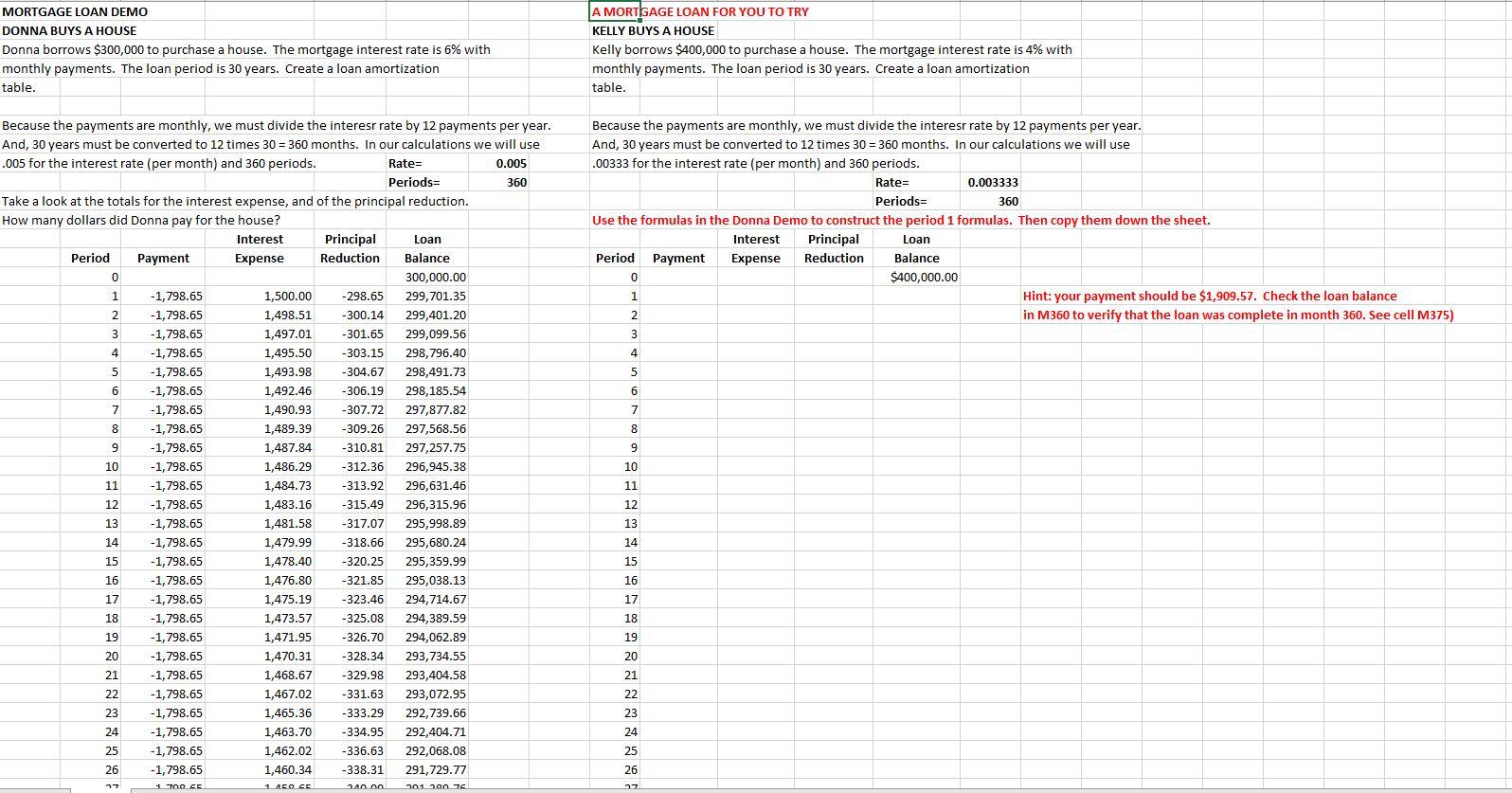

MORTGAGE LOAN DEMO DONNA BUYS A HOUSE Donna borrows $300,000 to purchase a house. The mortgage interest rate is 6% with monthly payments. The loan period is 30 years. Create a loan amortization table. A MORTGAGE LOAN FOR YOU TO TRY KELLY BUYS A HOUSE Kelly borrows $400,000 to purchase a house. The mortgage interest rate is 4% with monthly payments. The loan period is 30 years. Create a loan amortization table. Because the payments are monthly, we must divide the interesr rate by 12 payments per year. And, 30 years must be converted to 12 times 30 = 360 months. In our calculations we will use .00333 for the interest rate (per month) and 360 periods. Rate= 0.003333 Periods 360 Use the formulas in the Donna Demo to construct the period 1 formulas. Then copy them down the sheet. Interest Principal Loan Period Payment Expense Reduction Balance 0 $400,000.00 1 Hint: your payment should be $1,909.57. Check the loan balance in M360 to verify that the loan was complete in month 360. See cell M375) 3 2 4 5 6 7 8 9 Because the payments are monthly, we must divide the interesr rate by 12 payments per year. And, 30 years must be converted to 12 times 30 = 360 months. In our calculations we will use .005 for the interest rate (per month) and 360 periods. Rate= 0.005 Periods 360 Take a look at the totals for the interest expense, and of the principal reduction. How many dollars did Donna pay for the house? Interest Principal Loan Period Payment Expense Reduction Balance 0 300,000.00 1 -1,798.65 1,500.00 -298.65 299,701.35 2 -1,798.65 1,498.51 -300.14 299,401.20 3 -1,798.65 1,497.01 -301.65 299,099.56 4 -1,798.65 1,495.50 -303.15 298,796.40 5 -1,798.65 1,493.98 -304.67 298,491.73 6 -1,798.65 1,492.46 -306.19 298,185.54 7 -1,798.65 1,490.93 -307.72 297,877.82 8 -1,798.65 1,489.39 -309.26 297,568.56 9 -1,798.65 1,487.84 -310.81 297,257.75 10 -1,798.65 1,486.29 -312.36 296,945.38 11 -1,798.65 1,484.73 -313.92 296,631.46 12 -1,798.65 1,483.16 -315.49 296,315.96 13 -1,798.65 1,481.58 -317.07 295,998.89 14 -1,798.65 1,479.99 -318.66 295,680.24 15 -1,798.65 1,478.40 -320.25 295,359.99 16 -1,798.65 1,476.80 -321.85 295,038.13 17 -1,798.65 1,475.19 -323.46 294,714.67 18 -1,798.65 1,473.57 -325.08 294,389.59 19 -1,798.65 1,471.95 -326.70 294,062.89 20 -1,798.65 1,470.31 -328.34 293,734.55 21 -1,798.65 1,468.67 -329.98 293,404.58 22 -1,798.65 1,467.02 -331.63 293,072.95 23 -1,798.65 1,465.36 -333.29 292,739.66 24 -1,798.65 1,463.70 -334.95 292,404.71 25 -1,798.65 1,462.02 -336.63 292,068.08 26 -1,798.65 1,460.34 -338.31 291,729.77 200 10-1200 70 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 1 700 CE 1 ALOCEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started