Answered step by step

Verified Expert Solution

Question

1 Approved Answer

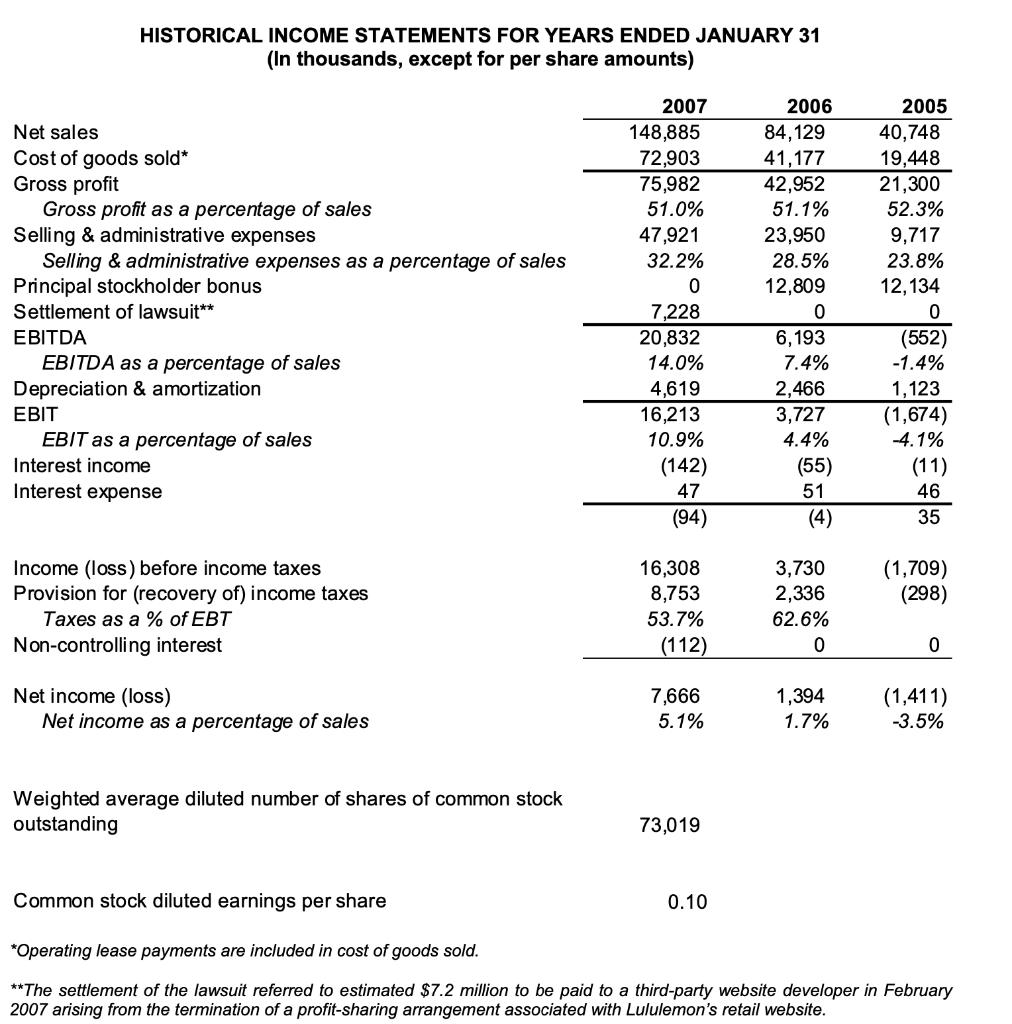

Is there a good rationale for raising $30 to $60 million at the time of the case? What do you estimate the companys value (total

- Is there a good rationale for raising $30 to $60 million at the time of the case?

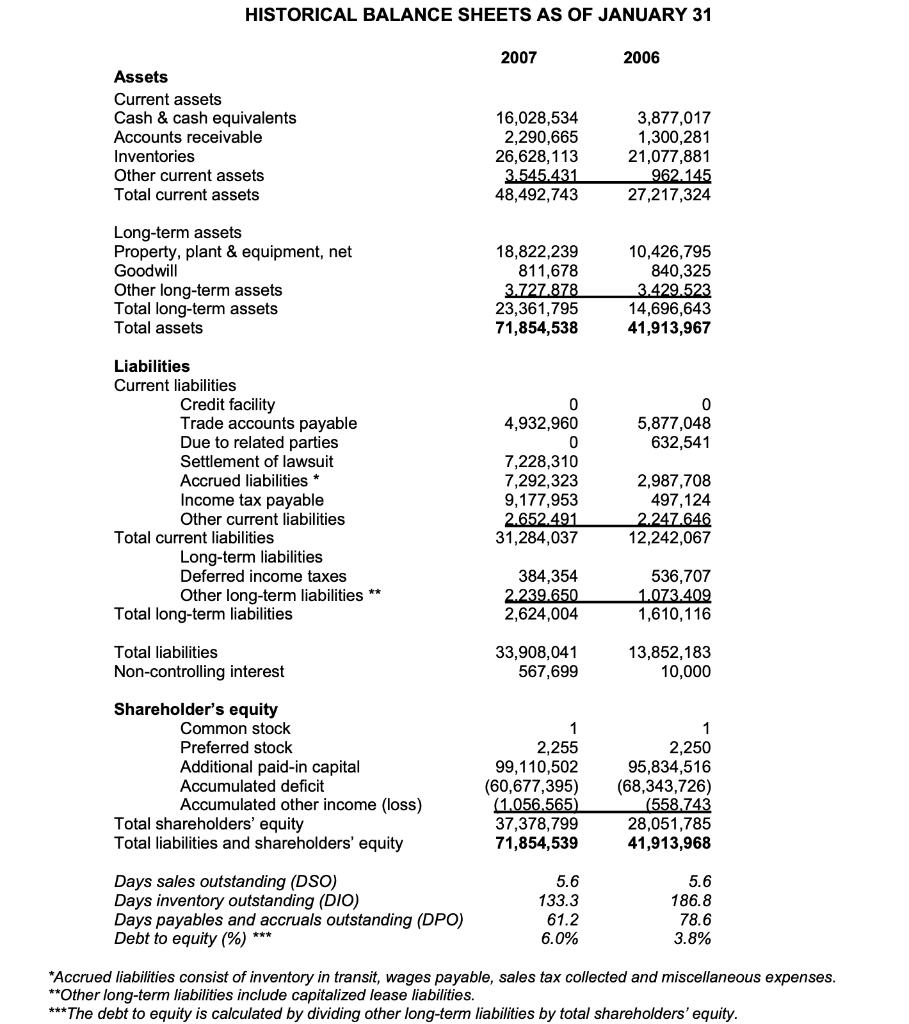

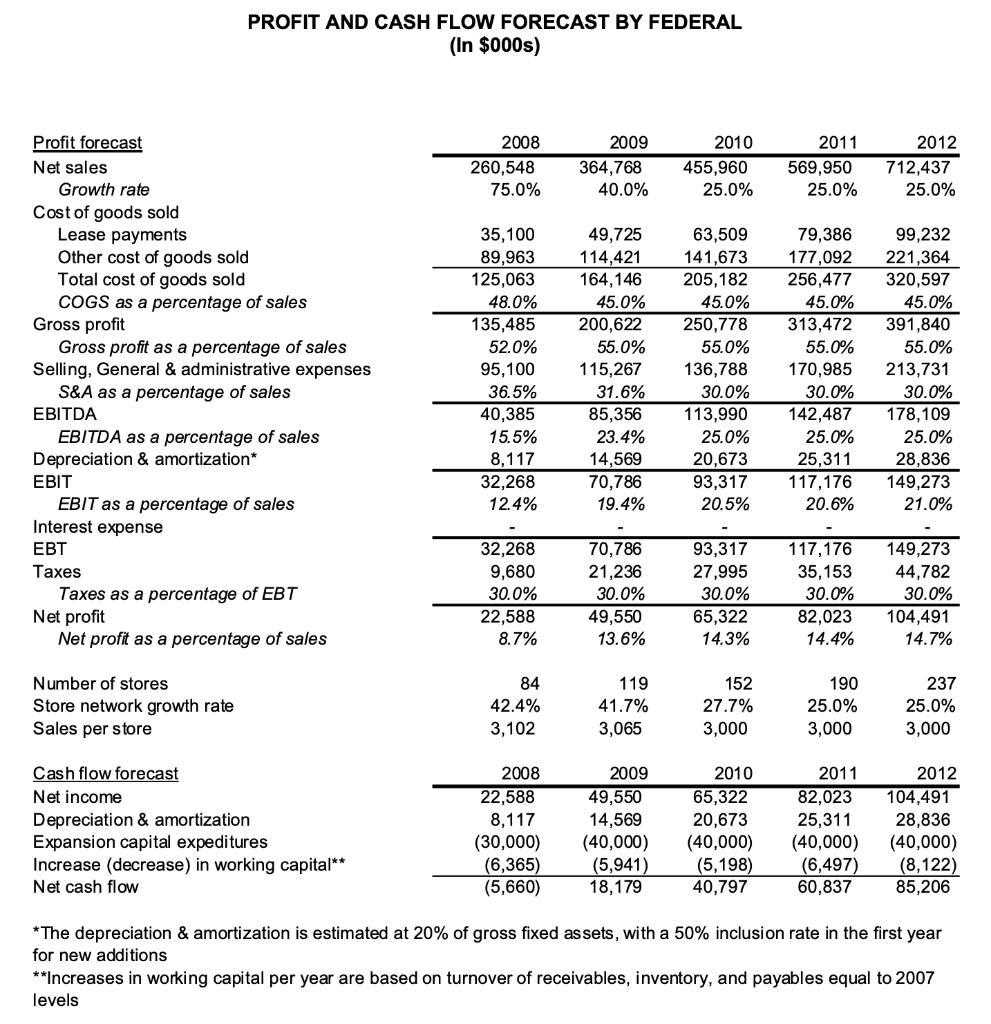

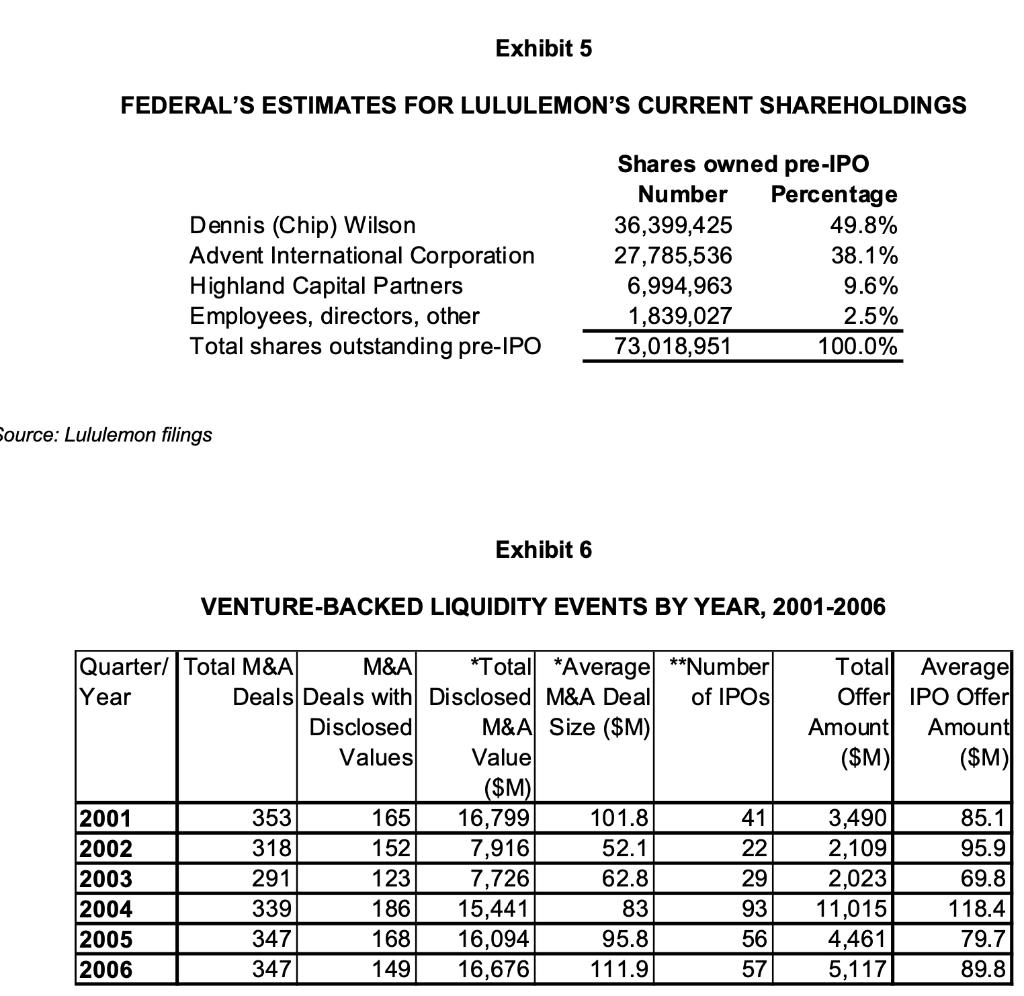

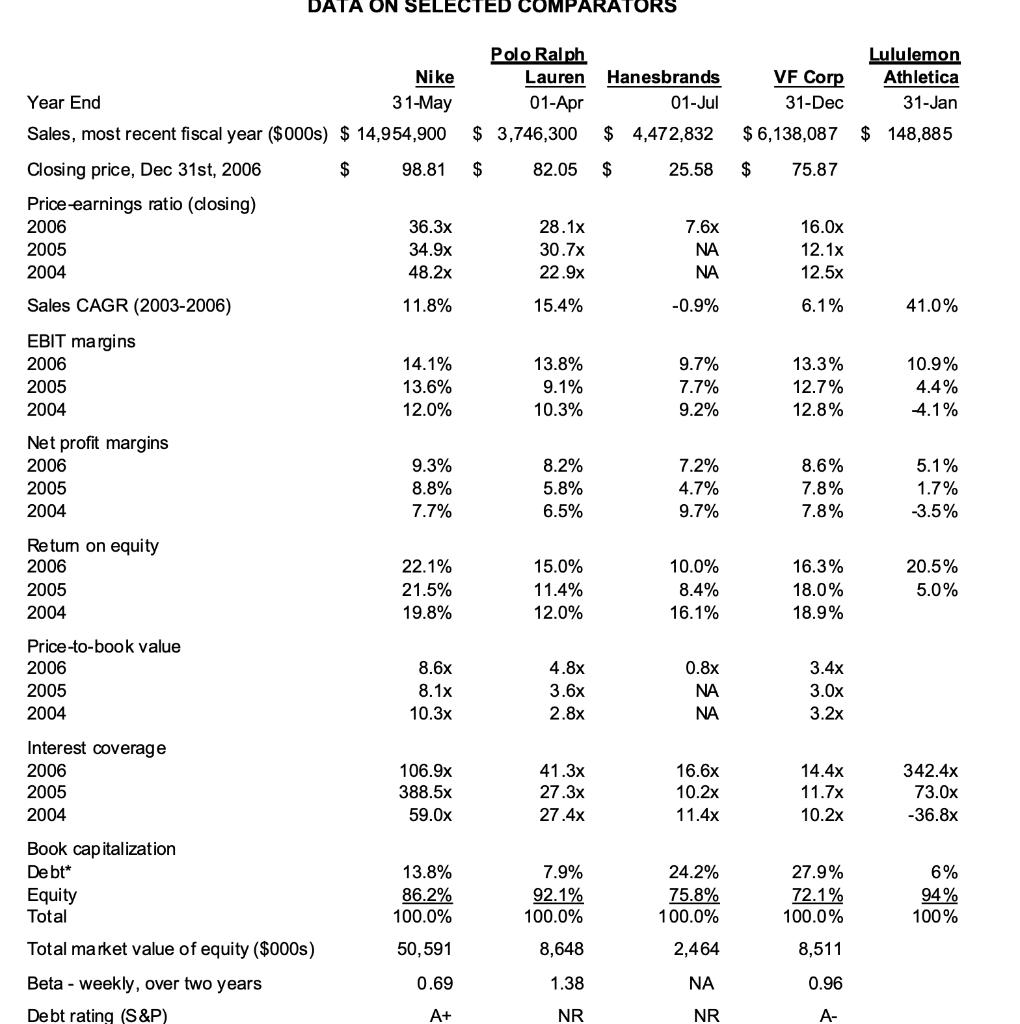

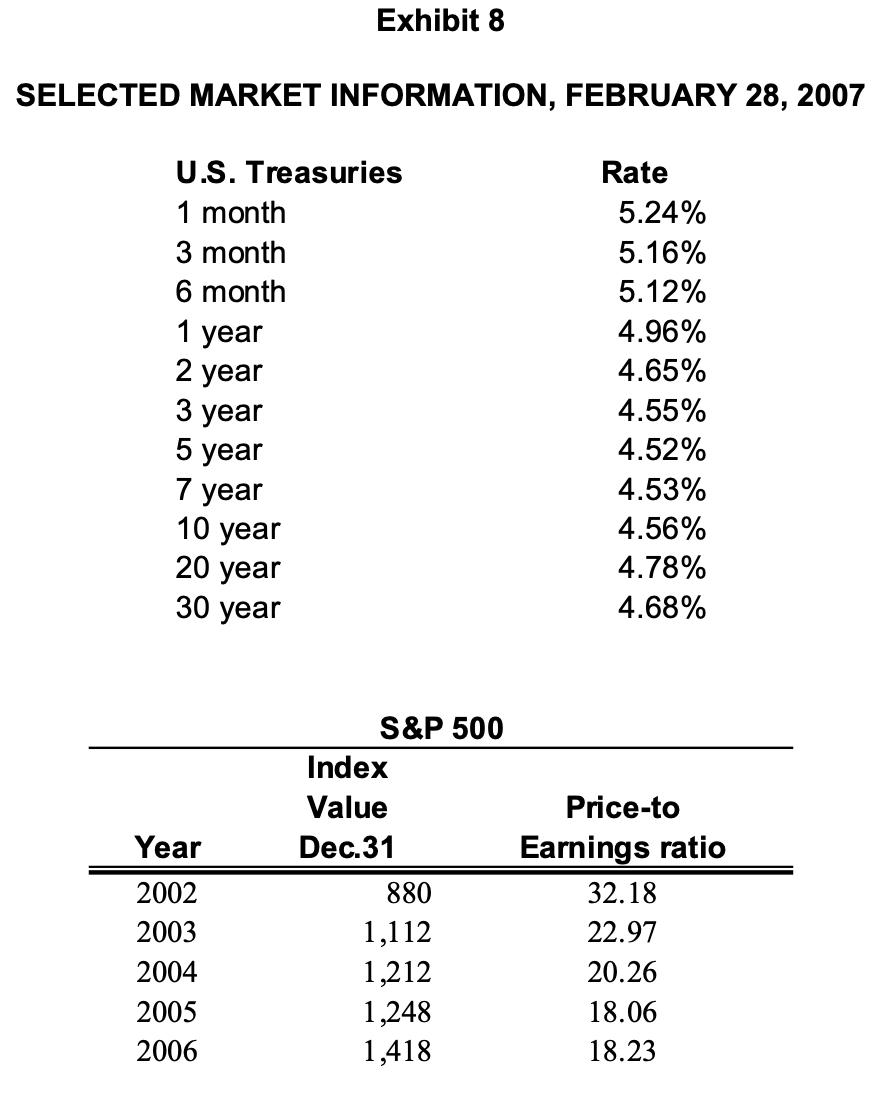

- What do you estimate the company’s value (total and per share) to be as of March 2007? This does not mean looking back and reading from history. It means estimating value as we have done before – projected net cash flows have to be appropriately discounted. Estimate the discount rate. The resultant estimated company value can be checked using market multiples of comparable companies.

- Consider the debt vs. equity discussion.

- How much value would be created if $50 million debt were to be added?

- Would the Weighted Average Cost of Capital change? How?

- What would EPS be under the two alternatives at a low future EBITDA? At a high future EBITDA?

- Is debt or equity preferable?

- What is the condition of the equity markets? Is an IPO at the time of the case a good bet? Which party benefits from the sale?

- Recommend a course of action to Mr. McDonald

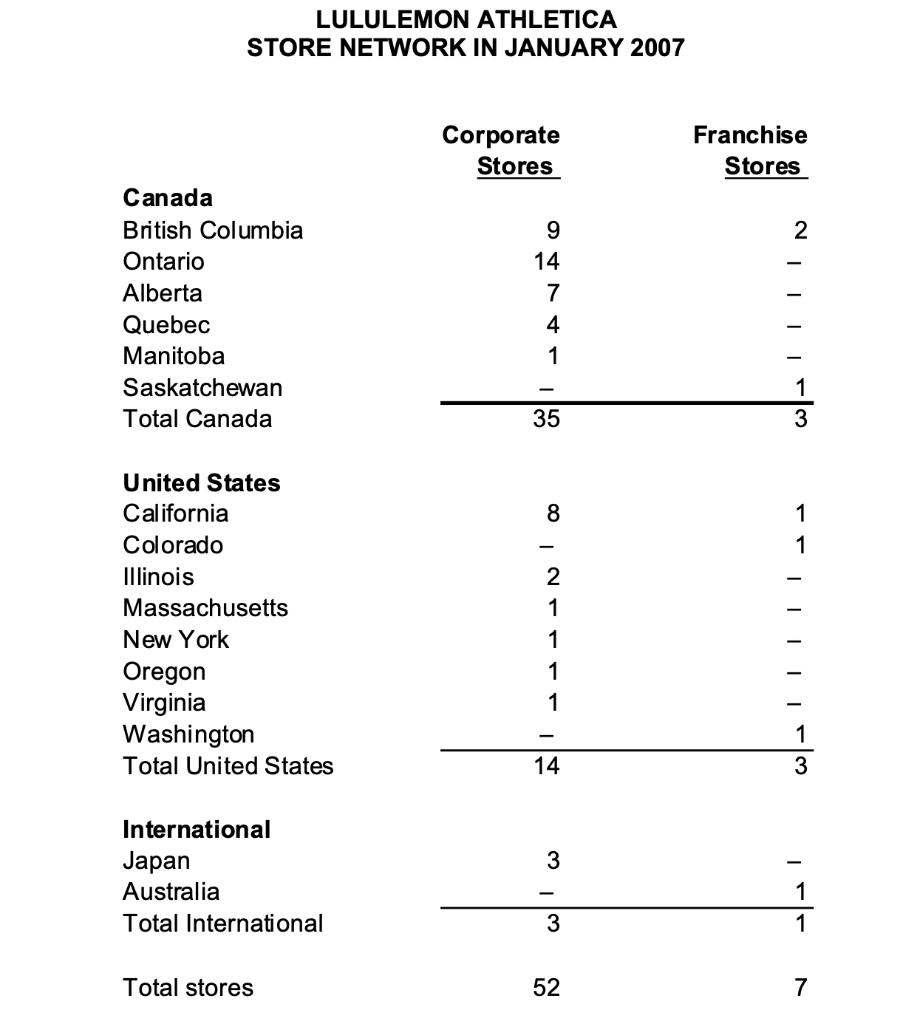

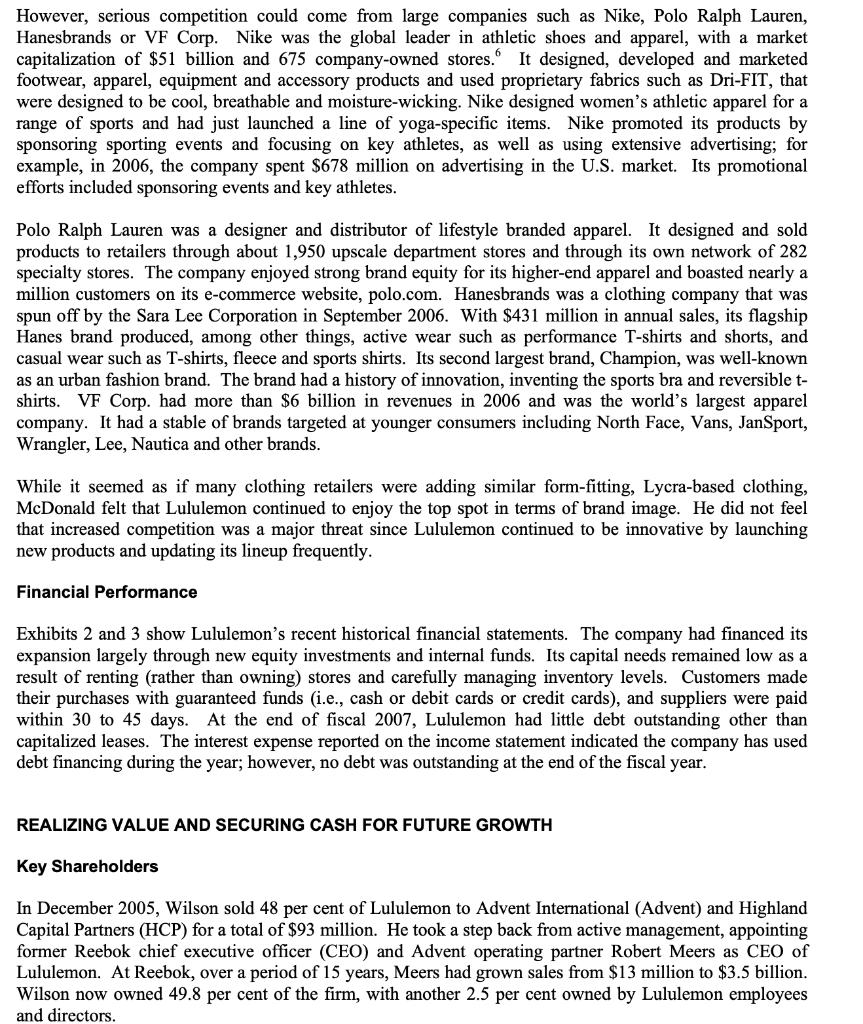

LULULEMON ATHLETICA STORE NETWORK IN JANUARY 2007 Canada British Columbia Ontario Alberta Quebec Manitoba Saskatchewan Total Canada United States California Colorado Illinois Massachusetts New York Oregon Virginia Washington Total United States International Japan Australia Total International Total stores Corporate Stores 9 14 7 4 1 - 35 8 ' 2 1 - 14 3 3 52 Franchise Stores 2 1 3 1 ||||| 1 3 1 1 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Do you recall Cuba Gooding Jrs popculture defining phone conversation with Tom Cruise in Jerry Maguire The one where Cruise has to do a Show me the money lungbuster to convince his client Gooding Jr t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started