Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is there a quick way of entering this information into the calculator? BA II Plus? Instead of writing each year out? Example: Colgate-Palmolive Company has

Is there a quick way of entering this information into the calculator? BA II Plus? Instead of writing each year out? Example:

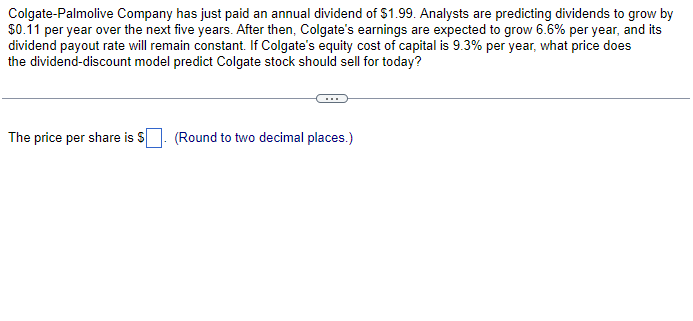

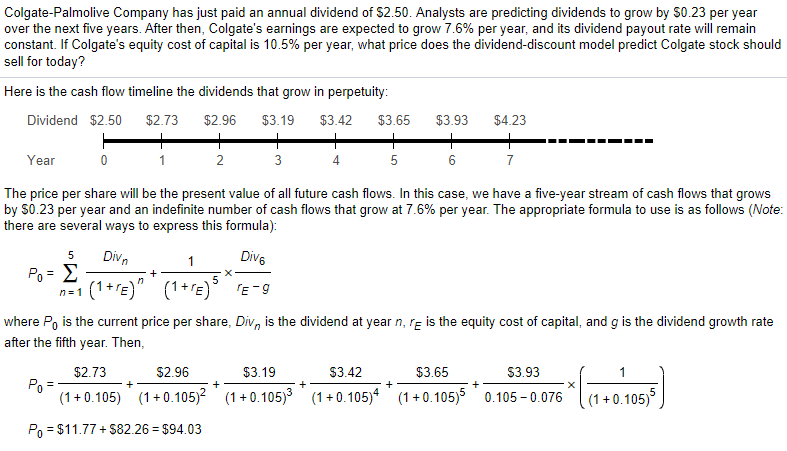

Colgate-Palmolive Company has just paid an annual dividend of $1.99. Analysts are predicting dividends to grow by $0.11 per year over the next five years. After then, Colgate's earnings are expected to grow 6.6% per year, and its dividend payout rate will remain constant. If Colgate's equity cost of capital is 9.3% per year, what price does the dividend-discount model predict Colgate stock should sell for today? The price per share is $. (Round to two decimal places.) Colgate-Palmolive Company has just paid an annual dividend of $2.50. Analysts are predicting dividends to grow by $0.23 per year over the next five years. After then, Colgate's earnings are expected to grow 7.6% per year, and its dividend payout rate will remain constant. If Colgate's equity cost of capital is 10.5% per year, what price does the dividend-discount model predict Colgate stock should sell for today? Here is the cash flow timeline the dividends that grow in perpetuity: The price per share will be the present value of all future cash flows. In this case, we have a five-year stream of cash flows that grows by $0.23 per year and an indefinite number of cash flows that grow at 7.6% per year. The appropriate formula to use is as follows (Note: there are several ways to express this formula): P0=n=15(1+rE)nDivn+(1+rE)51rEgDiv6 where P0 is the current price per share, Divn is the dividend at year n,rE is the equity cost of capital, and g is the dividend growth rate after the fifth year. Then, P0=(1+0.105)$2.73+(1+0.105)2$2.96+(1+0.105)3$3.19+(1+0.105)4$3.42+(1+0.105)5$3.65+0.1050.076$3.93((1+0.105)51)P0=$11.77+$82.26=$94.03

Colgate-Palmolive Company has just paid an annual dividend of $1.99. Analysts are predicting dividends to grow by $0.11 per year over the next five years. After then, Colgate's earnings are expected to grow 6.6% per year, and its dividend payout rate will remain constant. If Colgate's equity cost of capital is 9.3% per year, what price does the dividend-discount model predict Colgate stock should sell for today? The price per share is $. (Round to two decimal places.) Colgate-Palmolive Company has just paid an annual dividend of $2.50. Analysts are predicting dividends to grow by $0.23 per year over the next five years. After then, Colgate's earnings are expected to grow 7.6% per year, and its dividend payout rate will remain constant. If Colgate's equity cost of capital is 10.5% per year, what price does the dividend-discount model predict Colgate stock should sell for today? Here is the cash flow timeline the dividends that grow in perpetuity: The price per share will be the present value of all future cash flows. In this case, we have a five-year stream of cash flows that grows by $0.23 per year and an indefinite number of cash flows that grow at 7.6% per year. The appropriate formula to use is as follows (Note: there are several ways to express this formula): P0=n=15(1+rE)nDivn+(1+rE)51rEgDiv6 where P0 is the current price per share, Divn is the dividend at year n,rE is the equity cost of capital, and g is the dividend growth rate after the fifth year. Then, P0=(1+0.105)$2.73+(1+0.105)2$2.96+(1+0.105)3$3.19+(1+0.105)4$3.42+(1+0.105)5$3.65+0.1050.076$3.93((1+0.105)51)P0=$11.77+$82.26=$94.03 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started