Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tou have been approached by a friend of yours who sees you as a guru when it comes to your financial situation. This friend earns

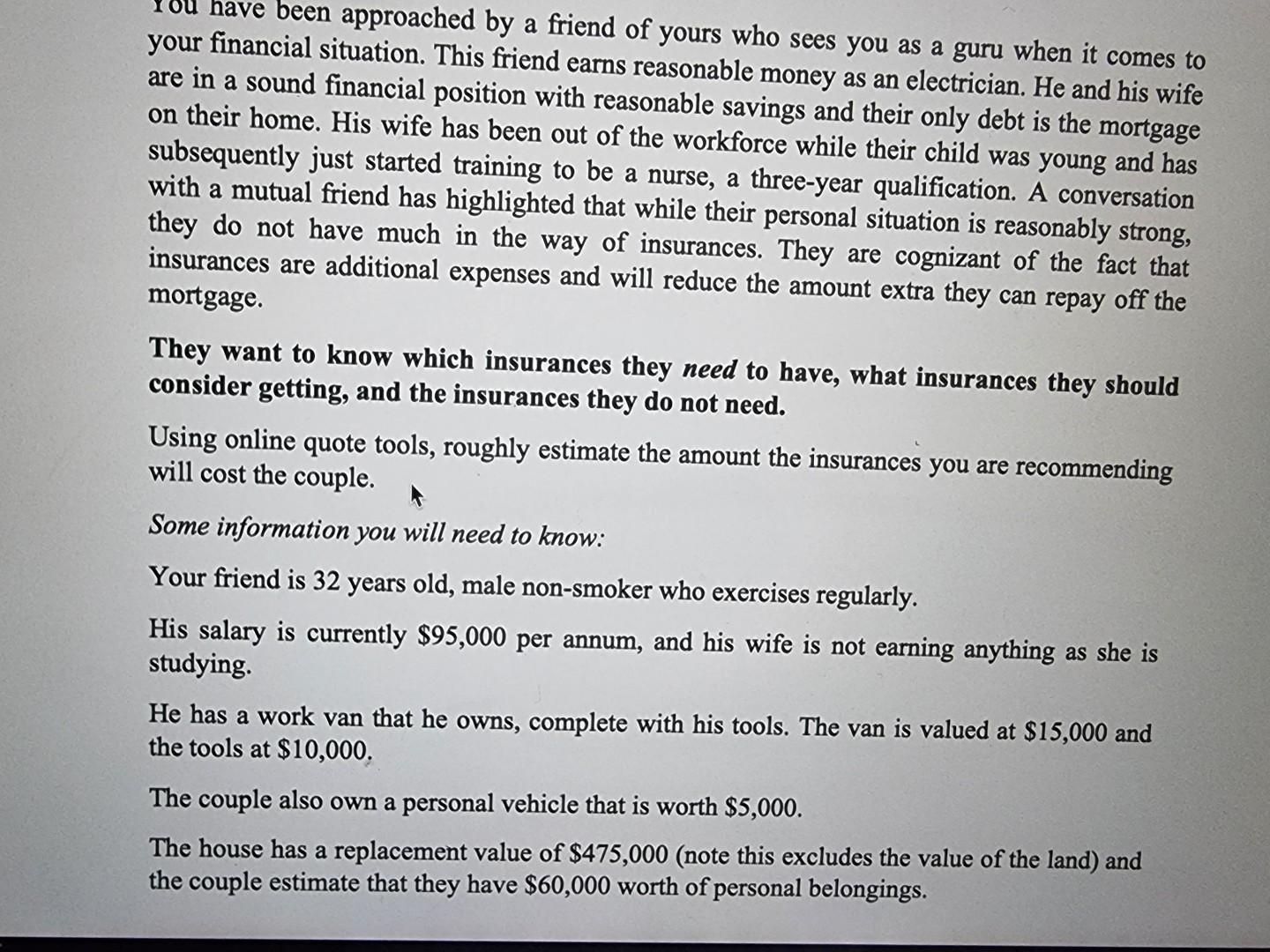

Tou have been approached by a friend of yours who sees you as a guru when it comes to your financial situation. This friend earns reasonable money as an electrician. He and his wife are in a sound financial position with reasonable savings and their only debt is the mortgage on their home. His wife has been out of the workforce while their child was young and has subsequently just started training to be a nurse, a three-year qualification. A conversation with a mutual friend has highlighted that while their personal situation is reasonably strong, they do not have much in the way of insurances. They are cognizant of the fact that insurances are additional expenses and will reduce the amount extra they can repay off the mortgage. They want to know which insurances they need to have, what insurances they should consider getting, and the insurances they do not need. Using online quote tools, roughly estimate the amount the insurances you are recommending will cost the couple. Some information you will need to know: Your friend is 32 years old, male non-smoker who exercises regularly. His salary is currently $95,000 per annum, and his wife is not earning anything as she is studying. He has a work van that he owns, complete with his tools. The van is valued at $15,000 and the tools at $10,000. The couple also own a personal vehicle that is worth $5,000. The house has a replacement value of $475,000 (note this excludes the value of the land) and the couple estimate that they have $60,000 worth of personal belongings. Tou have been approached by a friend of yours who sees you as a guru when it comes to your financial situation. This friend earns reasonable money as an electrician. He and his wife are in a sound financial position with reasonable savings and their only debt is the mortgage on their home. His wife has been out of the workforce while their child was young and has subsequently just started training to be a nurse, a three-year qualification. A conversation with a mutual friend has highlighted that while their personal situation is reasonably strong, they do not have much in the way of insurances. They are cognizant of the fact that insurances are additional expenses and will reduce the amount extra they can repay off the mortgage. They want to know which insurances they need to have, what insurances they should consider getting, and the insurances they do not need. Using online quote tools, roughly estimate the amount the insurances you are recommending will cost the couple. Some information you will need to know: Your friend is 32 years old, male non-smoker who exercises regularly. His salary is currently $95,000 per annum, and his wife is not earning anything as she is studying. He has a work van that he owns, complete with his tools. The van is valued at $15,000 and the tools at $10,000. The couple also own a personal vehicle that is worth $5,000. The house has a replacement value of $475,000 (note this excludes the value of the land) and the couple estimate that they have $60,000 worth of personal belongings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started