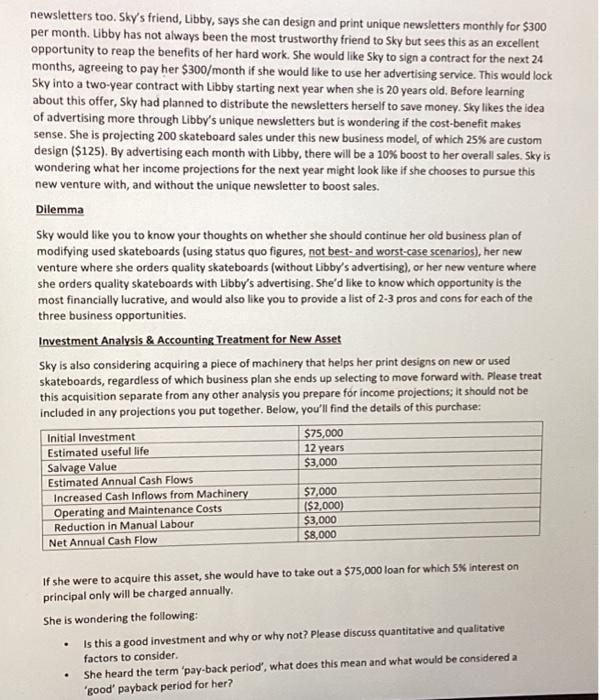

Is this a good investment and why or why not? Please discuss quantitative and qualitative factors to consider.

She heard the term pay-back period, what does this mean and what would be considered a good payback period for her?

Sky is the owner of a small business called Sky's Skateboards. Sky, who grew up in a circle of avid boarders, started the business last year, initially adding cool designs to her siblings' and friends' skateboards. Sky is 19 years old and has ambitions of starting her college degree within the next two years. Current Business Plan For the past year, Sky has customized used skateboards for $30 each (the average job took $5 in materials and an hour of her time). Initially, she averaged 15 designs a month. This number peaked in the summer (beginning of June to the end of September) at about 30 designs monthly. By the end of the year, the average had dipped to about 15 a month again. If Sky were to go and work for a local slate shop, she would be paid $12 an hour for completing similar work. Sky is wondering what she should project for this business activity next year, assuming demand increases by 5%, but is also curious as to what her best- and worst-case scenarios might look like. Worst Case Scenario She bellieves that in a worst-case scenario, sales may decline by 20 ss throughout the year, with exception to the June to end of September summer period, where sales may decline by 10% only. In this scenario, she believes it would take 90 minutes per design, as opposed to an hour (status quo). Best Case Scenario In the best-case scenario, sales will increase by 12.5% year-round, reaching a 25% increase for the summer months. In this scenario, she believes it would only take her 45 minutes per design, as opposed to an hour (status quo). Analysis Can you please prepare an analysis to advise Sky on financial projections for the best case, worst case, and status quo scenarios next year? Please demonstrate your calculations by using an appendix or by embedding a table within the report to show your work. Sky enjoys working on old boards as it allows her to connect with local members of her community and learning about their skating journeys. The personal element of this business models makes her feel fulfilled at what she does. She also enjors the fact that these boards are not extremely time consuming to complete so she has more time to study and spend time with friends. It is also a process she is familiar with and has ganed a level of mastery at. Potential (New) Business Plan Over the holiday season, 5ky had done some research and found she could order quality skateboards in basic colours (black, white, blue, etc) for $50 each. She expects to sell boards for $100 each after designing them. If a customer wants to request a specific design, she will charge a premium and sell the skateboard for $125. Sky anticipates that each new skateboard will require $10 in materials (after initial purchase) and require two hours of her time. For custom designs, she is budgeting an extra 30 minutes for communicating with her customer. For the time being, Siky will continue selling out of her parents' garage as it keeps costs low. She is planning on relying on word-of-mouth marketing and perhaps some newsletters too. Sky's friend, Libby, says she can design and print unique newsletters monthly for $300 per month. Libby has not always been the most trustworthy friend to Sky but sees this as an excellent opportunity to reap the benefits of her hard work. She would like Sky to sign a contract for the next 24 months, agreeing to pay her $300/ month if she would like to use her advertising service. This would lock Sky into a two-year contract with Libby starting next year when she is 20 years old. Before learning about this offer, Sky had planned to distribute the newsletters herself to save money. Sky likes the idea of advertising more through Libby's unique newsletters but is wondering if the cost-benefit makes sense. She is projecting 200 skateboard sales under this new business model, of which 25% are custom design (\$125). By advertising each month with Libby, there will be a 10% boost to her overall sales. 5ky is wondering what her income projections for the next year might look like if she chooses to pursue this new venture with, and without the unique newsletter to boost sales. Dilemma Sky would like you to know your thoughts on whether she should continue her old business plan of modifying used skateboards (using status quo figures, not best- and worst-case scenarios), her new venture where she orders quality skateboards (without Libby's advertising), or her new venture where she orders quality skateboards with Libby's advertising. She'd like to know which opportunity is the most financially lucrative, and would also like you to provide a list of 23 pros and cons for each of the three business opportunities. Investment Analysis \& Accounting Treatment for New Asset Sky is also considering acquiring a plece of machinery that helps her print designs on new or used skateboards, regardless of which business plan she ends up selecting to move forward with. Please treat this acquisition separate from any other analysis you prepare for income projections; it should not be included in any projections you put together. Below, you'll find the details of this purchase: If she were to acquire this asset, she would have to take out a $75,000 loan for which 5% interest on principal only will be charged annually. She is wondering the following: - Is this a good investment and why or why not? Please discuss quantitative and qualitative factors to consider. - She heard the term 'pay-back period', what does this mean and what would be considered a 'good' payback period for her