Answered step by step

Verified Expert Solution

Question

1 Approved Answer

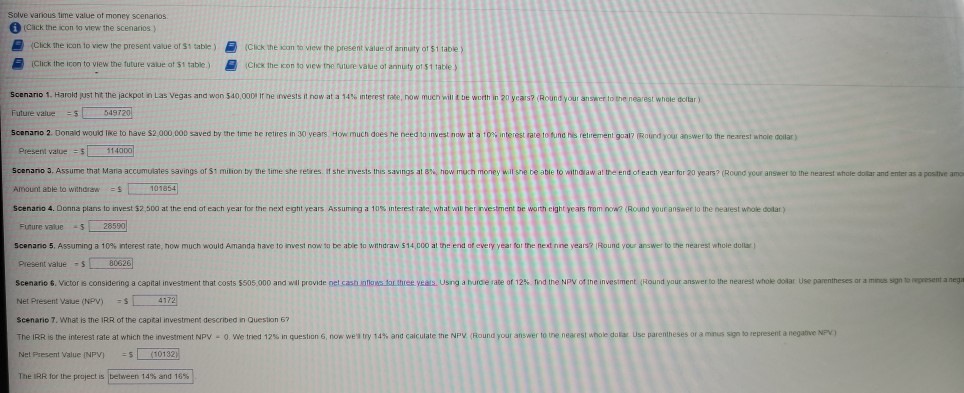

is this better? Solve various time value of money scenarios @ (Cack the icon to view the scenarios ) Cick the kean to wew the

is this better?

Solve various time value of money scenarios @ (Cack the icon to view the scenarios ) Cick the kean to wew the present val 2 ( (Cic the ion t vew he pesent vaiue of armuny or st tabe) (Clicx the con to view the future vaue of annuty of $1 table y Click the scan to view the present value of annuity of $1 table y Click the icon to view the future value ot $1 table ) scenaro 1, Harold just ht the iackpot in Las Vegas and won S40.000rhe invests it now at a 14% interest rate, now much will t tie wcah in 20 years? Future value s Scenano 2. Donald would like to have $2 000 000 saved by the time he retires in 30 years. How much does he need ta invest nosw est whole dcllar ) 5497 rate to fund his relirement goal? (Round your answer to the nearest whole doilar Present value 11400 Scenanio 3. Assume that Mana accumulates savings of $t milion by the time she reires. it she invests this savings at Amount able to withdraw S scenano 4. Dorna plans to invest 32,500 at the end of each year for the next eght years Assumng a 10% interest rate, what wil ble to vwithdlaw at the end of each year for 20 years? (Round your answer to the nearest whole dolar and enter as a posithe amo 101854 ent be worth eight years from now? d your answer lo the nearest whole dolar) Future value s28590 Scenar o 5. Assuming a 1 as n erest rate now much would Amanda have to mest naw ?? be able 1o withdraw s 14,000 at te en te ery ear the ne tr ne ears? IRound VOU answer to te nearest whole dollar ! Present value -s80626 scenario 6 victor?considering a capital investment trat costs ss05 000 and will provide netcasannonstortree years usng a burser ate of 12% fnd the NPV fine nve Net Present Vatue (NPV)s4172 Scenario T. What is the IRR of the captal investment described in Question 6? The RR s the interest rate at which he investment PV0. We tried 12% in guest on 6 now wen t 14% and calculate the NPV Round r answer t ne nea esi e da ? Use parent eses or a us s n s epresenta ne an e NPV Net Present value INPV) 10132 The IRR for the project is Round your answer to the nearest whole dolar Use parentheses or a minus sign 14% and 16% Solve various time value of money scenarios @ (Cack the icon to view the scenarios ) Cick the kean to wew the present val 2 ( (Cic the ion t vew he pesent vaiue of armuny or st tabe) (Clicx the con to view the future vaue of annuty of $1 table y Click the scan to view the present value of annuity of $1 table y Click the icon to view the future value ot $1 table ) scenaro 1, Harold just ht the iackpot in Las Vegas and won S40.000rhe invests it now at a 14% interest rate, now much will t tie wcah in 20 years? Future value s Scenano 2. Donald would like to have $2 000 000 saved by the time he retires in 30 years. How much does he need ta invest nosw est whole dcllar ) 5497 rate to fund his relirement goal? (Round your answer to the nearest whole doilar Present value 11400 Scenanio 3. Assume that Mana accumulates savings of $t milion by the time she reires. it she invests this savings at Amount able to withdraw S scenano 4. Dorna plans to invest 32,500 at the end of each year for the next eght years Assumng a 10% interest rate, what wil ble to vwithdlaw at the end of each year for 20 years? (Round your answer to the nearest whole dolar and enter as a posithe amo 101854 ent be worth eight years from now? d your answer lo the nearest whole dolar) Future value s28590 Scenar o 5. Assuming a 1 as n erest rate now much would Amanda have to mest naw ?? be able 1o withdraw s 14,000 at te en te ery ear the ne tr ne ears? IRound VOU answer to te nearest whole dollar ! Present value -s80626 scenario 6 victor?considering a capital investment trat costs ss05 000 and will provide netcasannonstortree years usng a burser ate of 12% fnd the NPV fine nve Net Present Vatue (NPV)s4172 Scenario T. What is the IRR of the captal investment described in Question 6? The RR s the interest rate at which he investment PV0. We tried 12% in guest on 6 now wen t 14% and calculate the NPV Round r answer t ne nea esi e da ? Use parent eses or a us s n s epresenta ne an e NPV Net Present value INPV) 10132 The IRR for the project is Round your answer to the nearest whole dolar Use parentheses or a minus sign 14% and 16%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started