is this clearer? please include the T-accounts for cost of control, non controlling interests and consolidated reserves like asked. thank you!

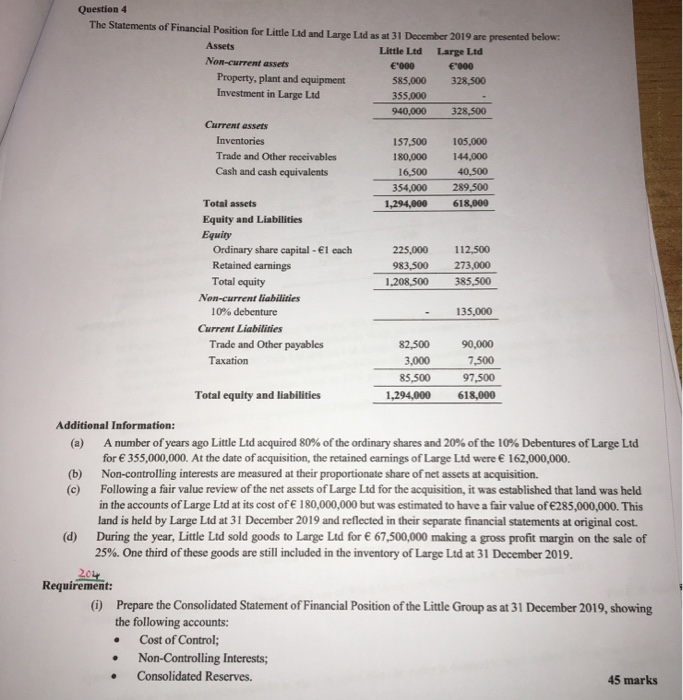

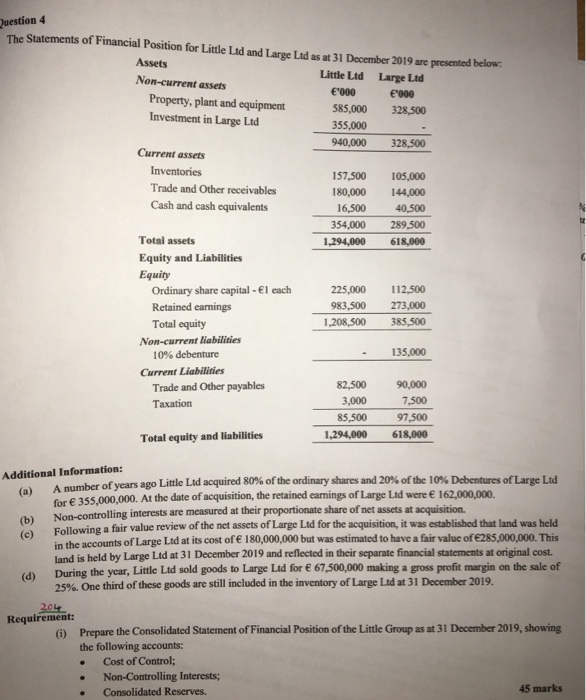

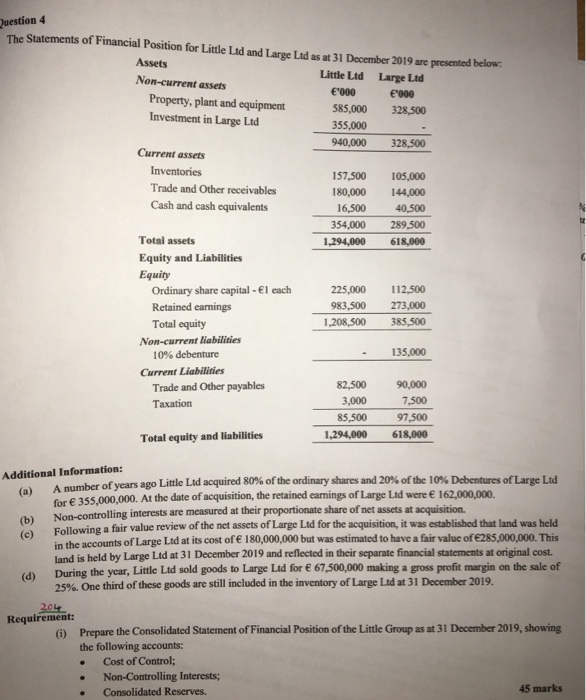

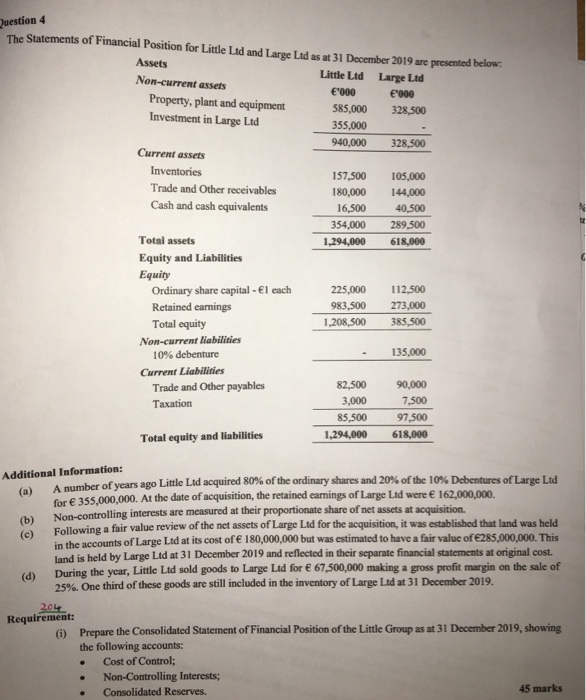

Question 4 The Statements of Financial Position for Little Lid and Large Ltd as at 31 December 2019 are presented below: Assets Little Ltd Large Ltd Non-current assets E'000 "000 Property, plant and equipment 585,000 328,500 Investment in Large Ltd 355,000 940,000 328,500 Current assets Inventories 157,500 105,000 Trade and Other receivables 180,000 144,000 Cash and cash equivalents 16,500 40.500 354,000 289,500 Total assets 1,294,000 618,000 Equity and Liabilities Equity Ordinary share capital - 1 each 225,000 112,500 Retained earnings 983,500 273,000 Total equity 1,208,500 385,500 Non-current liabilities 10% debenture 135,000 Current Liabilities Trade and Other payables 82,500 90,000 Taxation 3,000 7,500 85,500 97,500 Total equity and liabilities 1,294,000 618,000 Additional Information: a) A number of years ago Little Ltd acquired 80% of the ordinary shares and 20% of the 10% Debentures of Large Ltd for 355,000,000. At the date of acquisition, the retained earnings of Large Ltd were 162,000,000. (b) Non-controlling interests are measured at their proportionate share of net assets at acquisition. (c) Following a fair value review of the net assets of Large Ltd for the acquisition, it was established that land was held in the accounts of Large Ltd at its cost of 180,000,000 but was estimated to have a fair value of 285,000,000. This land is held by Large Ltd at 31 December 2019 and reflected in their separate financial statements at original cost. (d) During the year, Little Ltd sold goods to Large Ltd for 67,500,000 making a gross profit margin on the sale of 25%. One third of these goods are still included in the inventory of Large Ltd at 31 December 2019. 204 Requirement: (1) Prepare the Consolidated Statement of Financial Position of the Little Group as at 31 December 2019, showing the following accounts: Cost of Control; Non-Controlling Interests; Consolidated Reserves. 45 marks . Question 4 The Statements of Financial Position for Little Ltd and Large Ltd as at 31 December 2019 are presented below. Assets Little Ltd Non-current assets Large Ltd '000 "000 Property, plant and equipment 585,000 328,500 Investment in Large Ltd 355,000 940,000 328,500 Current assets Inventories 157,500 105,000 Trade and Other receivables 180,000 144,000 Cash and cash equivalents 16,500 40,500 354,000 289,500 Total assets 1,294,000 618,000 Equity and Liabilities Equity Ordinary share capital - 1 each 225,000 112,500 Retained earnings 983,500 273,000 Total equity 1,208,500 385,500 Non-current liabilities 10% debenture 135,000 Current Liabilities Trade and Other payables 82,500 90,000 Taxation 3,000 7,500 85,500 97,500 1,294,000 618,000 Total equity and liabilities Additional Information: (a) (b) (c) A number of years ago Little Ltd acquired 80% of the ordinary shares and 20% of the 10% Debentures of Large Ltd for 355,000,000. At the date of acquisition, the retained earnings of Large Ltd were 162,000,000. Non-controlling interests are measured at their proportionate share of net assets at acquisition. Following a fair value review of the net assets of Large Lid for the acquisition, it was established that land was held in the accounts of Large Ltd at its cost of 180,000,000 but was estimated to have a fair value of 285,000,000. This land is held by Large Ltd at 31 December 2019 and reflected in their separate financial statements at original cost. (d) During the year, Little Ltd sold goods to Large Ltd for 67,500,000 making a gross profit margin on the sale of 25%. One third of these goods are still included in the inventory of Large Ltd at 31 December 2019. 204 Requirement: (1) Prepare the Consolidated Statement of Financial Position of the Little Group as at 31 December 2019, showing the following accounts: Cost of Control: Non-Controlling Interests; Consolidated Reserves. 45 marks