Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is this correct? At December 31, 2018, Smole Corporation's adjusted trial balance shows the following balances: (Click the icon to view the balances) Click the

Is this correct?

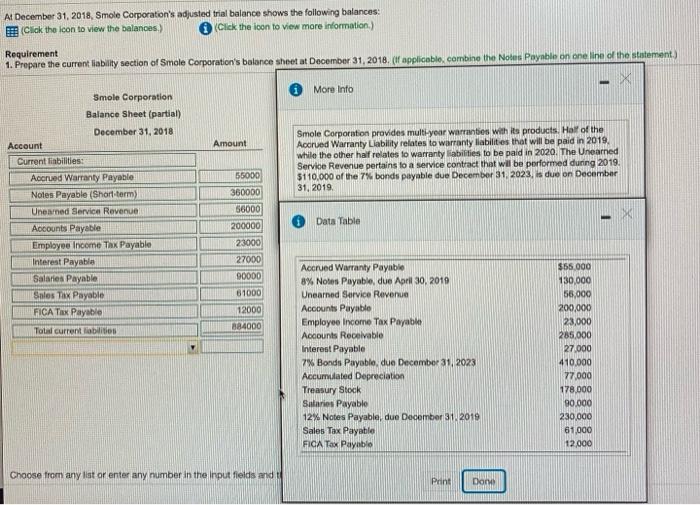

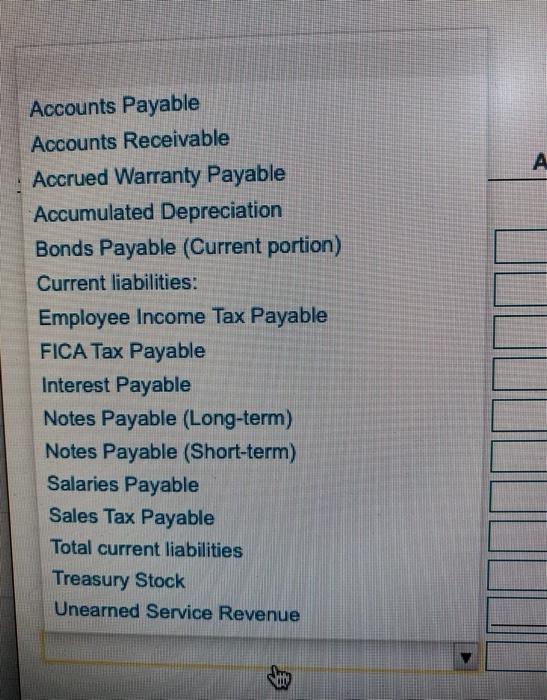

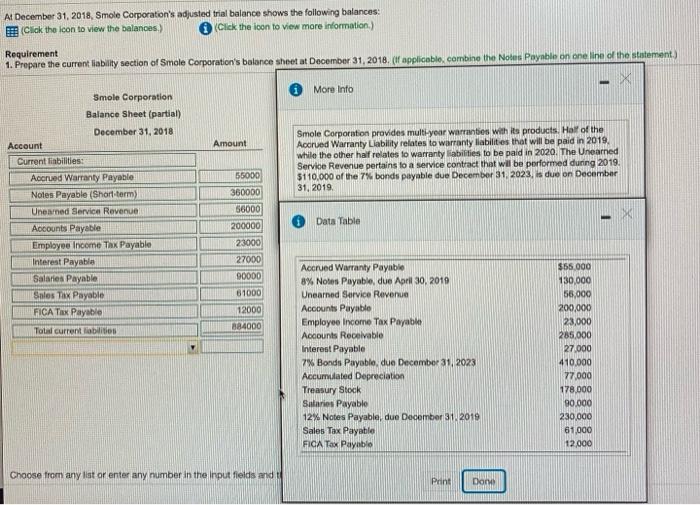

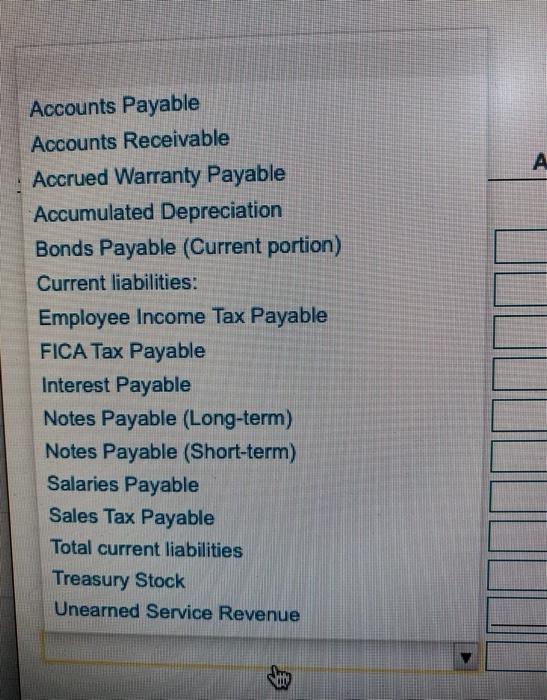

At December 31, 2018, Smole Corporation's adjusted trial balance shows the following balances: (Click the icon to view the balances) Click the loon to view more information) Requirement 1. Prepare the current liability section of Smole Corporation's balance sheet at December 31, 2018. (if applicable, combine the Nobus Payable on one line of the statement More Info Amount Smole Corporation provides multi-year warranties with its products. Half of the Accrued Warranty Liability relates to warranty liabilities that will be paid in 2019, while the other half relates to warranty liabilities to be paid in 2020. The Unearned Service Revenue pertains to a service contract that will be performed during 2019 $110,000 of the 7% bonds payable due December 31, 2023, is due on December 31, 2019 55000 Smole Corporation Balance Sheet (partial) December 31, 2018 Account Current liabilities: Accrued Warranty Payable Notes Payable (Short term) Uneared Service Revenue Accounts Payable Employee Income Tax Payable Interest Payable Salaries Payable Sales Tax Payable FICA Tax Payable Total current liabilition Data Table 360000 56000 200000 23000 27000) 90000 61000 12000 884000 Accrued Warranty Payable 8% Notes Payable, due April 30, 2019 Unearned Service Revenue Accounts Payable Employee Income Tax Payable Accounts Receivable Interest Payable 7% Bonds Payable, due December 31, 2023 Accumulated Depreciation Treasury Stock Salarios Payable 12% Notes Payable, due December 31, 2019 Sales Tax Payable FICA Tax Payable $55.000 130,000 55.000 200,000 23,000 285.000 27.000 410.000 77.000 178,000 90.000 230,000 61.000 12.000 Choose from any list or enter any number in the input fields and Print Don Accounts Payable Accounts Receivable Accrued Warranty Payable Accumulated Depreciation Bonds Payable (Current portion) Current liabilities: Employee Income Tax Payable FICA Tax Payable Interest Payable Notes Payable (Long-term) Notes Payable (Short-term) Salaries Payable Sales Tax Payable Total current liabilities Treasury Stock Unearned Service Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started