Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is this correct? Problem 4 (10 pts.) You are currently considering three investment possibilities. The first is a bond selling in the market for $1,100.

Is this correct?

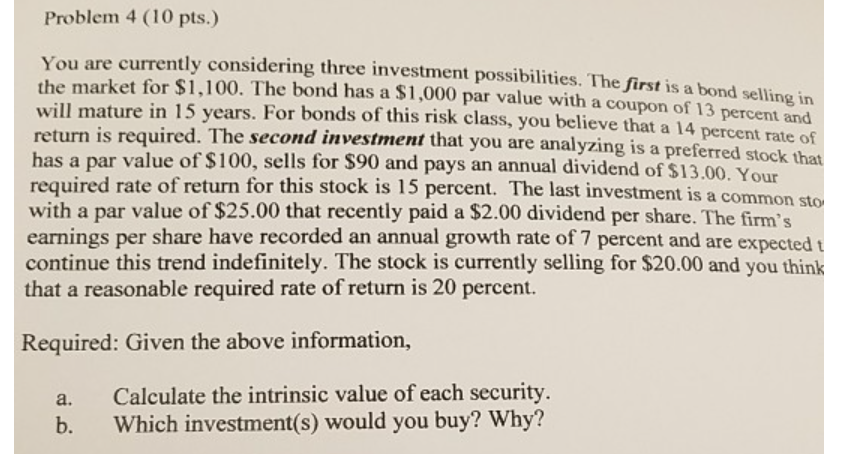

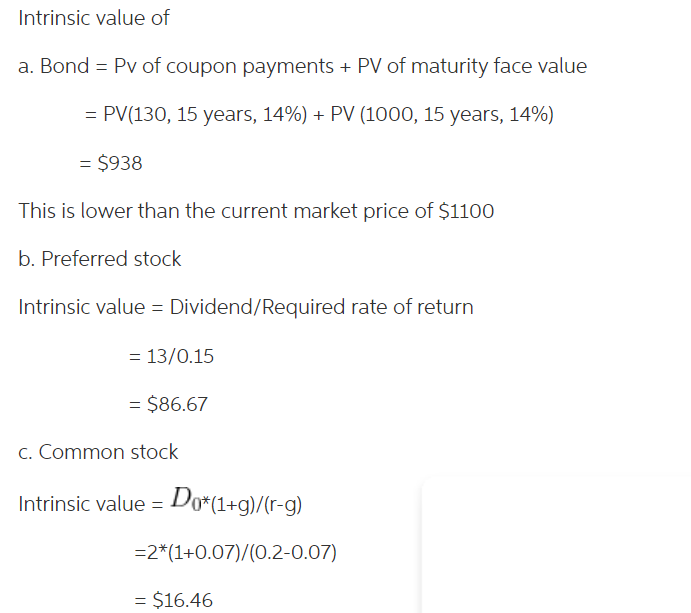

Problem 4 (10 pts.) You are currently considering three investment possibilities. The first is a bond selling in the market for $1,100. The bond has a $1,000 par value with a coupon of 13 percent and will mature in 15 years. For bonds of this risk class, you believe that a 14 percent rate of return is required. The second investment that you are analyzing is a preferred stock that has a par value of $100, sells for $90 and pays an annual dividend of $13.00. Your required rate of return for this stock is 15 percent. The last investment is a common sto with a par value of $25.00 that recently paid a $2.00 dividend per share. The firm's earnings per share have recorded an annual growth rate of 7 percent and are expected t continue this trend indefinitely. The stock is currently selling for $20.00 and you think that a reasonable required rate of return is 20 percent. Required: Given the above information, a. b. Calculate the intrinsic value of each security. Which investment(s) would you buy? Why? Intrinsic value of a. Bond = Pv of coupon payments + PV of maturity face value = PV(130, 15 years, 14%) + PV (1000, 15 years, 14%) = $938 This is lower than the current market price of $1100 b. Preferred stock Intrinsic value = Dividend/Required rate of return = 13/0.15 = $86.67 c. Common stock Intrinsic value = Do*(1+g)/(r-g) =2*(1+0.07)/(0.2-0.07) = $16.46

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started