is this correct so far ? If not can you please help and explain by completeing the answer ?

can you please help and let me know if this is correct so far. If not, please explain and help with the answer.

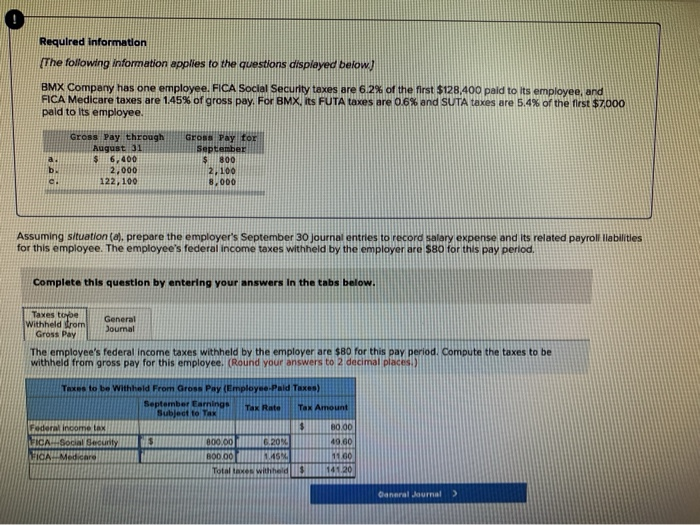

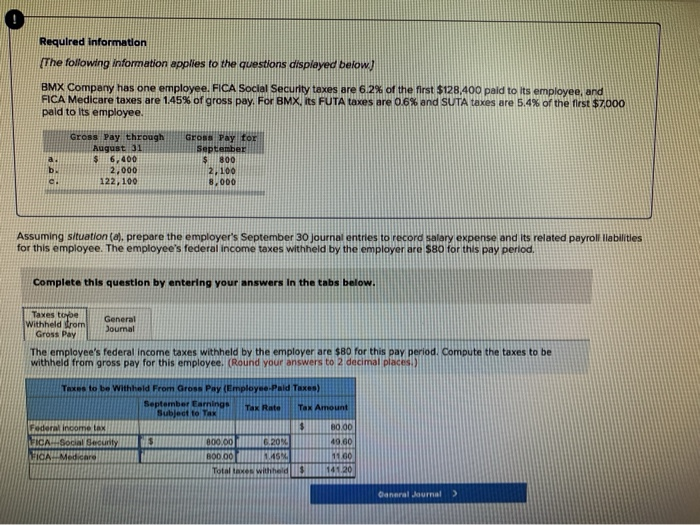

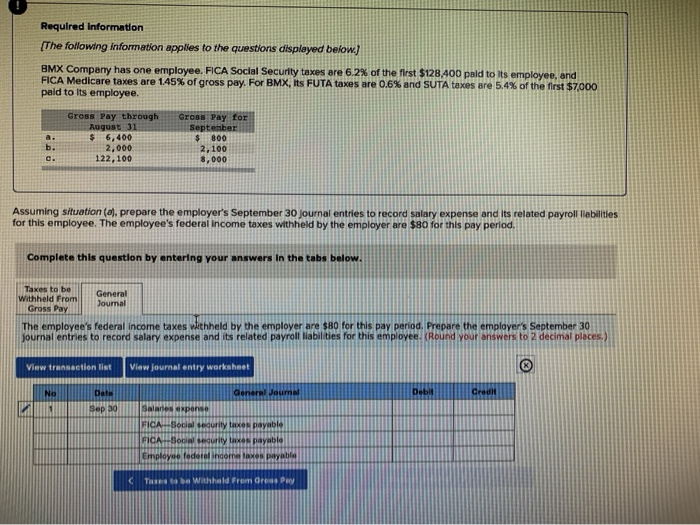

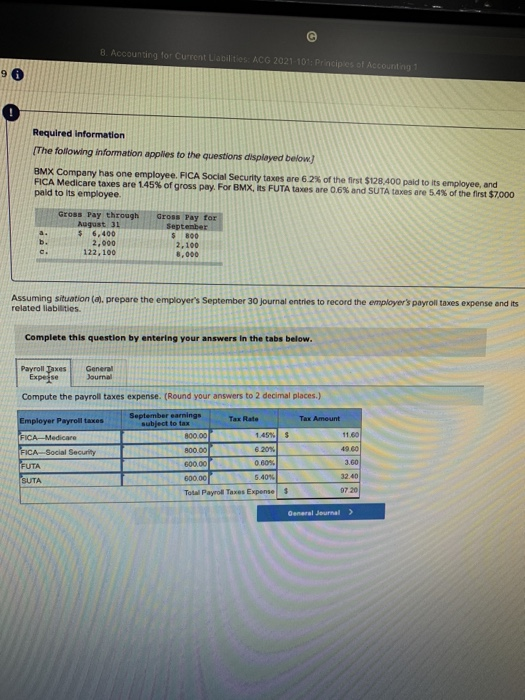

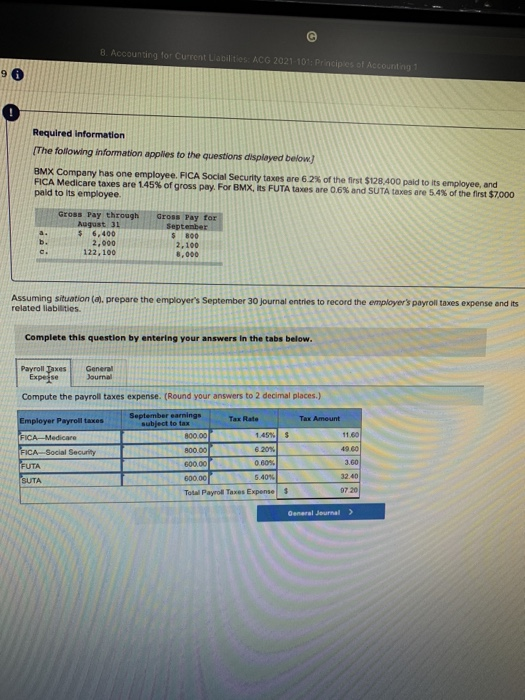

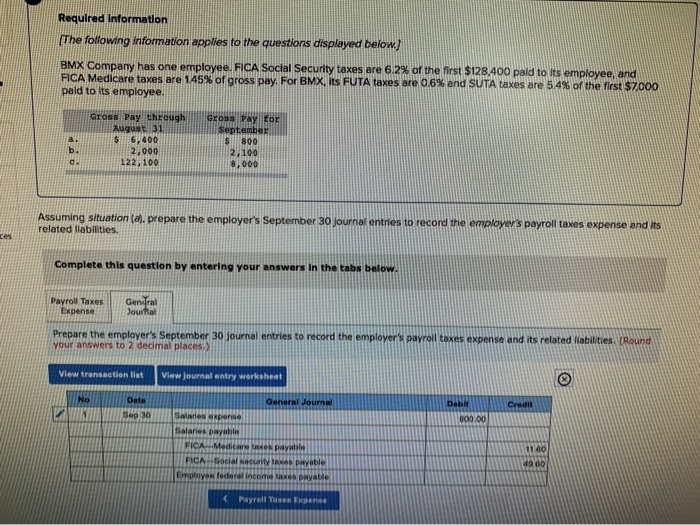

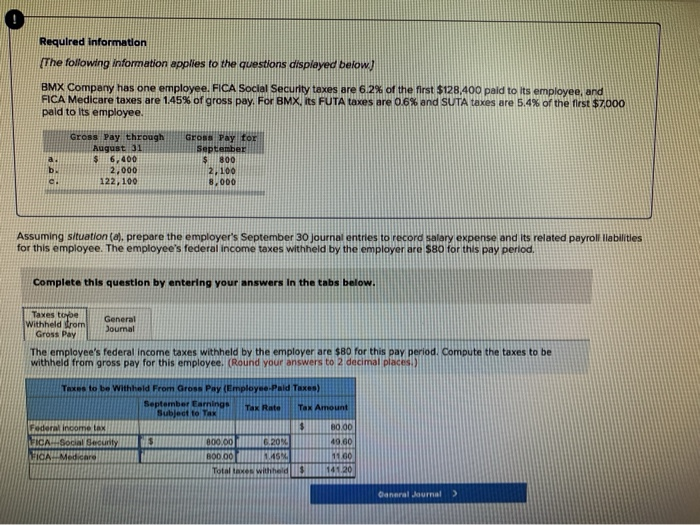

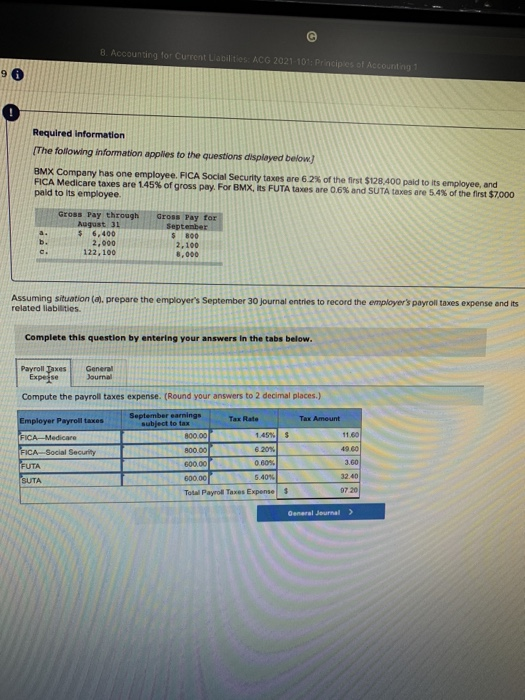

Required information [The following information applies to the questions displayed below) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128.400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 pald to its employee. Gross Pay through August 31 $ 6,400 2,000 122, 100 Gross Pay for September $ 800 2, 100 8,000 Assuming situation (a), prepare the employer's September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. Complete this question by entering your answers in the tabs below. Taxes tybe General Withheld from Journal Gross Pay The employee's federal income taxes withheld by the employer are $80 for this pay period. Compute the taxes to be withheld from gross pay for this employee. (Round your answers to 2 decimal places.) Taxes to be Withheld From Gross Pay (Employee-Pald Taxes) September Earnings Tax Rate Tax Amount Subject to Tak Federal income tax $ B000 FICA Social Security 800.00 6.2014 40.60 Medicare BODO 1.45 11.00 Total taxes with 14120 Oeneral Aurnal > Required Information (The following information applies to the questions displayed below.) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128.400 pald to its employee, and FICA Medicare taxes are 145% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 pald to its employee. a. b. Gross Pay through August 31 $ 6,400 2,000 122,100 Gross Pay for September $ 800 2,100 8,000 Assuming situation (l. prepare the employer's September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. Complete this question by entering your answers in the tabs below. Taxes to be Withheld From General Journal Gross Pay The employee's federal income taxes withheld by the employer are $80 for this pay period. Prepare the employer's September 30 journal entries to record salary expense and its related payroll liabilities for this employee. (Round your answers to 2 decimal places.) View transaction let View journal entry worksheet NO Data General Jouma Debit Credit Sep 30 Salades expono FICA-Social security taxes payable FICA Boca dority tax payable Employee federalnome taxes payable The to be withheld From Ores 8. Accounting for Current LacitiesACG 2021 101: Principles of Accounting 1 9 A Required information (The following information applies to the questions displayed below) BMX Company has one employee, FICA Social Security taxes are 62% of the first $128.400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. a. b. Gross Pay through August 31 $ 6,400 2,000 122, 100 Gross Pay for September $ 800 2,100 8,000 Assuming situation (a), prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related liabilities Complete this question by entering your answers in the tabs below. Payroll Taxes General Expese Journal Compute the payroll taxes expense. (Round your answers to 2 decimal places.) Employer Payroll taxes September earnings Tax Rate Tax Amount subject to tax FICA-Medicare 800.00 1.4545 11.60 800.00 FICA-Social Security 6.2016 4960 FUTA 600.00 0.60% 3.60 SUTA 600.00 5.40% 32.40 Total Payroll Taxes Expenses 9720 General Journal > Required information [The following information applies to the questions displayed below.) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128.400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7.000 paid to its employee. GEOSS Pay through August 31 $ 6,400 2,000 122, 100 Gross Pay for September S800 2,100 8,000 C Assuming situation (a), prepare the employer's September 30 Journal entnes to record the employer's payroll taxes expense and its related liabilities. ces Complete this question by entering your answers in the tabs below. Payroll Taxes Expense Journal Prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related liabilities. (Round your answers to 2 decimal places View transaction let View journal entry worksheet No Dobi Data Sep 30 Credit 800.00 General Journal Salas pense Salaries payable FICA-Medicare te payable FICA Social security taxes payable Employes federal income taxes payable 11.00 4900 Payrell respond