Answered step by step

Verified Expert Solution

Question

1 Approved Answer

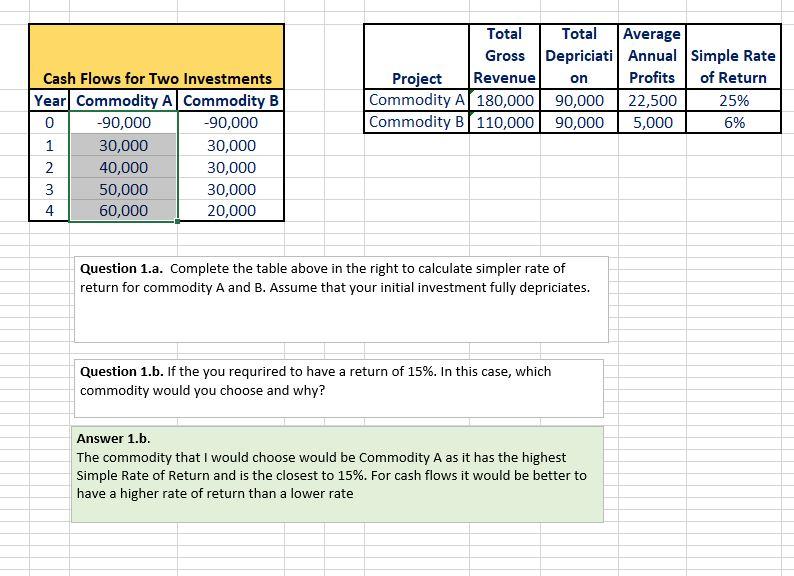

Is this correct ? Total Gross Project Revenue Commodity A 180,000 Commodity B 110,000 Total Average Depriciati Annual Simple Rate Profits of Return 90,000 22,500

Is this correct ?

Total Gross Project Revenue Commodity A 180,000 Commodity B 110,000 Total Average Depriciati Annual Simple Rate Profits of Return 90,000 22,500 25% 90,000 5,000 6% on Cash Flows for Two Investments Year Commodity A Commodity B 0 -90,000 -90,000 1 30,000 30,000 2 40,000 30,000 3 50,000 30,000 4 60,000 20,000 Question 1.a. Complete the table above in the right to calculate simpler rate of return for commodity A and B. Assume that your initial investment fully depriciates. Question 1.b. If the you requrired to have a return of 15%. In this case, which commodity would you choose and why? Answer 1.b. The commodity that I would choose would be commodity A as it has the highest Simple Rate of Return and is the closest to 15%. For cash flows it would be better to have a higher rate of return than a lower rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started