Answered step by step

Verified Expert Solution

Question

1 Approved Answer

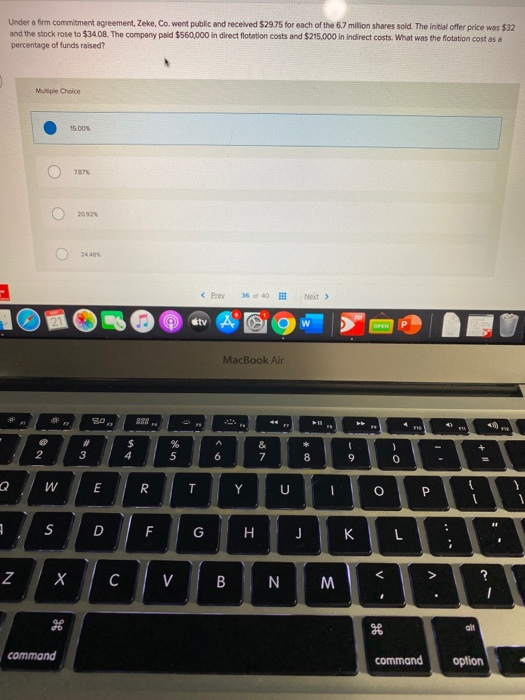

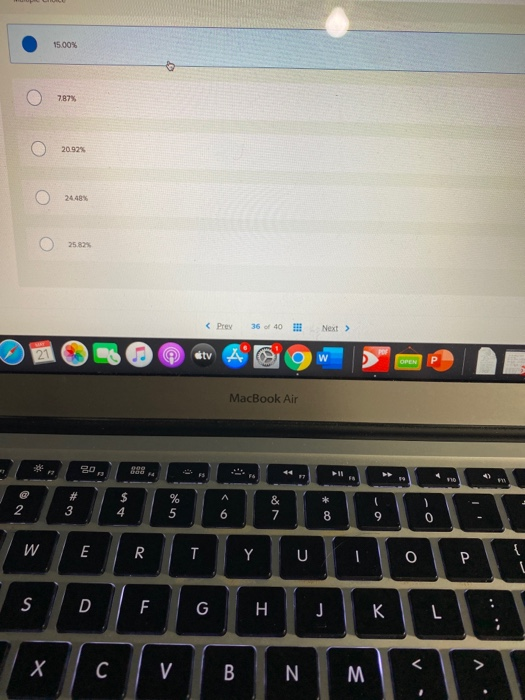

is this correct? Under a firm commitment agreement, Zeke, Co. went public and received $29.75 for each of the 6.7 million shares sold. The initial

is this correct?

Under a firm commitment agreement, Zeke, Co. went public and received $29.75 for each of the 6.7 million shares sold. The initial offer price was $32 and the stock rose to $34.08. The company paid $560,000 in direct flotation costs and $215,000 in Indirect costs. What was the flotation cost as a percentage of funds raised? Multiple Choice 15.00 7873 20.92% Gtv A w OPEN MacBook Air 888 - - $ 4 2 % 5 + 3 & 7 6 8 9 Q A W E R T Y U L S T : D F G J K L : N C V B Z M. . command command option 15.00% 7.87% 20.92% 24 48% 25.82% 21 Odtv w OPEN P MacBook Air 3 ** NE # 3 % 5 4 & 7 6 8 a 0 3 E RT Y U O { P SD F G H J K L C > V B N M v Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started