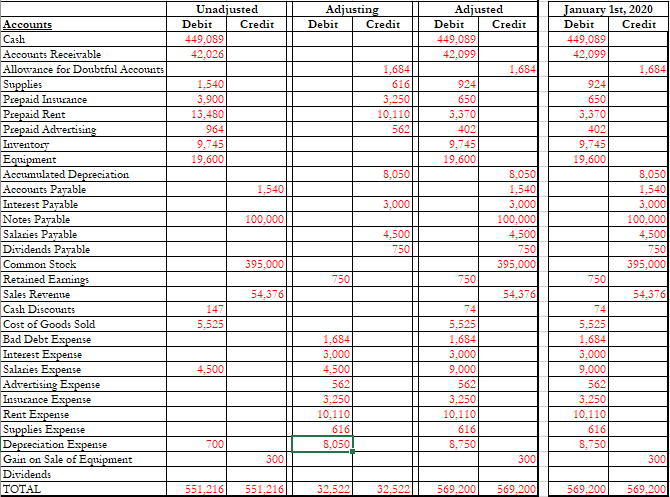

Is this correct?

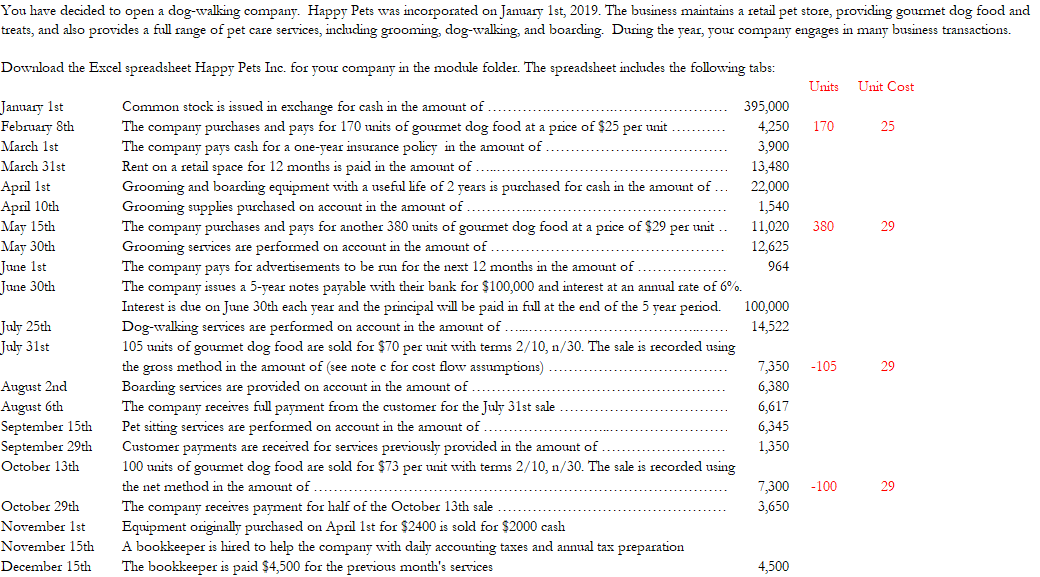

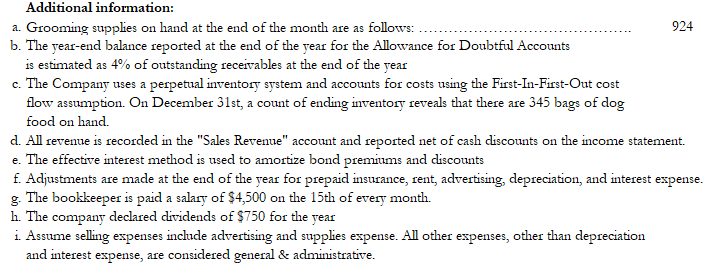

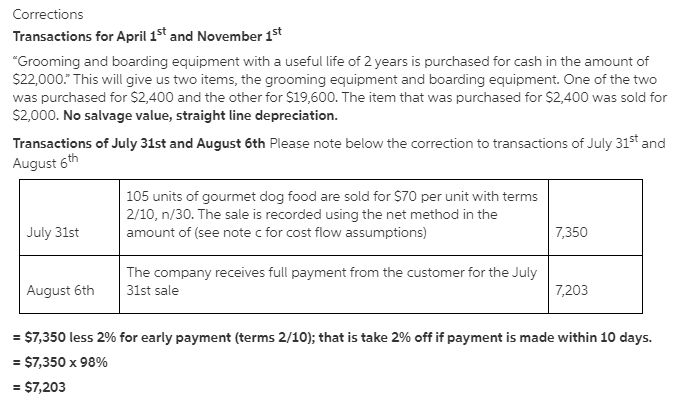

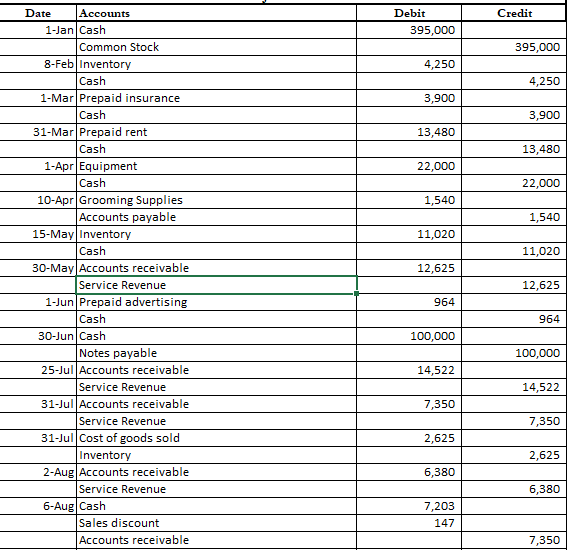

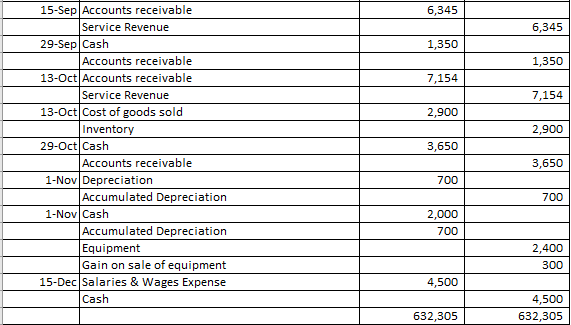

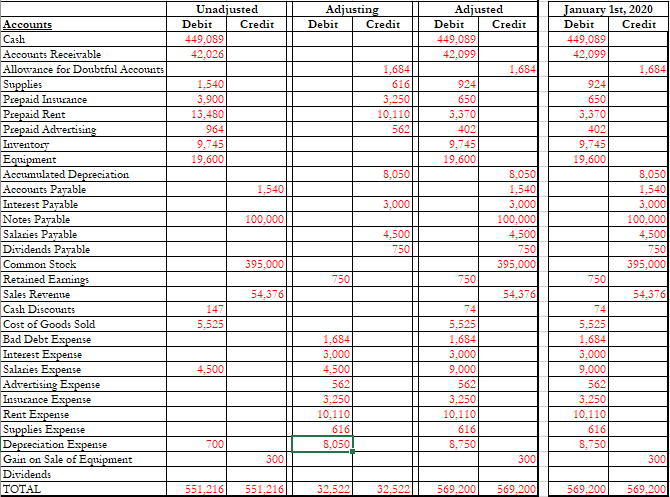

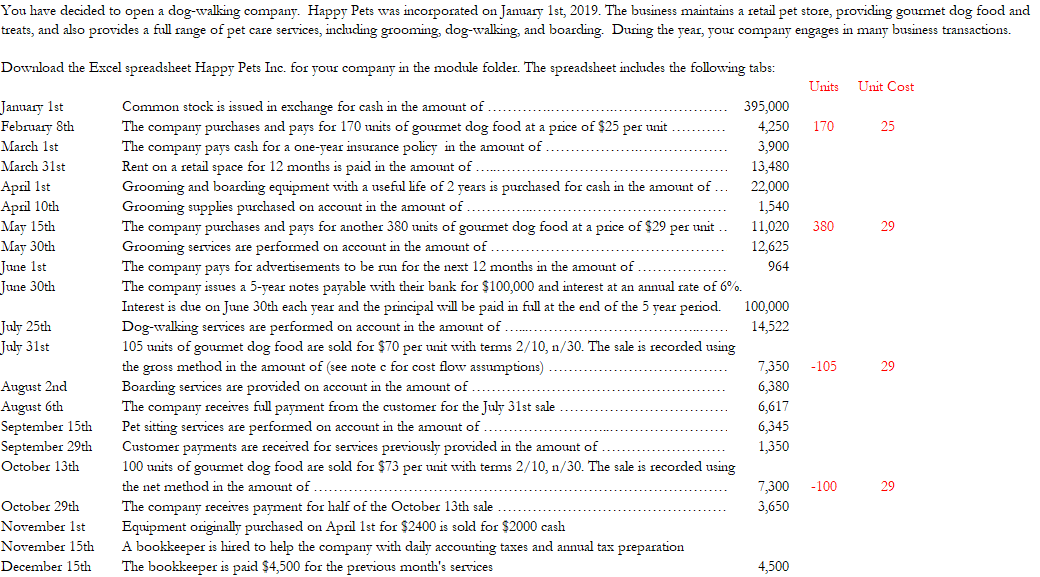

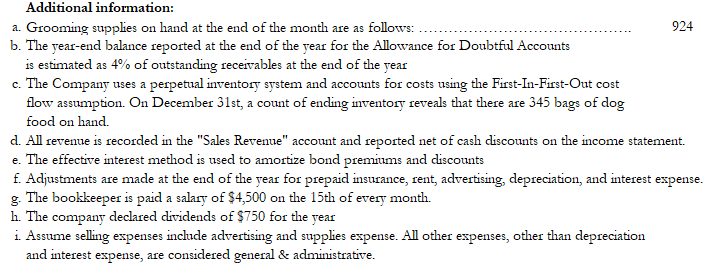

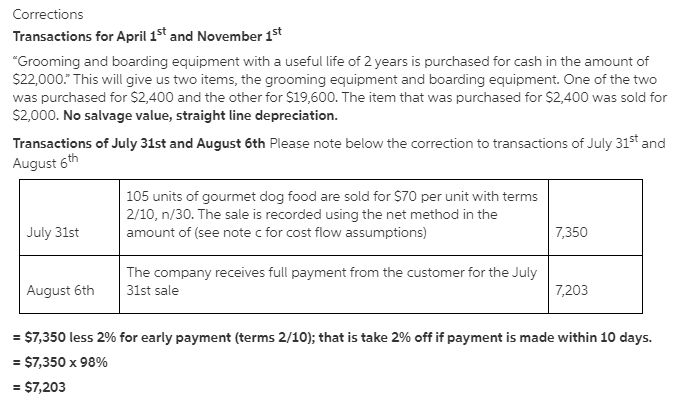

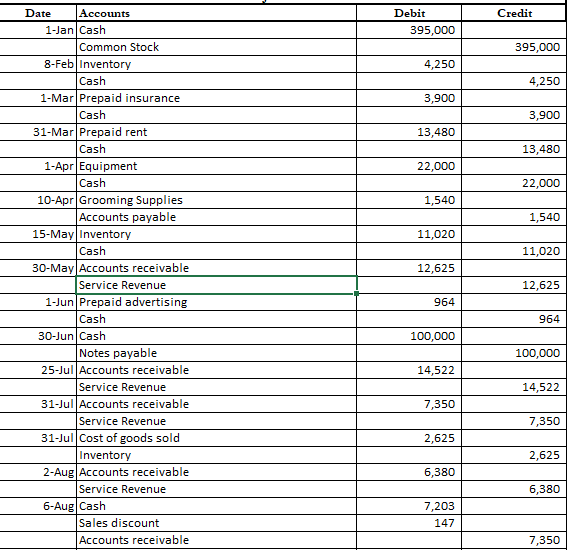

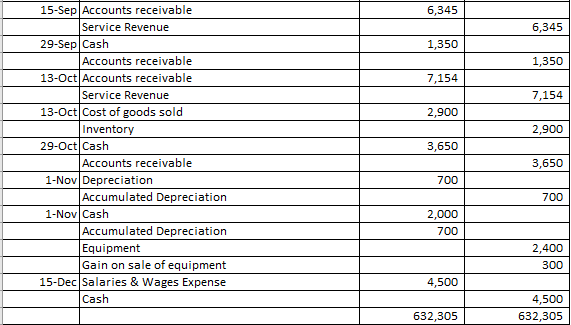

You have decided to open a dog-walking company. Happy Pets was incorporated on January 1st, 2019. The business maintains a retail pet store, providing gourmet dog food and treats, and also provides a full range of pet care services, including grooming, dog-walking, and boarding. During the year, your company engages in many business transactions. Download the Excel spreadsheet Happy Pets Inc. for your company in the module folder. The spreadsheet includes the following tabs: Units Unit Cost ......... 170 2 5 January 1st February 8th March 1st March 31st April 1st April 10th May 15th May 30th June 1st June 30th 380 29 July 25th July 31st Common stock is issued in exchange for cash in the amount of 395,000 The company purchases and pays for 170 units of gourmet dog food at a price of $25 per unit ........... 4,250 The company pays cash for a one-year insurance policy in the amount of ............ .......... 3,900 Rent on a retail space for 12 months is paid in the amount of ....... 13,480 Grooming and boarding equipment with a useful life of 2 years is purchased for cash in the amount of ... 22,000 Grooming supplies purchased on account in the amount of ...... 1,540 The company purchases and pays for another 380 units of gourmet dog food at a price of $29 per unit 11,020 Grooming services are performed on account in the amount of 12,625 The company pays for advertisements to be run for the next 12 months in the amount of ............... 964 The company issues a 5-year notes payable with their bank for $100,000 and interest at an annual rate of 6%. Interest is due on June 30th each year and the principal will be paid in full at the end of the 5 year period 100,000 Dog-walking services are performed on account in the amount of .................. ............. 14,522 105 units of gourmet dog food are sold for $70 per unit with terms 2/10, n/30. The sale is recorded using the gross method in the amount of (see note c for cost flow assumptions) ...... 7,350 Boarding services are provided on account in the amount of ........................ 6,380 The company receives full payment from the customer for the July 31st sale ........ 6,617 Pet sitting services are performed on account in the amount of 6,345 Customer payments are received for services previously provided in the amount of ............ 1,350 100 units of gourmet dog food are sold for $73 per unit with terms 2/10, n/30. The sale is recorded using the net method in the amount of ..... 7,300 The company receives payment for half of the October 13th sale .............. 3,650 Equipment originally purchased on April 1st for $2400 is sold for $2000 cash A bookkeeper is hired to help the company with daily accounting taxes and annual tax preparation The bookkeeper is paid $4,500 for the previous month's services 4,500 .......... -105 2 9 August 2nd August 6th September 15th September 29th October 13th -100 29 October 29th November 1st November 15th December 15th Additional information: a. Grooming supplies on hand at the end of the month are as follows: ..... ..................... 924 b. The year-end balance reported at the end of the year for the Allowance for Doubtful Accounts is estimated as 4% of outstanding receivables at the end of the year c. The Company uses a perpetual inventory system and accounts for costs using the First-In-First-Out cost flow assumption. On December 31st, a count of ending inventory reveals that there are 345 bags of dog food on hand d. All revenue is recorded in the "Sales Revenue" account and reported net of cash discounts on the income statement. e. The effective interest method is used to amortize bond premiums and discounts f. Adjustments are made at the end of the year for prepaid insurance, rent, advertising, depreciation, and interest expense. g. The bookkeeper is paid a salary of $4,500 on the 15th of every month. h. The company declared dividends of $750 for the year i. Assume selling expenses include advertising and supplies expense. All other expenses, other than depreciation and interest expense, are considered general & administrative. Corrections Transactions for April 1st and November 1st "Grooming and boarding equipment with a useful life of 2 years is purchased for cash in the amount of $22,000." This will give us two items, the grooming equipment and boarding equipment. One of the two was purchased for $2,400 and the other for $19,600. The item that was purchased for $2,400 was sold for $2,000. No salvage value, straight line depreciation. Transactions of July 31st and August 6th Please note below the correction to transactions of July 31st and August 6th 105 units of gourmet dog food are sold for $70 per unit with terms 2/10, n/30. The sale is recorded using the net method in the amount of (see note c for cost flow assumptions) July 31st 7,350 August 6th The company receives full payment from the customer for the July 31st sale 7,203 = $7,350 less 2% for early payment (terms 2/10); that is take 2% off if payment is made within 10 days. = $7,350 x 98% = $7,203 Credit Debit 395,000 395,000 4,250 4,250 3,900 3,900 13,480 13,480 22,000 22,000 1,540 1,540 11,020 | 11,020 12,625 Date Accounts 1-Jan Cash Common Stock 8-Feb Inventory Cash 1-Mar Prepaid insurance Cash 31-Mar Prepaid rent I Cash 1-Apr Equipment Cash 10-Apr Grooming Supplies Accounts payable 15-May Inventory Cash 30-May Accounts receivable Service Revenue 1-Jun Prepaid advertising Cash 30-Jun Cash Notes payable 25-Jul Accounts receivable Service Revenue 31-Jul Accounts receivable Service Revenue 31-Jul Cost of goods sold Inventory 2-Aug Accounts receivable Service Revenue 6-Aug Cash Sales discount Accounts receivable 12,625 964 964 100,000 100,000 1 14,522 | 14,522 7,350 7,350 2,625 2,625 6,380 6,380 7,203 147 7,350 6,345 6,345 1,350 1,350 7,154 7,154 2,900 2,900 15-Sep Accounts receivable Service Revenue 29-Sep Cash Accounts receivable 13-Oct Accounts receivable Service Revenue 13-OctCost of goods sold Inventory 29-OctCash Accounts receivable 1-Nov Depreciation Accumulated Depreciation 1-Nov Cash Accumulated Depreciation Equipment Gain on sale of equipment 15-Dec Salaries & Wages Expense Cash 3,650 3,650 700 700 2,000 700 2,400 300 4,500 4,500 632,305 632,305 Adjusting Debit Credit | Unadjusted Debit Credit | 449,089 42.026 Adjusted Debit Credit 449,089 42,099 1,684 6161 3.2501 10.110|| 1,540 3.900 13,480 964 9.745 19.600 924 650 3,3701 402 9,745 19,600 5621 January 1st, 2020 Debit Credit 449,089 42,099 1.6841 924 650 3.3701 4021 9,745 19.600 8.0501 1,540 3,000 100,000 4.500 7501 395.000 8,050|| 1.540 3,000 8.050 1,5401 3,000 100.000 4,500 100,000|| 4.500|| 750|| Accounts Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Insurance Prepaid Rent Prepaid Advertising Inventory Equipment Accumulated Depreciation Accounts Payable Interest Payable Notes Payable Salaries Payable Dividends Payable Common Stock Retained Earnings Sales Revenue Cash Discounts Cost of Goods Sold Bad Debt Espense Interest Expense Salaries Expense Advertising Expense Insurance Expense Rent Expense Supplies Expense Depreciation Expense Gain on Sale of Equipment Dividends TOTAL 750 395.000|| 395.0001 75 750 501 54,376|| 54.376 54,376 5.525 4.500 1.684 3,000 4.500 5621 3.250 10.1101 6161 8,0501 5,525 1.6841 3,000 9.000 5621 3.2501 10.110 6161 8.750 5,525 1,684 3,000 9,000 562 3.250 10.1101 6161 8.750 700 1 300|| 300 3001 551.216 551.2160 32.522 32.522 569.200 569.200 569.200 569.200