is this solution right please explain it more and show me how to solve it the easitest way

Lin Lid constructed a machine at a total cost of $35 million. Construction was completearnett en the machine was placed in service at the beginning of 2009. The machine was being depreciated over a 10-year life using the double-declining-balance method. An annual rate of 20% is applied under the double-declining. balance method. The residual value is expected to be $2 million. At the beginning of 2012, Lin decided to change to the straight-line method. Ignoring income taxes, what joural entry(s) should Lin record relating to the machine for 2012?

Refer to the situation described in BE 20-4. Suppose Lin has been using the straight-line method and switches to the double-declining-balance method. An annual rate of 20% is to be applied under the new method. Ignoring income taxes, what journal entry(s) should Lin record relating to the machine for 2012?

check if this anwser is right or wrong

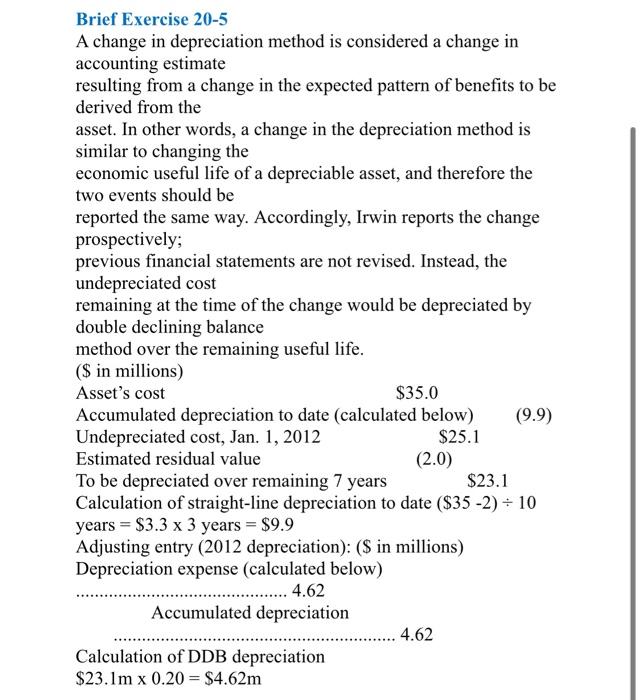

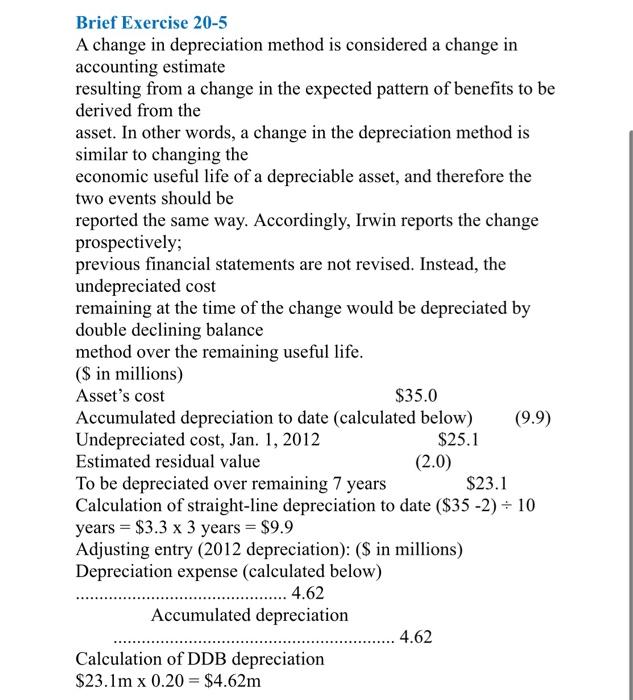

makhine for 2012? Brief Exercise 20-5 A change in depreciation method is considered a change in accounting estimate resulting from a change in the expected pattern of benefits to be derived from the asset. In other words, a change in the depreciation method is similar to changing the economic useful life of a depreciable asset, and therefore the two events should be reported the same way. Accordingly, Irwin reports the change prospectively; previous financial statements are not revised. Instead, the undepreciated cost remaining at the time of the change would be depreciated by double declining balance method over the remaining useful life. ( $ in millions) Asset's cost $35.0 Accumulated depreciation to date (calculated below) (9.9) Undepreciated cost, Jan. 1, 2012$25.1 Estimated residual value (2.0) To be depreciated over remaining 7 years $23.1 Calculation of straight-line depreciation to date ($352)10 years =$3.33 years =$9.9 Adjusting entry (2012 depreciation): ( $ in millions) Depreciation expense (calculated below) Accumulated depreciation 4.62 Calculation of DDB depreciation $23.1m0.20=$4.62m Brief Exercise 20-5 A change in depreciation method is considered a change in accounting estimate resulting from a change in the expected pattern of benefits to be derived from the asset. In other words, a change in the depreciation method is similar to changing the economic useful life of a depreciable asset, and therefore the two events should be reported the same way. Accordingly, Irwin reports the change prospectively; previous financial statements are not revised. Instead, the undepreciated cost remaining at the time of the change would be depreciated by double declining balance method over the remaining useful life. ( $ in millions) Asset's cost $35.0 Accumulated depreciation to date (calculated below) (9.9) Undepreciated cost, Jan. 1, 2012$25.1 Estimated residual value (2.0) To be depreciated over remaining 7 years $23.1 Calculation of straight-line depreciation to date ($352)10 years =$3.33 years =$9.9 Adjusting entry (2012 depreciation): (\$ in millions) Depreciation expense (calculated below) 4.62 Accumulated depreciation 4.62 Calculation of DDB depreciation $23.1m0.20=$4.62m makhine for 2012? Brief Exercise 20-5 A change in depreciation method is considered a change in accounting estimate resulting from a change in the expected pattern of benefits to be derived from the asset. In other words, a change in the depreciation method is similar to changing the economic useful life of a depreciable asset, and therefore the two events should be reported the same way. Accordingly, Irwin reports the change prospectively; previous financial statements are not revised. Instead, the undepreciated cost remaining at the time of the change would be depreciated by double declining balance method over the remaining useful life. ( $ in millions) Asset's cost $35.0 Accumulated depreciation to date (calculated below) (9.9) Undepreciated cost, Jan. 1, 2012$25.1 Estimated residual value (2.0) To be depreciated over remaining 7 years $23.1 Calculation of straight-line depreciation to date ($352)10 years =$3.33 years =$9.9 Adjusting entry (2012 depreciation): ( $ in millions) Depreciation expense (calculated below) Accumulated depreciation 4.62 Calculation of DDB depreciation $23.1m0.20=$4.62m Brief Exercise 20-5 A change in depreciation method is considered a change in accounting estimate resulting from a change in the expected pattern of benefits to be derived from the asset. In other words, a change in the depreciation method is similar to changing the economic useful life of a depreciable asset, and therefore the two events should be reported the same way. Accordingly, Irwin reports the change prospectively; previous financial statements are not revised. Instead, the undepreciated cost remaining at the time of the change would be depreciated by double declining balance method over the remaining useful life. ( $ in millions) Asset's cost $35.0 Accumulated depreciation to date (calculated below) (9.9) Undepreciated cost, Jan. 1, 2012$25.1 Estimated residual value (2.0) To be depreciated over remaining 7 years $23.1 Calculation of straight-line depreciation to date ($352)10 years =$3.33 years =$9.9 Adjusting entry (2012 depreciation): (\$ in millions) Depreciation expense (calculated below) 4.62 Accumulated depreciation 4.62 Calculation of DDB depreciation $23.1m0.20=$4.62m