Answered step by step

Verified Expert Solution

Question

1 Approved Answer

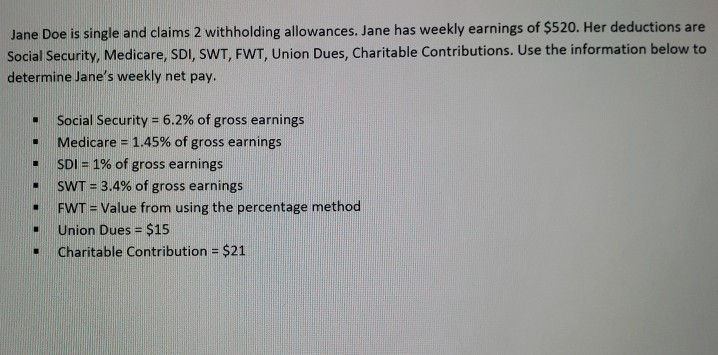

Is Weekly Jane Doe is single and claims 2 withholding allowances. Jane has weekly earnings of $520. Her deductions are Social Security, Medicare, SDI, SWT,

Is Weekly

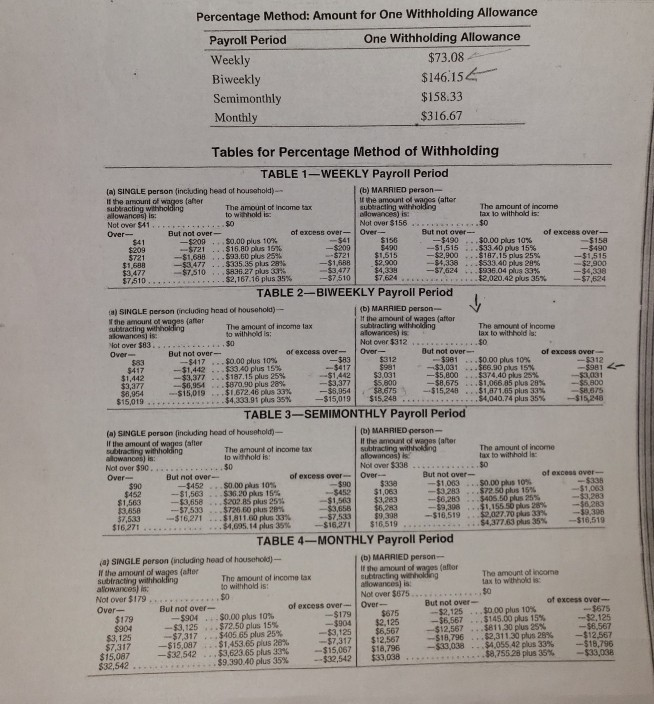

Jane Doe is single and claims 2 withholding allowances. Jane has weekly earnings of $520. Her deductions are Social Security, Medicare, SDI, SWT, FWT, Union Dues, Charitable Contributions. Use the information below to determine Jane's weekly net pay. . . Social Security = 6.2% of gross earnings Medicare = 1.45% of gross earnings SDI = 1% of gross earnings SWT = 3.4% of gross earnings FWT = Value from using the percentage method Union Dues = $15 Charitable Contribution = $21 . Percentage Method: Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly $73.08 Biweekly $146.154 Semimonthly $158.33 Monthly $316.67 SET -$209 V Over Over -$417 $6.954 $15.248. Tables for Percentage Method of Withholding TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after ut the amount of wages (atter subtracting withholding The amount of income tax subtracting withholding allowanons) is: The amount of income to withholdis: allowances) is: tax lo withhold is: Not over $11 $0 Not over $156 ... $0 Over- But not over of excess over Over- But not over- of excess over- $0.00 plus 10% -$41 $156 -$490 ... $0.00 plus 10% $209 -$721 $15.80 plus 157 -$200 $15a $490 --$1,515 ...$33.40 plus 15% -$490 5721 -$1,688 $93.00 plus 25% --$721 $1,515 -$2,900 ... $187.15 plus 25% $1.588 -53.477 $335.35 plus 28% $1,688 $2.900 -$4.338 -$1,515 $533.40 plus 20% $2.900 $3.477 -$7.510 $936.27 plus 3.3% $3,477 $4,338 -$7,624 $936.04 plus 33% $7510 $2,167.16 plus 35% -$4,338 ---$7510 $2,020.42 plus 36% $7,624 TABLE 2-BIWEEKLY Payroll Period a) SINGLE person including head of household) - (b) MARRIED person the amount of wages after If the amount of wages (after subtracting withholding The amount of income tax subtracting with holding The amount of Income alowance is to withhold is alowances) is lax to withholdis: Not over $63. $0 Not over $312. But not over- or excess over- But not over of exDOS Over --$417 $0.00 plus 10% -383 $312 -$981 $0.00 plus 10% $417 -$1,442 $33.40 plus 15% $981 -- $312 -$3,031 - $981 $1,442 $66.90 plus 15% -$3,377 ... $187.15 plus 25% -$1,442 $3,031 -$5,800 $374.40 plus 23% -1031 $3,877 -$6,054 $870,90 plus 28% -$3,377 $5.800 -$8.575 $1,066 85 plus 28% -$5.800 $15,019 $1.672.48 plus 33% -$8.954 $8.675 -$15,240 $1,871,65 plus 33% $8.875 $15,019 $4.333.91 plus 35% ---$15,019 $4,040.74 plus 35% --$15,248 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household)- () MARRIED person- If the amount of wages (alter If the amount of wages falter subtracting withholding The amount of income tax Subtracting withholding The amount of income allowances) is: Io withhold is allowances) is tax to withhold i Not over $90... ...30 Nol over $336 $0 Over- But not over- of excess over Over- But not over- of excess over $90 $0.00 plus 10% $90 $330 -$1.053 50.00 plus 10% -$335 $452 -$1,563 $36.20 pks 15% $1,063 -$3.283 $72.50 plus 15% -$1,063 $1,563 -$3,658 $202.85 plus 255 $1,563 $3,283 -$6.283 $405.50 plus 25% $3,283 33,650 -57,533 $726.60 plus 28% $3,658 $6,283 -$9,308 $1.155 50 plus 28% $6283 37,533 -$16.271 $1,811.60 plus 33% - $7,500 $9,308 -$16,519 $9.027.70 plus 33% $9.308 $16.271 $4,695.14 plus 35 -$16,271 ...$4,377.63 plus 35% ---$16,519 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- If the amount of wages (alter If the amount of ways after Subtracting withholding The amount of income tax subtracting wholding The amount of income allowances) is to withhold is: allowances) is tax to withhold i Not over $179 $0 Not over $675 $0 But not over- Over- of excess over- Over- But not over- of excess over -$904 ... $0.00 plus 10% $675 -$179 $179 -$2,125 -$675 $0.00 plus 10% $904 -$904 -$3,125 .. $72,50 plus 15% -$2,125 $2,125 -$6,567 .. $145.00 plus 15% -$7,317 $3,125 $405 65 plus 25% -$3,125 $6,567 -$12,567 $811.30 plus 25% -$8,567 $2,311.30 plus 28% $7,317 -$12,567 -$7,317 -$15,087 -$18,796 $1,453.65 plus 28% $4,055.42 plus 33% -$15,067 $15,087 -$32,542 $18,796 -$33,038 -$18,796 $3,623.65 plus 33% $8,755.28 plus 35% $30,038 --$32,542 -$33,038 $9.390.40 plus 35% $32,542 $16.519 ... $12.567 Jane Doe is single and claims 2 withholding allowances. Jane has weekly earnings of $520. Her deductions are Social Security, Medicare, SDI, SWT, FWT, Union Dues, Charitable Contributions. Use the information below to determine Jane's weekly net pay. . . Social Security = 6.2% of gross earnings Medicare = 1.45% of gross earnings SDI = 1% of gross earnings SWT = 3.4% of gross earnings FWT = Value from using the percentage method Union Dues = $15 Charitable Contribution = $21 . Percentage Method: Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly $73.08 Biweekly $146.154 Semimonthly $158.33 Monthly $316.67 SET -$209 V Over Over -$417 $6.954 $15.248. Tables for Percentage Method of Withholding TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after ut the amount of wages (atter subtracting withholding The amount of income tax subtracting withholding allowanons) is: The amount of income to withholdis: allowances) is: tax lo withhold is: Not over $11 $0 Not over $156 ... $0 Over- But not over of excess over Over- But not over- of excess over- $0.00 plus 10% -$41 $156 -$490 ... $0.00 plus 10% $209 -$721 $15.80 plus 157 -$200 $15a $490 --$1,515 ...$33.40 plus 15% -$490 5721 -$1,688 $93.00 plus 25% --$721 $1,515 -$2,900 ... $187.15 plus 25% $1.588 -53.477 $335.35 plus 28% $1,688 $2.900 -$4.338 -$1,515 $533.40 plus 20% $2.900 $3.477 -$7.510 $936.27 plus 3.3% $3,477 $4,338 -$7,624 $936.04 plus 33% $7510 $2,167.16 plus 35% -$4,338 ---$7510 $2,020.42 plus 36% $7,624 TABLE 2-BIWEEKLY Payroll Period a) SINGLE person including head of household) - (b) MARRIED person the amount of wages after If the amount of wages (after subtracting withholding The amount of income tax subtracting with holding The amount of Income alowance is to withhold is alowances) is lax to withholdis: Not over $63. $0 Not over $312. But not over- or excess over- But not over of exDOS Over --$417 $0.00 plus 10% -383 $312 -$981 $0.00 plus 10% $417 -$1,442 $33.40 plus 15% $981 -- $312 -$3,031 - $981 $1,442 $66.90 plus 15% -$3,377 ... $187.15 plus 25% -$1,442 $3,031 -$5,800 $374.40 plus 23% -1031 $3,877 -$6,054 $870,90 plus 28% -$3,377 $5.800 -$8.575 $1,066 85 plus 28% -$5.800 $15,019 $1.672.48 plus 33% -$8.954 $8.675 -$15,240 $1,871,65 plus 33% $8.875 $15,019 $4.333.91 plus 35% ---$15,019 $4,040.74 plus 35% --$15,248 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household)- () MARRIED person- If the amount of wages (alter If the amount of wages falter subtracting withholding The amount of income tax Subtracting withholding The amount of income allowances) is: Io withhold is allowances) is tax to withhold i Not over $90... ...30 Nol over $336 $0 Over- But not over- of excess over Over- But not over- of excess over $90 $0.00 plus 10% $90 $330 -$1.053 50.00 plus 10% -$335 $452 -$1,563 $36.20 pks 15% $1,063 -$3.283 $72.50 plus 15% -$1,063 $1,563 -$3,658 $202.85 plus 255 $1,563 $3,283 -$6.283 $405.50 plus 25% $3,283 33,650 -57,533 $726.60 plus 28% $3,658 $6,283 -$9,308 $1.155 50 plus 28% $6283 37,533 -$16.271 $1,811.60 plus 33% - $7,500 $9,308 -$16,519 $9.027.70 plus 33% $9.308 $16.271 $4,695.14 plus 35 -$16,271 ...$4,377.63 plus 35% ---$16,519 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- If the amount of wages (alter If the amount of ways after Subtracting withholding The amount of income tax subtracting wholding The amount of income allowances) is to withhold is: allowances) is tax to withhold i Not over $179 $0 Not over $675 $0 But not over- Over- of excess over- Over- But not over- of excess over -$904 ... $0.00 plus 10% $675 -$179 $179 -$2,125 -$675 $0.00 plus 10% $904 -$904 -$3,125 .. $72,50 plus 15% -$2,125 $2,125 -$6,567 .. $145.00 plus 15% -$7,317 $3,125 $405 65 plus 25% -$3,125 $6,567 -$12,567 $811.30 plus 25% -$8,567 $2,311.30 plus 28% $7,317 -$12,567 -$7,317 -$15,087 -$18,796 $1,453.65 plus 28% $4,055.42 plus 33% -$15,067 $15,087 -$32,542 $18,796 -$33,038 -$18,796 $3,623.65 plus 33% $8,755.28 plus 35% $30,038 --$32,542 -$33,038 $9.390.40 plus 35% $32,542 $16.519 ... $12.567Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started