Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Isaac Mayat is a 38-year-old South African resident. The following provisional tax information relates to him: . . His assessment was received on 1

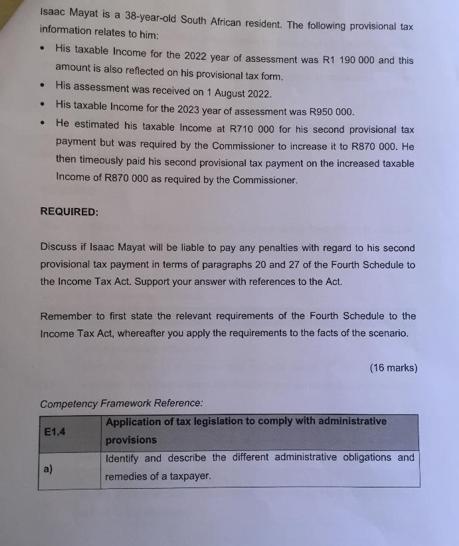

Isaac Mayat is a 38-year-old South African resident. The following provisional tax information relates to him: . . His assessment was received on 1 August 2022. His taxable Income for the 2023 year of assessment was R950 000. He estimated his taxable Income at R710 000 for his second provisional tax payment but was required by the Commissioner to increase it to R870 000. He then timeously paid his second provisional tax payment on the increased taxable Income of R870 000 as required by the Commissioner. . . His taxable Income for the 2022 year of assessment was R1 190 000 and this amount is also reflected on his provisional tax form. REQUIRED: Discuss if Isaac Mayat will be liable to pay any penalties with regard to his second provisional tax payment in terms of paragraphs 20 and 27 of the Fourth Schedule to the Income Tax Act. Support your answer with references to the Act. Remember to first state the relevant requirements of the Fourth Schedule to the Income Tax Act, whereafter you apply the requirements to the facts of the scenario. Competency Framework Reference: E1.4 a) (16 marks) Application of tax legislation to comply with administrative provisions Identify and describe the different administrative obligations and remedies of a taxpayer.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Paragraphs 20 and 27 of the Fourth Schedule to the Income Tax Act in South Africa outline the administrative obligations and penalties for provisional taxpayers Paragraph 20 of the Fourth Schedule sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started