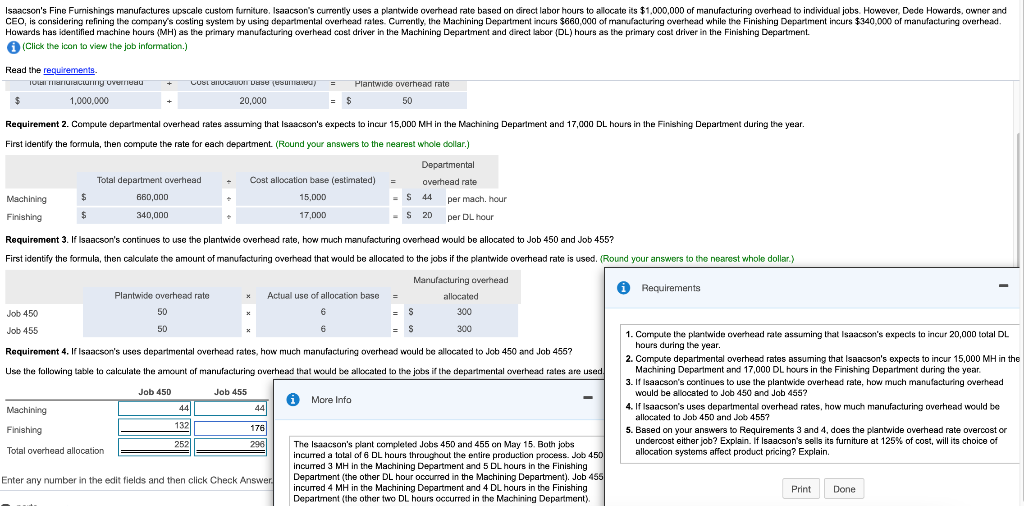

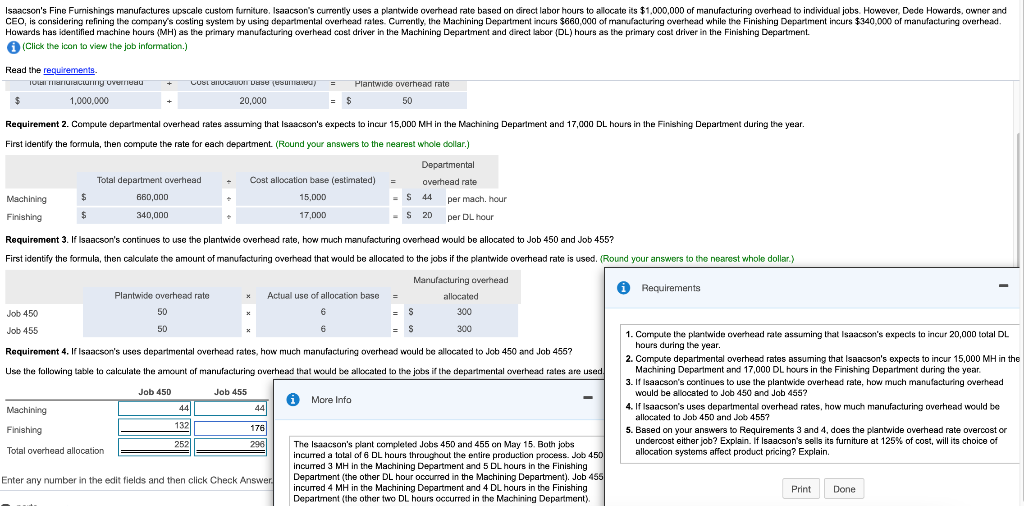

Isaacson's Fine Furnishings manufactures upscale custom furniture, Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,000,000 of manufacturing overhead to individual jobs. However, Dede Howards, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $660,000 of manufacturing overhead while the Finishing Department incurs $340,000 of manufacturing overhead. Howards has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department. (Click the icon to view the job information.) Read the requirements. TOLTHUIScry uvereau $ 1,000,000 Plantwide overhead rate LOSLUSION Dase (esume) 20,000 = $ 50 Requirement 2. Compute departmental overhead rates assuring that Isaacson's expects to incur 15,000 MH in the Machining Department and 17,000 DL hours in the Finishing Department during the year. First identify the formula, then compute the rate for each department. (Round your answers to the nearest whole dollar.) Total department overhead 660,000 $ Machining Finishing + Departmental overhead rate = S 44 per mach. hour - S 2D per DL hour Cost allocation base (estimated) 15,000 17,000 $ 340,000 x Requirement 3. If Isaacson's continues to use the plantwide overhead rate, how much manufacturing overhead would be allocated to Job 450 and Job 455? First identify the formula, then calculate the amount of manufacturing overhead that would be allocated to the jobs if the plantwide overhead rate is used. (Round your answers to the nearest whole dollar.) Manufacturing overhead Plantwide overhead rate Requirements Actual use of allocation base = allocated Job 450 50 6 = S 300 Job 455 50 6 = $ 300 1. Compute the plantwide overhead rate assuming that Isaacson's expects to incur 20,000 total DL Requirement 4. If Isaacson's uses departmental overhead rates, how much manufacturing overhead would be allocated to Job 450 and Job 455? hours during the year. 2. Compute departmental overhead rates assuming that Isaacson's expects to incur 15,000 MH in the Use the following table to calculate the amount of manufacturing overhead that would be allocated to the jobs if the departmental overhead rates are used. Machining Department and 17,000 DL hours in the Finishing Department during the year. 3. If Isaacson's continues to use the plantwide overhead rate, how much manufacturing overhead Job 450 Job 455 More Info would be allocated to Job 450 and Job 455? Machining 44 44 4. If Isaacson's uses departmental overhead rates, how much manufacturing overhead would be 132 allocated to Job 450 and Job 4557 Finishing 176 5. Based on your answers to Requirements 3 and 4, does the plantwide overhead rate overcostor 2521 296 The Isaacson's plant completed Jobs 450 and 455 on May 15. Both jobs undercost either job? Explain. If Isaacson's sells its furniture at 125% of cost, will its choice of Total overhead allocation incurred a total of 6 DL hours throughout the entire production process. Job 450 allocation systems affect product pricing? Explain. incurred 3 MH in the Machining Department and 5 DL hours in the Finishing Enter any number in the edit fields and then click Check Answer. Department (the other DL hour occurred in the Machining Department). Job 455 incurred 4 MH in the Machining Department and 4 DL hours in the Finishing Print Done Department (the other two DL hours occurred in the Machining Department)