Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Isaiah exercised a nonstatutory stock option and purchased shares of his company's stock on October 31, 2018. He purchased the shares for less than

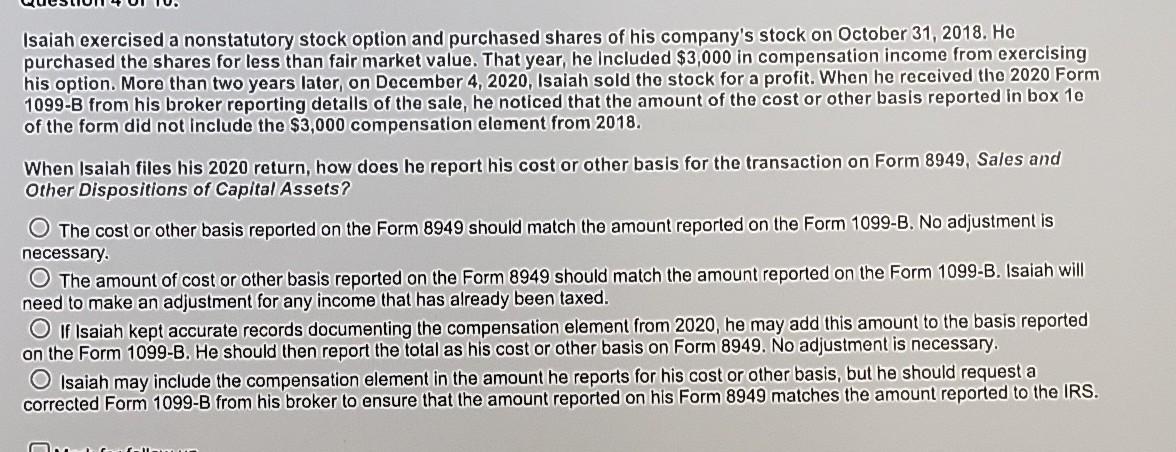

Isaiah exercised a nonstatutory stock option and purchased shares of his company's stock on October 31, 2018. He purchased the shares for less than fair market value. That year, he Included $3,000 in compensation income from exercising his option. More than two years later, on December 4, 2020, Isalah sold the stock for a profit. When he received the 2020 Form 1099-B from his broker reporting detalls of the sale, he noticed that the amount of the cost or other basis reported in box 1e of the form did not include the $3,000 compensation element from 2018. When Isalah files his 2020 return, how does he report his cost or other basis for the transaction on Form 8949, Sales and Other Dispositions of Capital Assets? O The cost or other basis reported on the Form 8949 should match the amount reported on the Form 1099-B. No adjustment is necessary. O The amount of cost or other basis reported on the Form 8949 should match the amount reported on the Form 1099-B. Isaiah will need to make an adjustment for any income that has already been taxed. O If Isaiah kept accurate records documenting the compensation element from 2020, he may add this amount to the basis reported on the Form 1099-B. He should then report the total as his cost or other basis on Form 8949. No adjustment is necessary. O Isaiah may include the compensation element in the amount he reports for his cost or other basis, but he should request a corrected Form 1099-B from his broker to ensure that the amount reported on his Form 8949 matches the amount reported to the IRS.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Isaiah exercised a nonstatutory stock option and purchased shares of his companys stock on October 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started